Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

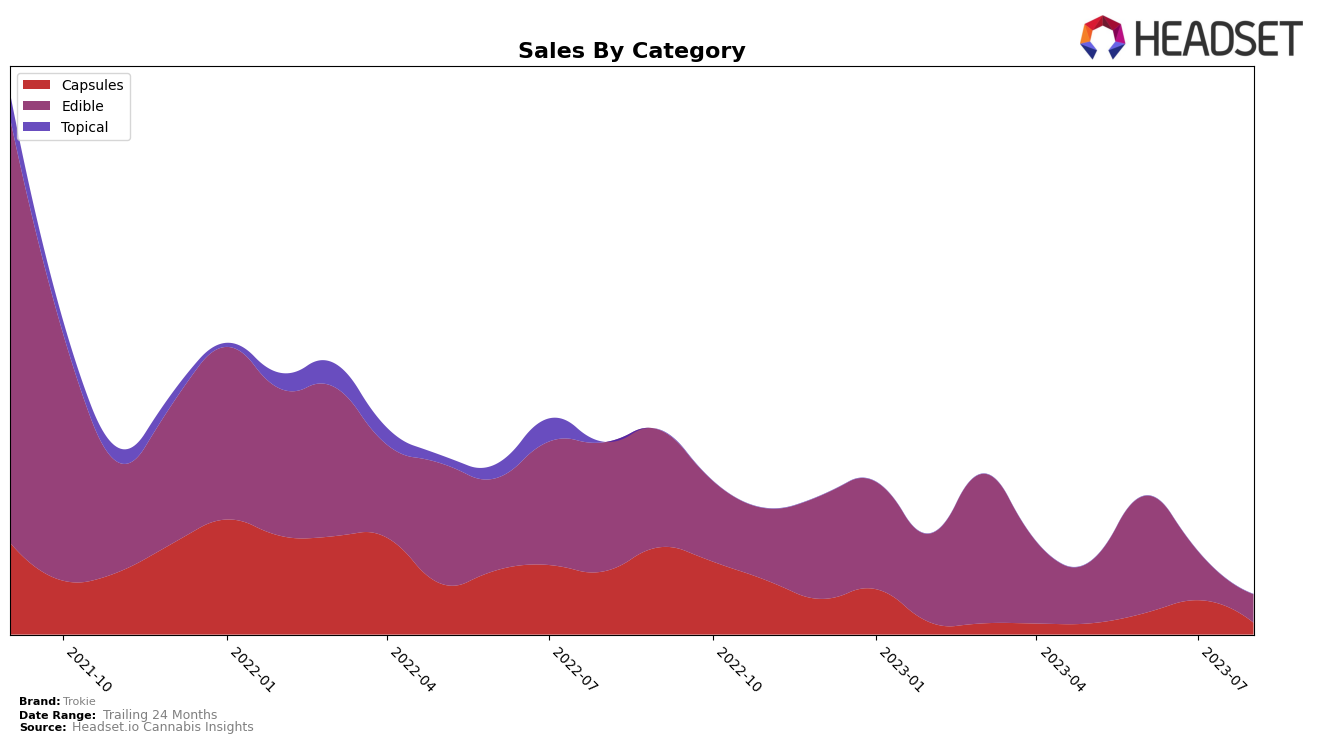

In the realm of Capsules, Trokie has been maintaining a strong presence in the Nevada market. Ranked 6th in August 2023, it indicates a slight drop from the previous two months where they held the 5th position, but an improvement from May 2023 where they were ranked 7th. This movement shows a consistent performance within the top 10 brands in this category, demonstrating a strong foothold in the Capsules market. However, it's important to note that the sales in August 2023 were significantly lower than the previous months, indicating a potential challenge for Trokie.

On the other hand, Trokie's performance in the Edibles category in Nevada shows a different trend. The brand was ranked 50th in August 2023, showing a gradual decline from June 2023 when it was ranked 41st. This indicates that Trokie is facing a tougher competition in the Edibles category. Despite this, there is a noticeable increase in sales from May to August 2023, suggesting a growing consumer interest. This could be an opportunity for Trokie to strengthen its position in the Edibles market.

Competitive Landscape

In the edible category within Nevada, Trokie has seen a fluctuating performance over the recent months. While it has consistently remained outside the top 20 brands, its rank has varied from 41st in June 2023 to 50th in August 2023. This suggests a slightly declining trend in terms of its competitive position. When compared to its competitors, Trokie has performed better than TRYKE and Yuzu CBD Plus, both of which have consistently ranked lower. However, it has lagged behind Canna Hemp and Dime Bag, which have generally ranked higher. Notably, Dime Bag's rank for June and May 2023 is missing, indicating that it was not among the top 20 brands in those months. In terms of sales, while specific figures are not provided, it's clear that Trokie's sales have been higher than TRYKE and Yuzu CBD Plus, but lower than Canna Hemp and Dime Bag.

Notable Products

In August 2023, the top-performing product from Trokie was the 1:1 Trokie with 6mg Melatonin (20mg CBD, 20mg THC) from the Edible category, with 64 units sold. This product climbed from the second rank in July and the fourth in June, showing a strong upward trend. The second place was occupied by the CBD Nano Capsules 30-Pack (750mg CBD), maintaining a consistent performance from the previous months. Surprisingly, the Sativa Lozenge 10-Pack (100mg), which dominated the sales in June and July with 222 and 108 units sold respectively, slipped to the third place tied with the CBD Fast Melt Tabs + Melatonin 50-Pack (500mg CBD, 75mg Melatonin). The rankings suggest a shift in customer preference towards products with a balance of CBD and THC, and those promoting sleep health.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.