Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

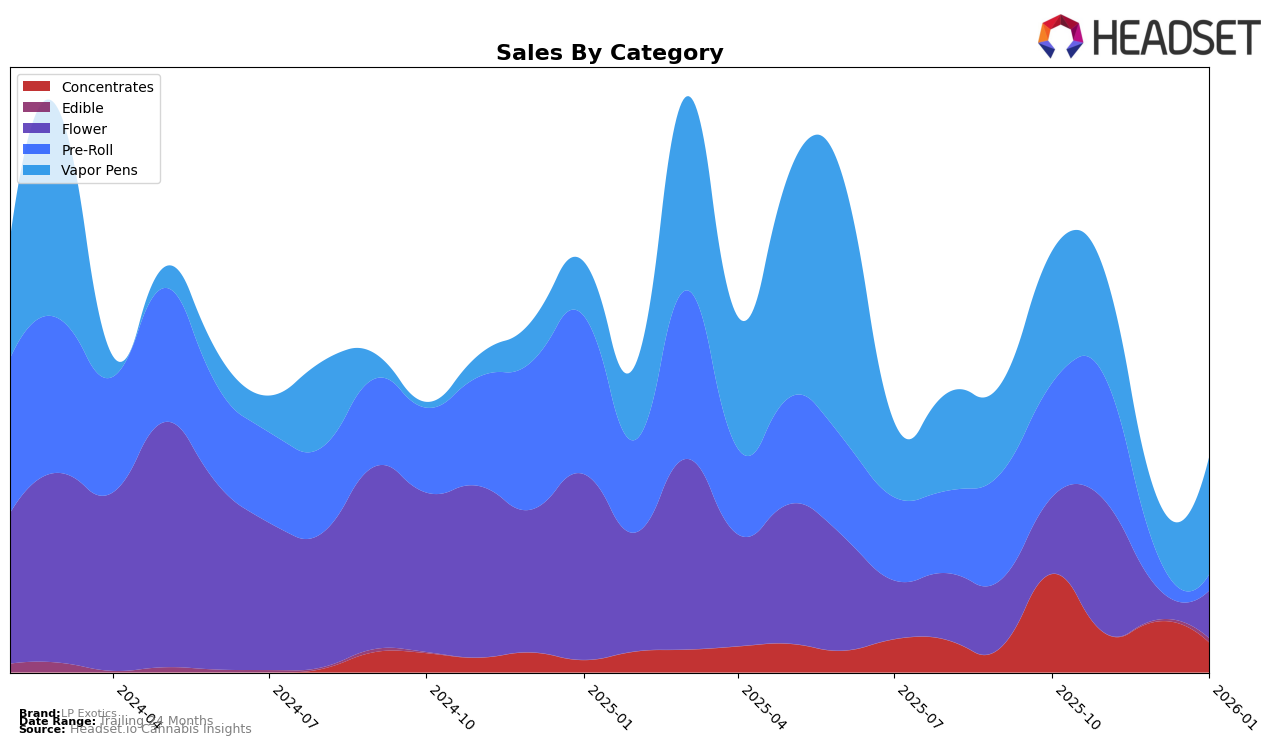

LP Exotics has shown a varied performance across different product categories in Nevada. In the Concentrates category, the brand experienced a notable fluctuation in rankings, starting strong at 6th place in October 2025 but dropping to 19th by January 2026. This indicates a significant volatility in their market presence within this category. Conversely, in the Vapor Pens category, LP Exotics demonstrated a more stable performance, maintaining a relatively consistent rank, with a slight improvement from 25th in October to 22nd by January. Such stability in Vapor Pens suggests a steady consumer base for this product line, even though the sales numbers saw some ups and downs.

The Flower and Pre-Roll categories present a different narrative. In the Flower category, LP Exotics was not in the top 30 in December 2025, which could be a concern for the brand as it indicates a drop in market competitiveness. However, they managed to improve to 60th place by January 2026, suggesting some recovery. Meanwhile, the Pre-Roll category saw the brand starting at a promising 16th position in October, but a decline to 52nd by January suggests challenges in maintaining consumer interest or competitive pricing. This category's performance highlights areas where LP Exotics may need to strategize to regain market share and improve brand positioning.

Competitive Landscape

In the Nevada Vapor Pens category, LP Exotics has shown a fluctuating performance in the rankings over the past few months, indicating a competitive landscape. From October 2025 to January 2026, LP Exotics moved from 25th to 22nd place, with a notable dip to 32nd in December. This volatility suggests challenges in maintaining a consistent market presence. Competitors like Srene have maintained a relatively stable position, ranking as high as 16th in December before dropping to 21st in January, which could indicate a temporary setback rather than a trend. Meanwhile, Alternative Medicine Association / AMA and Matrix NV have also experienced fluctuations, with rankings ranging from 20th to 27th, reflecting a competitive environment where no single brand consistently dominates. The sales figures for LP Exotics show a recovery in January after a significant drop in December, aligning with their improved rank, suggesting that strategic adjustments might be paying off. However, brands like Bonanza Cannabis Company entering the top 30 in December and January highlight the dynamic nature of the market, where new entrants can quickly impact the competitive landscape.

Notable Products

In January 2026, LP Exotics saw Banana Cream Jealousy Live Resin Cartridge (1g) take the top spot in sales, achieving a rank of 1 with sales figures reaching 649 units. Following closely, Grape Gas Pre-Roll (1g) secured the second position, while Kush Crasher Distillate Disposable (0.8g) ranked third. Mango Crack Distillate Disposable (0.8g) came in fourth, showing strong performance in the vapor pens category. Notably, Garlic Cocktail Live Rosin Badder (1g) experienced a slight drop from fourth position in December 2025 to fifth in January 2026. This shift in rankings highlights a competitive market, particularly within the vapor pens category, which dominated the top spots for this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.