Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

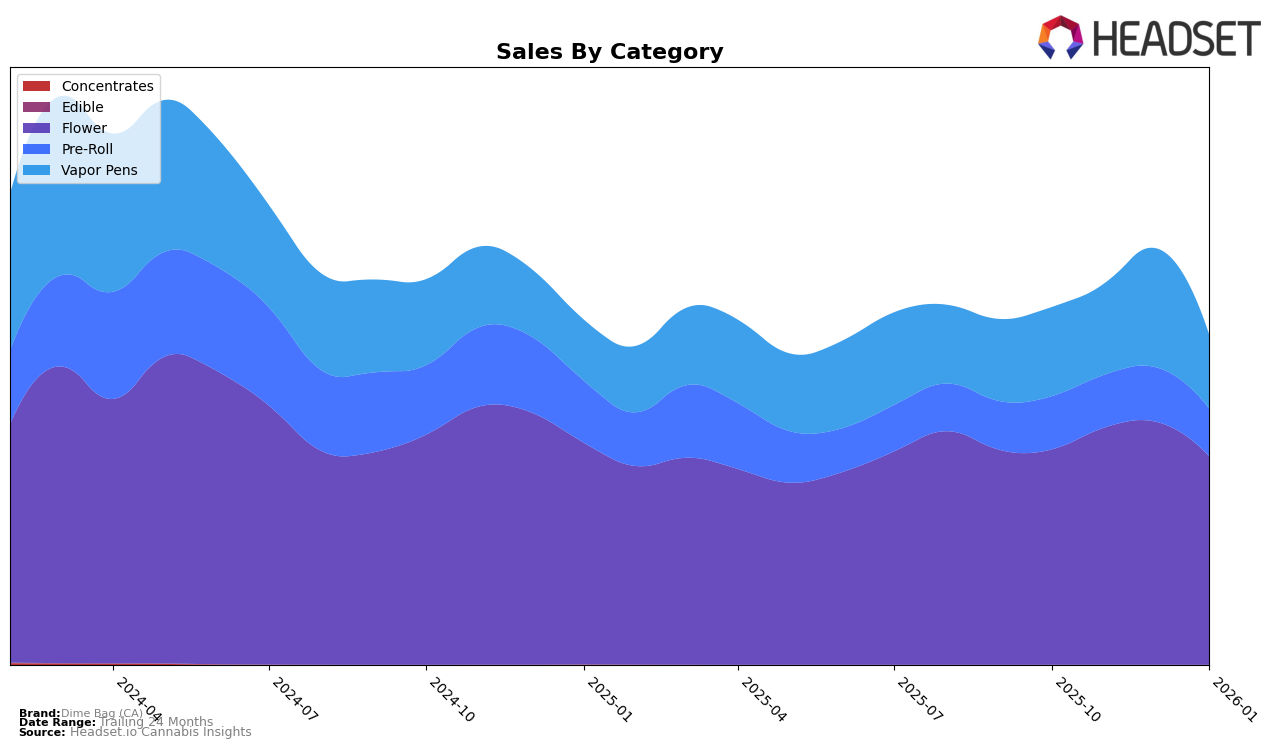

Dime Bag (CA) has shown varied performance across different product categories in California. In the Flower category, the brand held a steady position in the top 20, with a slight dip from 13th place in December 2025 to 15th in January 2026. This indicates a relatively stable market presence, although the slight decline might suggest increased competition or seasonal variations. Notably, despite the dip in rank, the brand's sales in this category saw a significant increase from October to December 2025, before a decrease in January 2026, reflecting potential market fluctuations or changes in consumer preferences.

In contrast, Dime Bag (CA) struggled to maintain a strong foothold in the Pre-Roll and Vapor Pens categories. The brand did not appear in the top 30 for Pre-Rolls in any month from October 2025 to January 2026, highlighting a potential area for improvement or strategic reevaluation. For Vapor Pens, while the brand's rank improved from 32nd in October to 26th in December 2025, it fell back to 34th in January 2026. This suggests a volatile performance in this category, possibly due to changing consumer tastes or competitive pressures. The sales trajectory mirrored this instability, with a peak in December followed by a notable decline in January, which might indicate a temporary spike in demand or promotional effects.

Competitive Landscape

In the competitive landscape of the California flower category, Dime Bag (CA) has shown notable fluctuations in its rank over the past few months, reflecting a dynamic market position. Starting from 17th place in October 2025, Dime Bag (CA) improved to 13th in November and maintained this position through December, before slipping slightly to 15th in January 2026. This performance is contrasted by brands like Glass House Farms (CA), which consistently improved its rank from 16th to 14th over the same period, and West Coast Treez, which surged from 18th to 13th by January. Meanwhile, Connected Cannabis Co. experienced a decline, dropping from 12th to 17th, and Quiet Kings saw a significant drop from 11th to 16th in January. These shifts indicate a competitive environment where Dime Bag (CA) must strategize to maintain and improve its standing amidst fluctuating ranks and sales dynamics.

Notable Products

In January 2026, Gastro Pop Pre-Roll (1g) emerged as the top-performing product for Dime Bag (CA), achieving the number one rank with sales figures reaching 2791 units. Glitter Bomb (3.5g) followed closely as the second-highest seller in the Flower category. The Green Crack Distillate Cartridge (1g) maintained a strong presence, moving up to the third position from its previous ranks of fifth in October and December and fourth in November. Purple Milk Pre-Roll (1g) secured the fourth spot, while Strawberry Sherbet (3.5g) rounded out the top five. Notably, Green Crack Distillate Cartridge has shown consistent sales growth over the past few months, indicating a steady increase in customer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.