Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

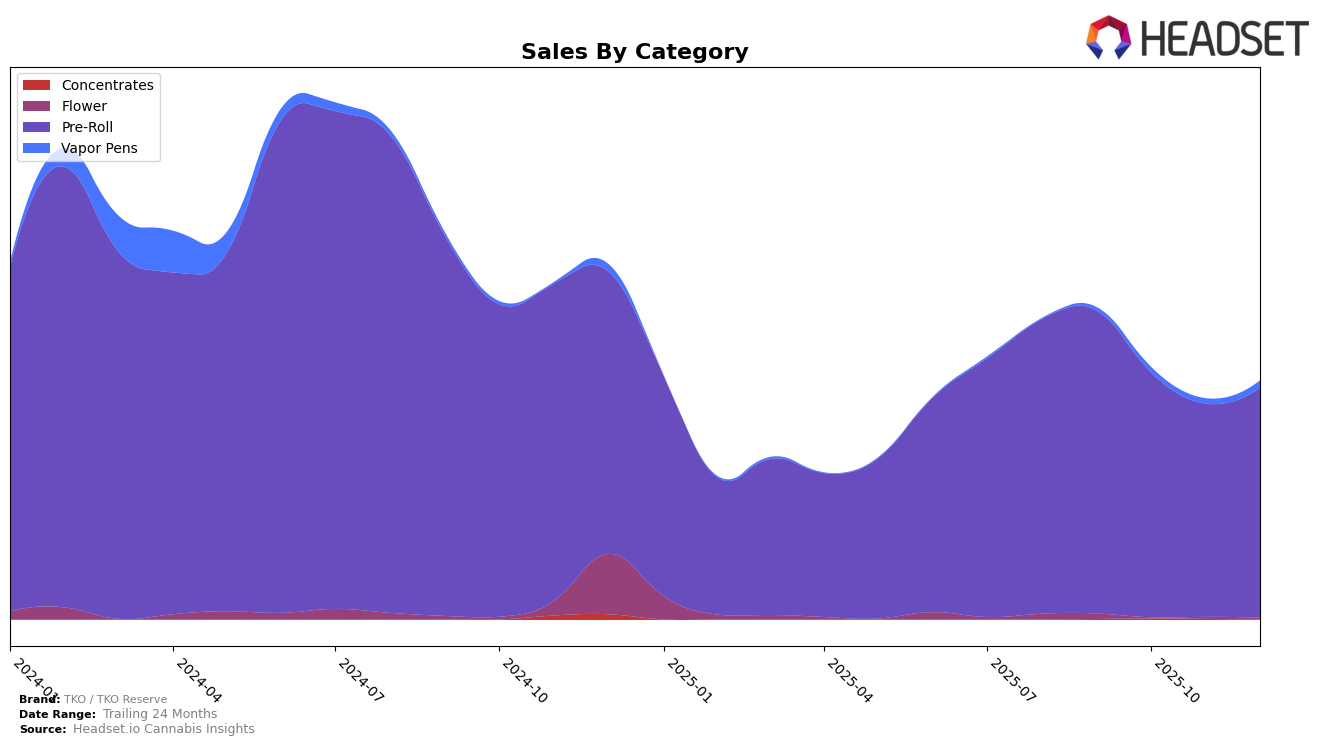

In the competitive landscape of the cannabis market, TKO / TKO Reserve has shown a varied performance across different states and product categories. In the Oregon market, the brand has maintained a presence within the top 30 for the Pre-Roll category, albeit with some fluctuations in its ranking. Starting at rank 20 in September 2025, TKO / TKO Reserve experienced a drop to rank 25 in both October and November, before slightly improving to rank 24 in December. This movement suggests a challenge in maintaining a stronghold in the Pre-Roll sector, despite a consistent presence in the rankings.

While TKO / TKO Reserve's performance in Oregon's Pre-Roll category reflects some instability, it’s important to note that the brand's sales figures have seen a decline over the months, with a notable decrease from September to November. However, there was a slight recovery in December, indicating potential for a rebound or strategic adjustments. The absence of TKO / TKO Reserve from the top 30 in other categories or states may highlight areas for improvement or strategic focus, but further data would be needed to fully assess their overall market strategy and performance across the board.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, TKO / TKO Reserve has experienced fluctuations in its ranking, reflecting a dynamic market environment. Notably, TKO / TKO Reserve dropped from 20th place in September 2025 to 25th in October and November, before slightly improving to 24th in December. This decline in rank is paralleled by a decrease in sales over the same period, indicating potential challenges in maintaining market share. In contrast, Rebel Spirit and Cascade Valley Cannabis also showed a downward trend in sales, but Mule Extracts managed to improve its rank to 22nd in December despite a dip in November. This suggests that while TKO / TKO Reserve faces competition, there are opportunities for strategic adjustments to regain momentum, especially as competitors like Decibel Farms remain consistently close in rankings.

Notable Products

In December 2025, the top-performing product for TKO / TKO Reserve was Purple Drank Pre-Roll (1g), securing the number one rank with notable sales reaching 2814 units. Lemon Cherry Gelato Pre-Roll (1g) followed closely, achieving the second position with a sales figure of 2132 units, moving up from the third position in November. Blockberry Pre-Roll (1g) took the third spot, showing a decline from its second-place ranking in October. Side Show Pre-Roll (1g) ranked fourth, slipping from its previous second-place position in November. Super Boof Pre-Roll (1g) rounded out the top five, dropping from first place in November to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.