Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

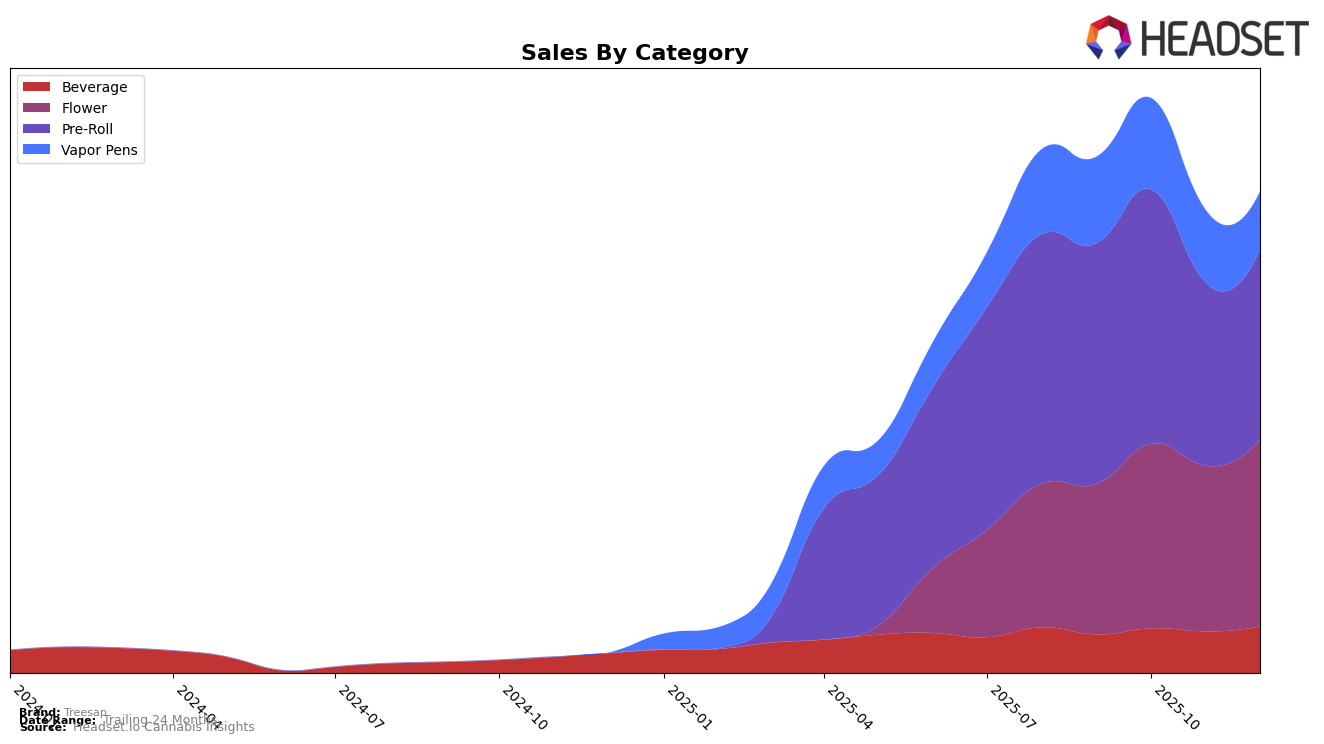

In the state of California, Treesap has shown consistent upward movement in the Beverage category, improving its rank from 14th in September 2025 to 10th by December 2025. This steady climb reflects a positive trend in consumer preference or market penetration, with sales figures also supporting this growth trajectory. In contrast, the Pre-Roll category presents a more fluctuating performance. While Treesap managed to climb slightly from 61st in November to 57th in December, the brand has struggled to break into the top 30, indicating potential challenges in this segment. Such performance discrepancies across categories suggest variable brand strength or market strategies that could be explored further.

The Vapor Pens category in California presents a more concerning picture for Treesap, as the brand failed to maintain a top 100 ranking by December 2025. This drop-off from a consistent 96th place in September and October to being unranked indicates potential issues, such as increased competition or a decline in consumer interest. The absence from the top 30 in this category highlights a significant area for improvement or reevaluation of market strategies. This contrast between the Beverage category's success and the challenges faced in Vapor Pens and Pre-Rolls underscores the importance of targeted strategies tailored to each product segment.

Competitive Landscape

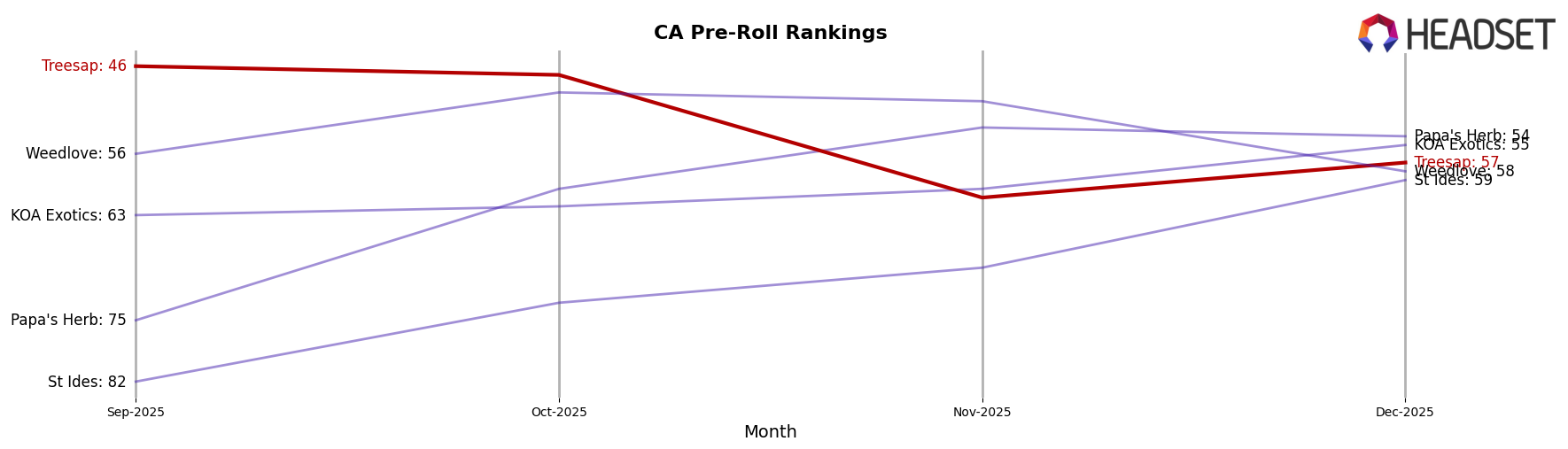

In the competitive landscape of the California pre-roll category, Treesap experienced notable fluctuations in its ranking from September to December 2025. Initially ranked at 46th in September, Treesap saw a decline to 61st in November before slightly recovering to 57th in December. Despite this volatility, Treesap maintained a competitive edge in sales, consistently outperforming brands like Papa's Herb, St Ides, and KOA Exotics, which were ranked lower throughout the period. However, Treesap's sales trajectory faced pressure from Weedlove, which showed a strong sales performance, particularly in October and November, indicating a potential threat to Treesap's market position. These dynamics highlight the importance for Treesap to strategize effectively to maintain its sales lead and improve its ranking amidst a competitive market.

Notable Products

In December 2025, the top-performing product for Treesap was Super Boof Shake (28g) in the Flower category, achieving the number one rank with sales of 1306 units. Mendo Purps Shake (28g) followed closely as the second best-seller. Death Star Shake (28g) dropped from the top position in November to third place in December, with notable sales of 1124 units. Dantes Inferno Shake (28g) maintained its fourth position from the previous month, while Durban Poison Shake (28g) entered the top five ranking for the first time. Overall, there was a slight reshuffling in product rankings, with Super Boof Shake (28g) emerging as the new leader.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.