Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

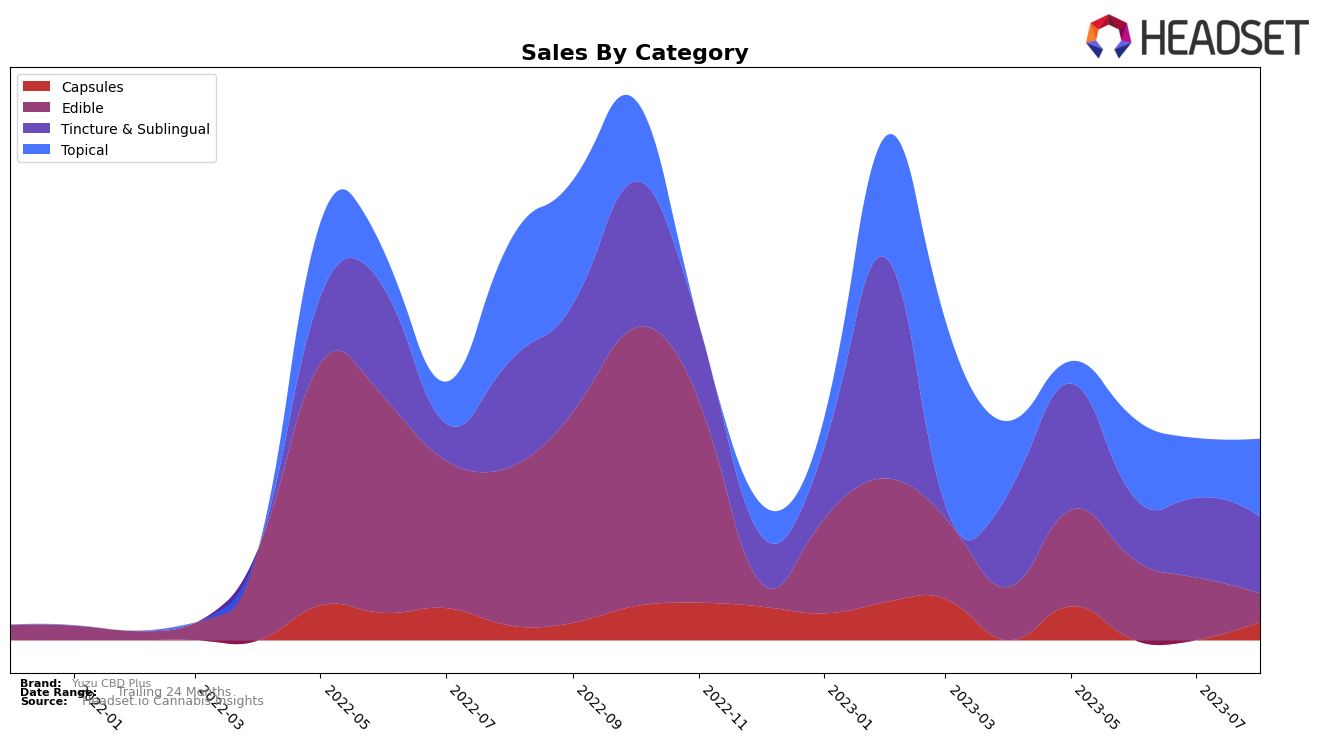

Yuzu CBD Plus has been experiencing some interesting fluctuations in the Nevada market. In the Capsules category, the brand has bounced back to a commendable 9th rank in August 2023, after not making it to the top 20 in the previous two months. The brand's performance in the Edibles category, however, has seen a gradual decline, falling from 54th rank in May and June to 58th in August. Despite this decline, it's worth noting that Yuzu CBD Plus remains within the top 60 brands in this highly competitive category.

Switching focus to Tincture & Sublingual and Topical categories, the brand's performance has remained relatively steady. In the Tincture & Sublingual category, the brand moved up to 19th place in August, after slipping to 23rd in June. Similarly, in the Topical category, Yuzu CBD Plus improved its ranking from 21st in May to 17th in August. These movements indicate a positive trend for the brand in these categories within the Nevada market. The brand's resilience and ability to maintain its position within the top 20 brands in these categories is certainly noteworthy.

Competitive Landscape

In the Topical category in Nevada, Yuzu CBD Plus has seen a slight improvement in its rank from 21st in May 2023 to 17th in August 2023, indicating a positive trend in its market position. However, it's worth noting that Yuzu CBD Plus is still trailing behind its competitors. TRYKE and Canna Hemp have consistently maintained higher ranks, with Canna Hemp even reaching the 13th position in July 2023. CAMP (NV), although having a similar rank to Yuzu CBD Plus in recent months, had a stronger performance in June and May 2023. Vlasic Labs has shown a more volatile trend, with its rank dropping to 22nd in June 2023 and not even making it to the top 20 in May 2023. This analysis suggests that while Yuzu CBD Plus is making progress, there is still significant competition in the market.

Notable Products

In August 2023, Yuzu CBD Plus's top-performing product was the 'CBD Citrus Tincture (1000mg CBD, 30ml)' from the Tincture & Sublingual category, advancing from the third position in May. The 'CBD Arthrodyne Complete Capsules 90-Pack (3600mg CBD)' from the Capsules category also secured the second spot in August. Interestingly, the 'CBD Berry Tincture (2000 CBD, 30ml)' and 'CBD Chicken Tincture (1000mg CBD, 30ml)' from the Tincture & Sublingual category, along with 'CBD Fruit Candy Drops 30-Pack (300mg CBD)' from the Edible category, all maintained the second position consistently. It's worth noting that 'CBD Berry Tincture (2000 CBD, 30ml)' was the top product in June. The 'CBD Citrus Tincture (1000mg CBD, 30ml)' had notable sales figures in August, with 8 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.