Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

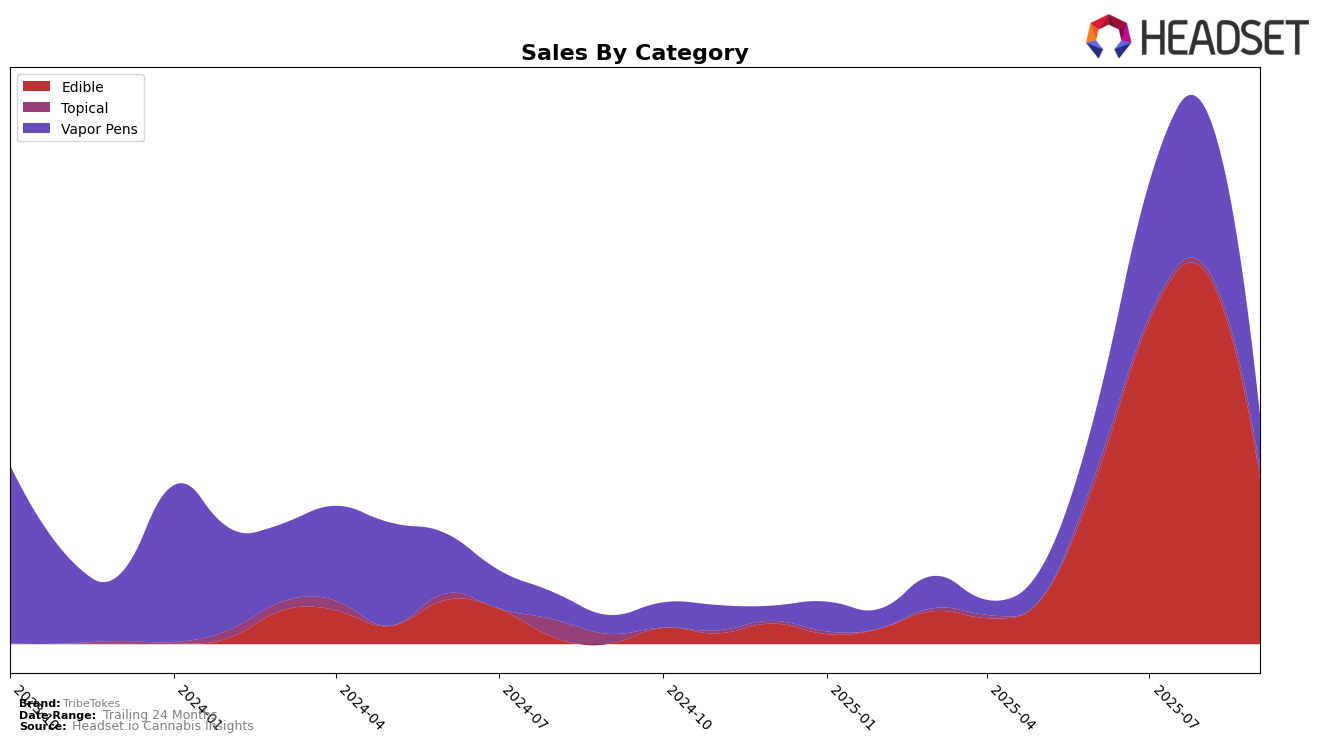

TribeTokes has demonstrated varying performance across different states and categories, with notable fluctuations in their rankings. In the New York market, their presence in the Edible category has been inconsistent. Notably, they were not ranked in the top 30 brands for June 2025, which suggests a challenging start to the summer. However, by July, they managed to climb to the 79th position, showing some improvement. This upward trend continued into August, where they reached the 70th position, indicating a positive momentum. The absence of a rank in September, however, might suggest a regression, or perhaps a strategic shift away from this particular category.

While specific sales figures are limited, TribeTokes' journey in the New York market showcases their ability to navigate a competitive landscape, albeit with some setbacks. The increase in sales from June to July highlights a period of growth, but the absence of sales data in August and September could imply either a plateau or a strategic pivot. This kind of performance analysis can provide insights into how brands like TribeTokes adapt to market dynamics and consumer preferences, offering a glimpse into their strategic decisions and market positioning.

Competitive Landscape

In the New York edible market, TribeTokes has demonstrated a modest yet notable upward trajectory in its ranking from July to September 2025, moving from 79th to 70th place. This improvement is indicative of a positive sales trend, as TribeTokes' sales increased from 10,014 to 11,565 units during this period. In comparison, OHHO, which was ranked 68th in June, saw a decline to 78th by July, suggesting a downward trend in their market presence. Similarly, Snobby Dankins experienced a drop from 63rd to 70th, aligning with TribeTokes' rise. Meanwhile, Ruby Farms and Tyson 2.0 were not in the top 20, indicating a less competitive stance in this category. TribeTokes' ability to climb the ranks amidst these fluctuations highlights its growing influence and potential for further market penetration in the competitive New York edibles sector.

Notable Products

In September 2025, the top-performing product for TribeTokes was the CBD/CBC Maca+Muira Puama +Catuaba + Mucuna +Cherry Libido Lift Gummies 20-Pack, which climbed to the number one ranking from the second position in the previous two months, with sales figures reaching 56 units. The CBN/CBD 1:2 Peach Live Resin Gummies 20-Pack, which had consistently held the top spot in June, July, and August, dropped to second place. The CBD/CBG 2:1 Lemon + Lime CBG Boosted Live Resin Gummies 20-Pack maintained a steady presence in the top three, ranking third in September, despite a gradual decline from its first-place position in June. The CBD Remedy Full Spectrum Disposable entered the rankings for the first time in September, securing the fourth position. Meanwhile, the CBD/CBG Mixed Berry Gummy Bears 20-Pack remained in fifth place, consistent with its August ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.