Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

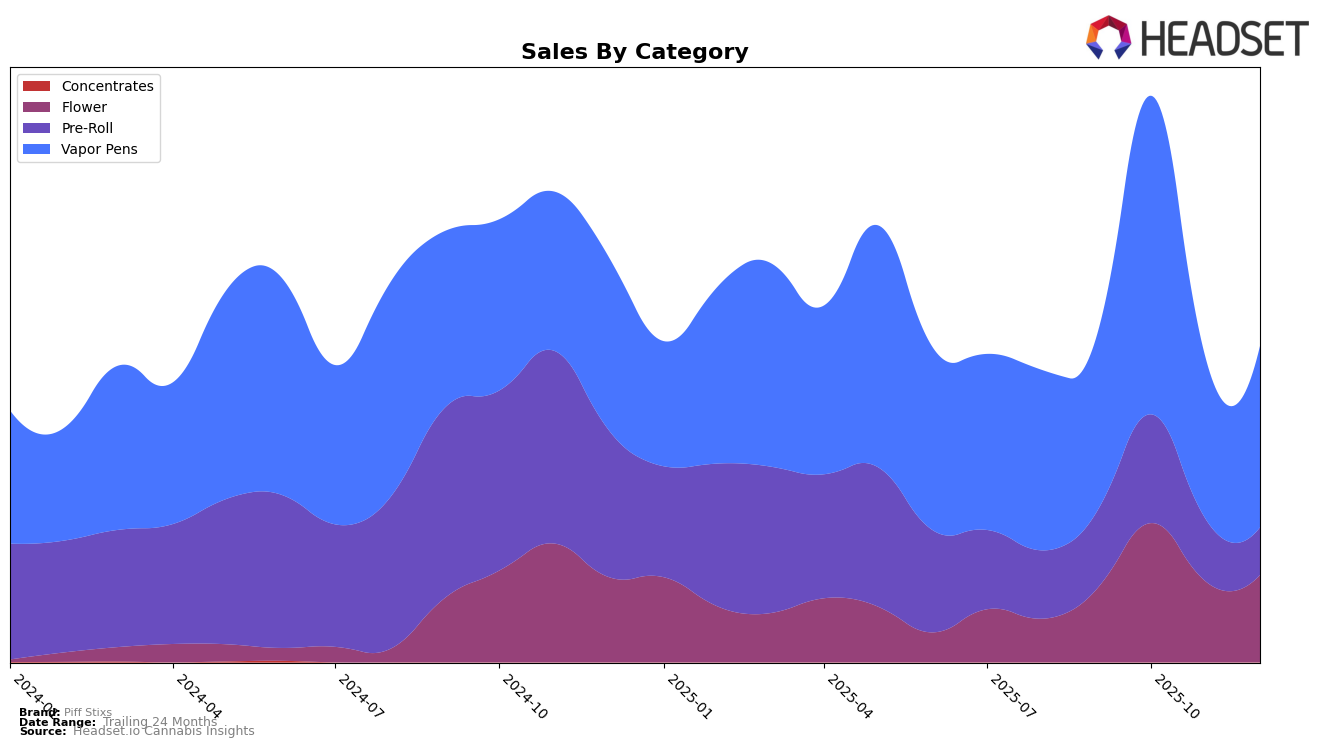

Piff Stixs has demonstrated varied performance across categories in Oregon, with notable fluctuations in their rankings. In the Flower category, the brand made a significant leap from being outside the top 30 in September to reaching the 29th position in October, before dropping back to 47th in both November and December. This trajectory suggests a temporary surge in popularity or a successful marketing push in October. Meanwhile, in the Pre-Roll category, Piff Stixs started strong in October with an 18th place ranking but saw a decline in subsequent months, ending the year at 41st place. This decline indicates potential challenges in maintaining consumer interest or facing increased competition.

In the Vapor Pens category, Piff Stixs maintained a more stable presence, achieving its highest ranking of 15th in October, before slightly declining to 25th by December. This category appears to be a more consistent performer for the brand, suggesting a solid consumer base or effective product offerings. The brand's ability to remain within the top 30 throughout the latter part of the year in this category is a positive indicator of its market position. However, the absence from the top 30 in the Flower category for most months highlights areas for potential improvement or strategic realignment to capture a larger market share.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Piff Stixs has experienced notable fluctuations in its ranking over the last few months, which could be indicative of shifting consumer preferences or competitive pressures. In September 2025, Piff Stixs was ranked 22nd, but it saw a significant improvement in October 2025, climbing to 15th place, likely driven by a substantial increase in sales during that period. However, the brand's rank slipped in the following months, dropping to 24th in November and 25th in December. This decline contrasts with the performance of competitors such as Beehive Extracts, which consistently improved its position from 30th in September to 23rd in December, and Mana Extracts, which maintained a relatively stable ranking, moving from 20th to 24th over the same period. The sales trajectory of Piff Stixs suggests a need for strategic adjustments to maintain competitiveness, especially as other brands like Willamette Valley Alchemy and Punch Bowl also vie for market share in this dynamic category.

Notable Products

In December 2025, Warheads Bulk from Piff Stixs led the sales rankings, securing the top position in the Flower category with sales of 4210 units. Following closely, Biscotti Distillate Cartridge 1g took the second spot in Vapor Pens, which was a notable entry as it hadn't ranked in previous months. Cream Smoothie Bulk maintained its third position from November in the Flower category, despite a slight dip in sales to 1754 units. Crunch Berries Snow Budz Diamond Infused Flower 3.5g and Sour Peel Cured Resin Cartridge 2g rounded out the top five, ranking fourth and fifth respectively, with both products making their first appearance in the rankings. Overall, December saw new entrants dominate the top positions, indicating a shift in consumer preferences towards these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.