May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

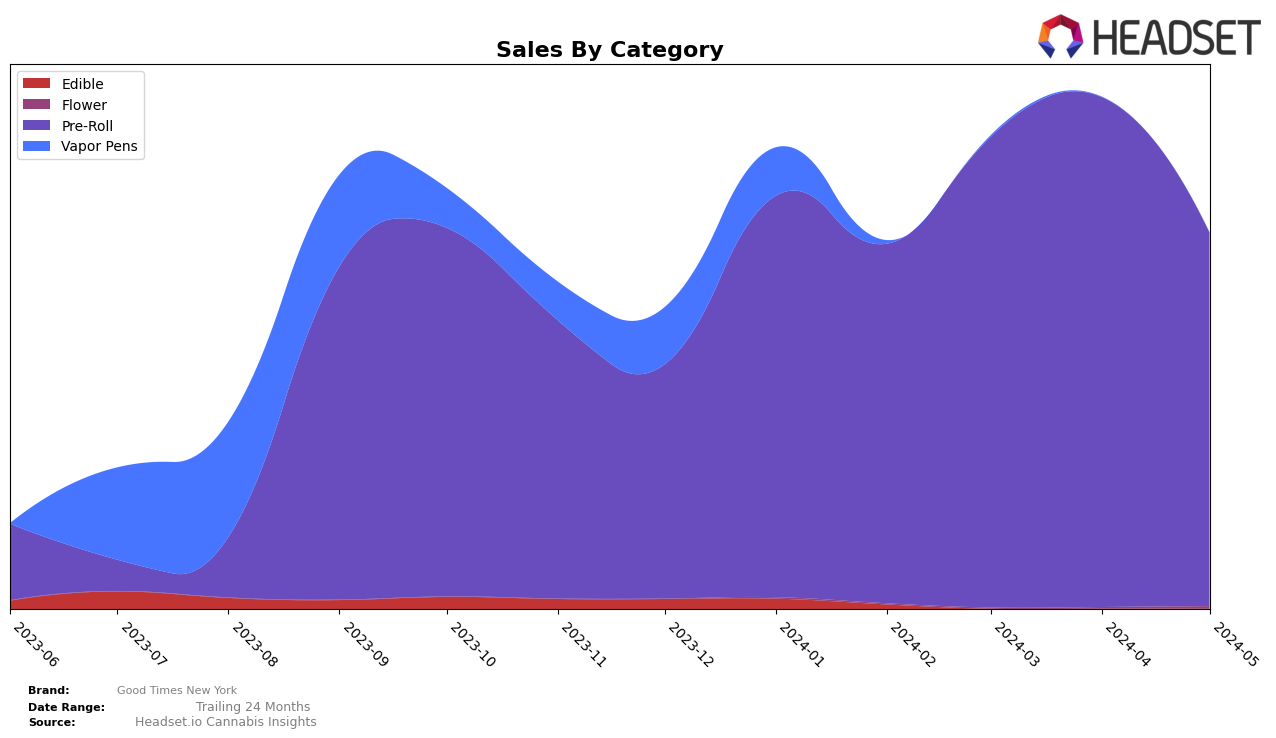

Good Times New York has shown a dynamic performance in the Pre-Roll category within New York. Starting from February 2024, the brand held the 12th position, which improved slightly to the 11th spot in both March and April. However, by May, the brand experienced a drop to the 17th position. This fluctuation suggests a competitive market environment in New York, with potential challenges in maintaining consistent rankings. Despite the May drop, the brand's sales peaked in April, indicating a strong market presence and consumer interest during that period.

The movement in rankings and sales performance of Good Times New York highlights the volatility and competitiveness of the Pre-Roll category in New York. The brand's inability to maintain a top 10 position, despite a peak in sales, could be a point of concern. It is crucial to monitor whether this trend continues or if the brand can reclaim a higher rank in subsequent months. This analysis suggests that while Good Times New York has had moments of strong performance, sustaining a top-tier position remains a challenge in the ever-evolving cannabis market of New York.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Good Times New York has experienced notable fluctuations in its rank and sales over the past few months. Despite a strong start in February 2024, maintaining a rank of 12, the brand saw a decline to 17 by May 2024. This drop in rank coincides with a decrease in sales from $170,239 in April to $124,686 in May. In contrast, competitors such as Lobo and Miss Grass have shown more stable performance, with Lobo consistently ranking around 15 and Miss Grass experiencing only a slight dip from 14 to 18. Additionally, Toast has made significant gains, moving from 21 to 16 in rank, indicating a rising trend in their market presence. The competitive pressure from these brands, especially those with upward trends, suggests that Good Times New York needs to reassess its market strategies to regain its foothold and improve sales performance in the New York pre-roll market.

Notable Products

In May-2024, the top-performing product for Good Times New York was Sour Skittles Infused Pre-Roll 5-Pack (2.5g), which climbed to the number one rank with sales of 845 units. Lemon Tree Kush Infused Pre-Roll (1g) followed closely, advancing to the second position from fourth in April. Pineapple Upside Down Cake Infused Pre-Roll (1g) also showed significant improvement, moving up to the third rank from fifth. Notably, Italian Ice Infused Pre-Roll (1g) re-entered the rankings at fourth place with 542 units sold. Purple Punch Infused Pre-Roll 5-Pack (2.5g), which previously held the top spot, dropped to fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.