Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

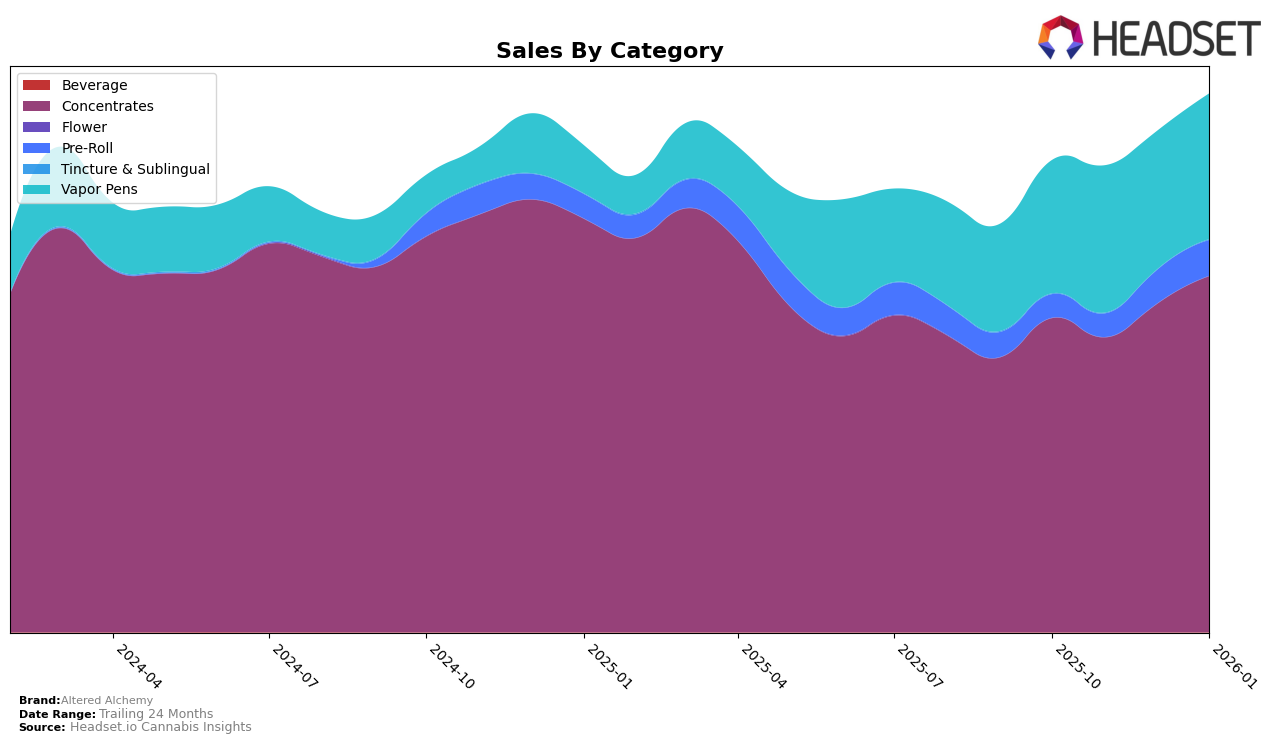

Altered Alchemy has shown a consistent performance in the Oregon market, particularly in the Concentrates category, where it has maintained the top position from October 2025 through January 2026. This sustained leadership indicates a strong foothold and possibly a loyal customer base in this category. In terms of overall sales, there was a noticeable increase from November to January, with January sales reaching $1,145,820, which suggests a positive growth trend. However, the brand's presence in the Pre-Roll category, while improving, started outside the top 30 in October 2025 and climbed to rank 27 by January 2026, indicating potential growth opportunities but also highlighting areas for improvement.

In the Vapor Pens category in Oregon, Altered Alchemy has maintained a relatively stable position, fluctuating slightly between ranks 16 and 17 from October 2025 to January 2026. This stability suggests a steady demand for their vapor pen products, although there is room for advancement to break into higher ranks. The sales figures reflect this consistency, with a slight uptick in January 2026. The brand's ability to hold and potentially improve its ranking in this competitive category will be crucial for future growth. The absence of Altered Alchemy from the top 30 in other states or categories might suggest a need for strategic expansion or increased marketing efforts to diversify its market presence.

Competitive Landscape

In the Oregon concentrates market, Altered Alchemy has consistently maintained its top position from October 2025 through January 2026, showcasing its dominance in the category. Despite fluctuations in sales, with a notable dip in November 2025, Altered Alchemy's sales rebounded strongly in December 2025 and January 2026, reinforcing its market leadership. Competitors like Red Eye Extracts (OR) and Oregrown have consistently held the second and third ranks respectively, but their sales figures remain significantly lower than Altered Alchemy's. This consistent ranking and sales performance highlight Altered Alchemy's strong brand presence and customer loyalty, positioning it well ahead of its competitors in the Oregon concentrates market.

Notable Products

In January 2026, Altered Alchemy's top-performing product was Adios MF Cured Resin (1g) in the Concentrates category, securing the first rank with a notable sales figure of $14,037. Following closely, Polar Pop Cured Resin (1g) and Space Candy Cured Resin (1g) held the second and third ranks, respectively, showcasing strong market presence. Permanent Marker Cured Resin (1g) achieved the fourth rank, while Golden Pineapple Cured Resin (1g) maintained its fifth position from December 2025. This consistency in rankings indicates stable consumer demand and a strong brand reputation for Altered Alchemy's Concentrates line. The data suggests that the top products have either maintained or improved their rankings from previous months, signifying positive sales momentum for the brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.