Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

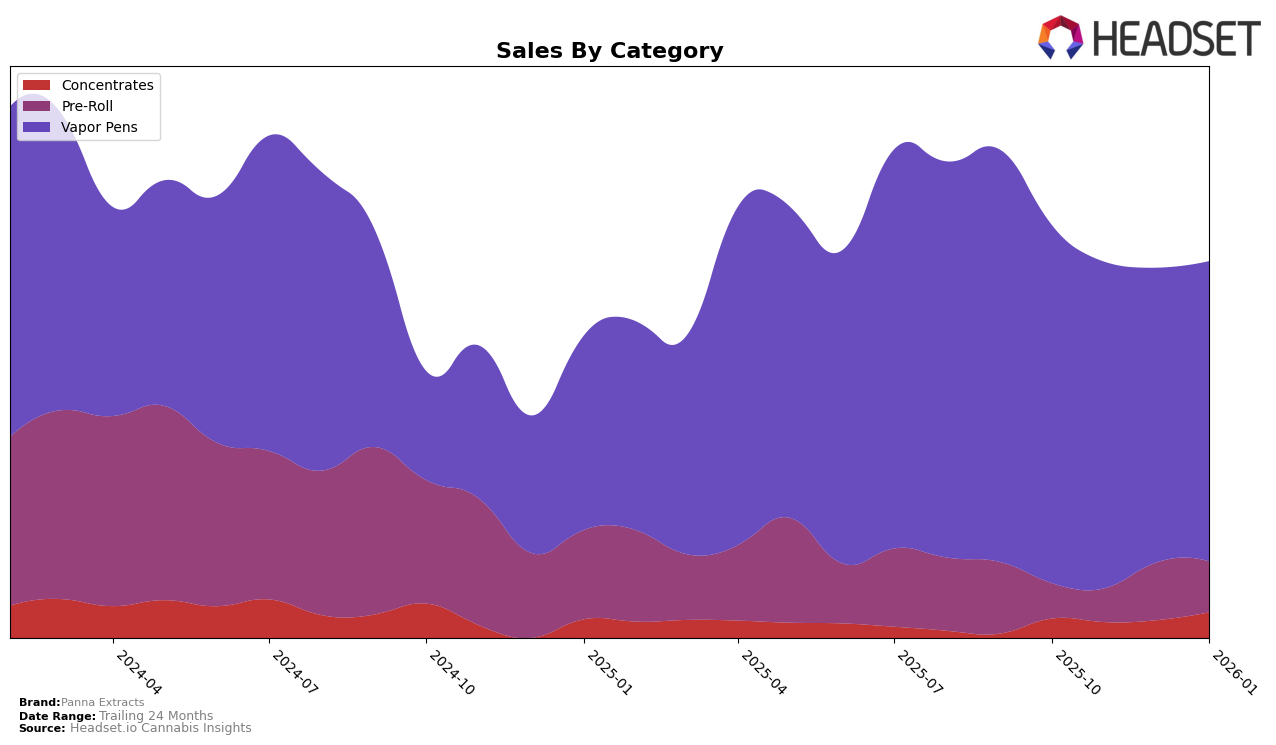

Panna Extracts has shown a steady performance in the Nevada market, particularly in the Concentrates category, where it improved its ranking from 25th in October 2025 to 23rd by January 2026. This upward trend is accompanied by a notable increase in sales, suggesting a growing consumer preference for their products in this category. In the Vapor Pens segment, Panna Extracts maintained a relatively stable position, fluctuating slightly between the 15th and 18th ranks over the same period. Despite a slight dip in sales from October to December, the brand managed to regain some momentum by January 2026, indicating resilience in a competitive market.

Conversely, Panna Extracts faced challenges in the Pre-Roll category in Nevada. While they were not in the top 30 rankings in October, they managed to climb to 33rd in December before slipping to 37th in January. This fluctuation suggests that while there was a temporary boost in sales during the holiday season, sustaining this growth might require strategic adjustments. The absence of Panna Extracts from the top 30 in the initial months highlights the competitive nature of the Pre-Roll market, and the brand's struggle to secure a strong foothold. For more insights into the Nevada market, visit the Nevada market page.

Competitive Landscape

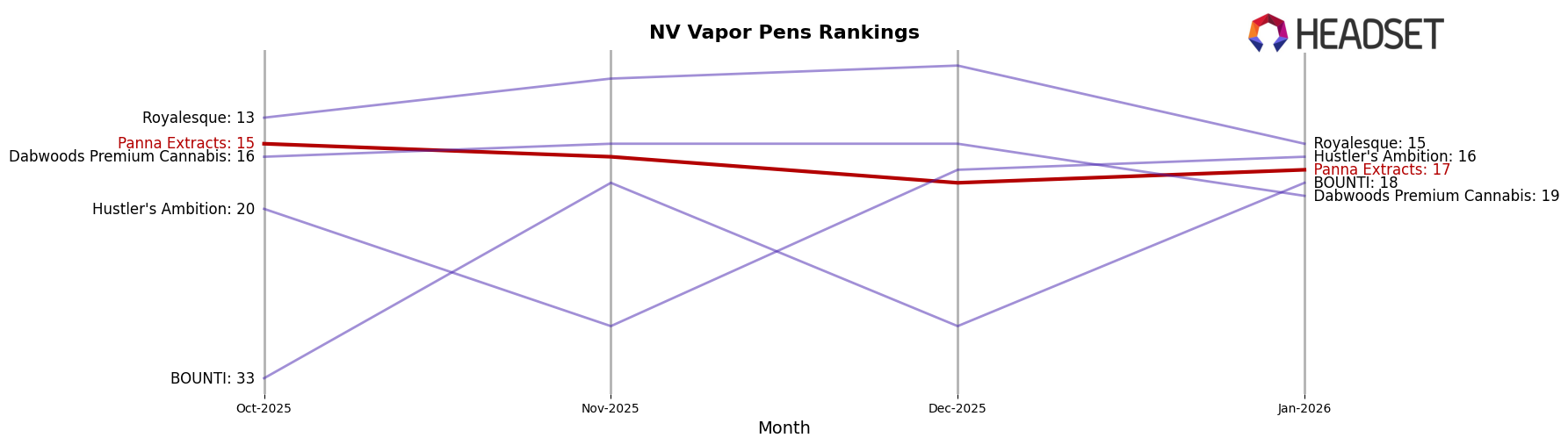

In the competitive landscape of vapor pens in Nevada, Panna Extracts experienced a slight decline in rank from October 2025 to January 2026, moving from 15th to 17th place. This shift is notable when compared to competitors like Royalesque, which consistently held higher ranks, peaking at 9th in December 2025, and Dabwoods Premium Cannabis, which maintained a relatively stable position around 15th before dropping to 19th in January 2026. While Panna Extracts' sales showed a downward trend over these months, competitors like BOUNTI saw a significant sales increase, particularly in November 2025, which likely contributed to their improved rank. Meanwhile, Hustler's Ambition demonstrated a volatile performance, ending January 2026 just above Panna Extracts at 16th. These dynamics suggest that while Panna Extracts remains a key player, the brand faces stiff competition from both established and emerging brands in the Nevada vapor pen market.

Notable Products

In January 2026, the top-performing product for Panna Extracts was the Lemon Diesel Live Resin Cartridge (0.5g) in the Vapor Pens category, maintaining its first-place ranking from December 2025 with sales of 906 units. The Champagne Kush Live Resin Cartridge (0.5g) secured the second position, a slight improvement from its unranked status in December. The Watermelon Kush Cured Resin Cartridge (0.5g) dropped one spot to third place, following a consistent presence in the top three since November 2025. The Mango Cookies Live Resin Cartridge (0.5g) debuted in the fourth position, highlighting its growing popularity. Finally, the Banana Mimosa Cured Resin Cartridge (0.5g) re-entered the rankings at fifth place, previously absent since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.