Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

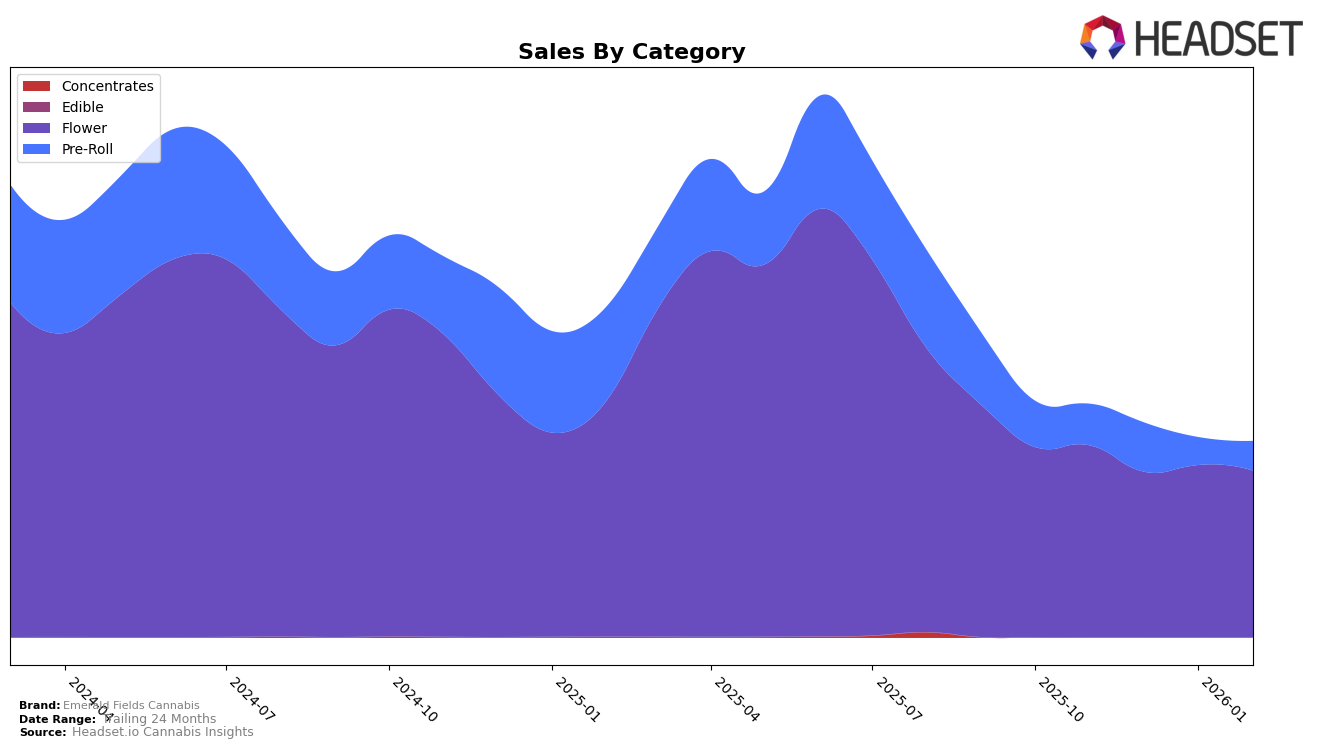

In the state of Oregon, Emerald Fields Cannabis has shown a consistent presence in the Flower category, although there have been fluctuations in their rankings. Starting at the 11th position in November 2025, they experienced a dip to 17th in December, but managed to climb back to 12th in January 2026, before slightly dropping again to 15th in February. This movement indicates a level of resilience in a competitive market, as they remain within the top 20 brands. The sales figures also reflect this trend, with a noticeable peak in January before a slight decline in February. However, the brand did not make it into the top 30 for the Pre-Roll category, consistently ranking outside this range, which highlights a potential area for growth or reevaluation of their strategy in this segment.

Emerald Fields Cannabis's performance in the Pre-Roll category in Oregon has been less prominent compared to their Flower category standings. Despite not breaking into the top 30, there was a slight improvement in their ranking from 46th in January to 42nd in February. This upward movement, albeit modest, could suggest that their efforts in enhancing their Pre-Roll offerings or marketing strategies are beginning to gain traction. The sales figures for Pre-Rolls, however, tell a different story, as there was a significant drop from December to January, followed by a minor recovery in February. This indicates that while the brand is making strides in improving their rank, they still face challenges in capturing a larger market share in this category.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Emerald Fields Cannabis has experienced notable fluctuations in its rankings and sales over recent months. In November 2025, Emerald Fields Cannabis held a strong position at rank 11, but by December, it slipped to rank 17, before recovering slightly to rank 12 in January 2026, and then dropping again to rank 15 in February. This volatility highlights the intense competition in the market, particularly from brands like William's Wonder Farms, which improved its rank from 20 in November to 15 in December, and House Party, which consistently climbed from rank 26 in November to an impressive 13 by February. Meanwhile, Focus North and Millerville Farms have shown upward trends, with Focus North reaching rank 14 in February and Millerville Farms making a significant leap from being outside the top 20 in November to rank 16 by February. These shifts indicate a dynamic market where Emerald Fields Cannabis must strategize effectively to maintain and improve its standing amidst rising competitors.

Notable Products

In February 2026, the top-performing product for Emerald Fields Cannabis was the Maui Blood Pre-Roll 10-Pack (5g) in the Pre-Roll category, maintaining its first-place rank from January 2026 with a sales figure of 3142.0. Meat Breath (1g) in the Flower category emerged as a strong contender, securing the second position, followed by Purple Martian (Bulk) also in the Flower category at third. Apple Sherebert x Banana Bomb Diamond Infused Pre-Roll (1.5g) ranked fourth, while Blue Cookies (1g) rounded out the top five in the Flower category. Notably, Maui Blood Pre-Roll 10-Pack (5g) has consistently ascended from the second position in December 2025, showcasing its increasing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.