Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

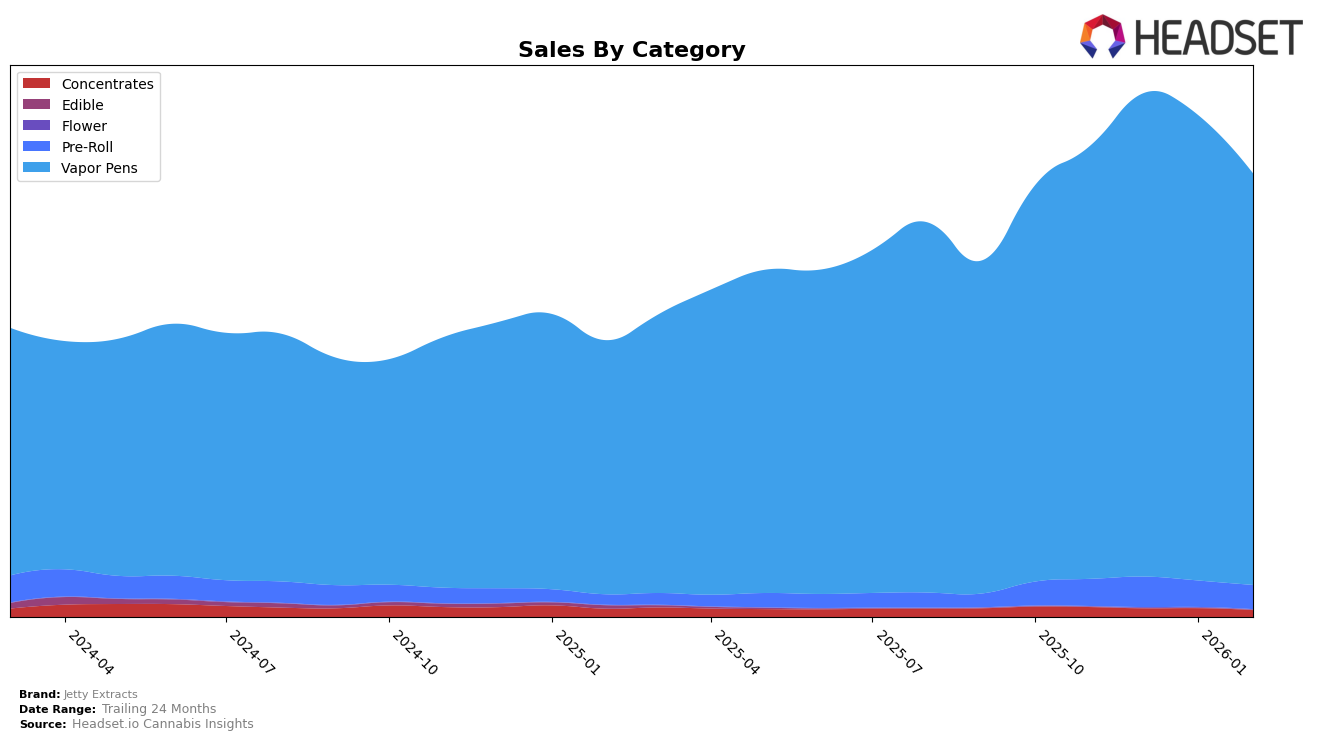

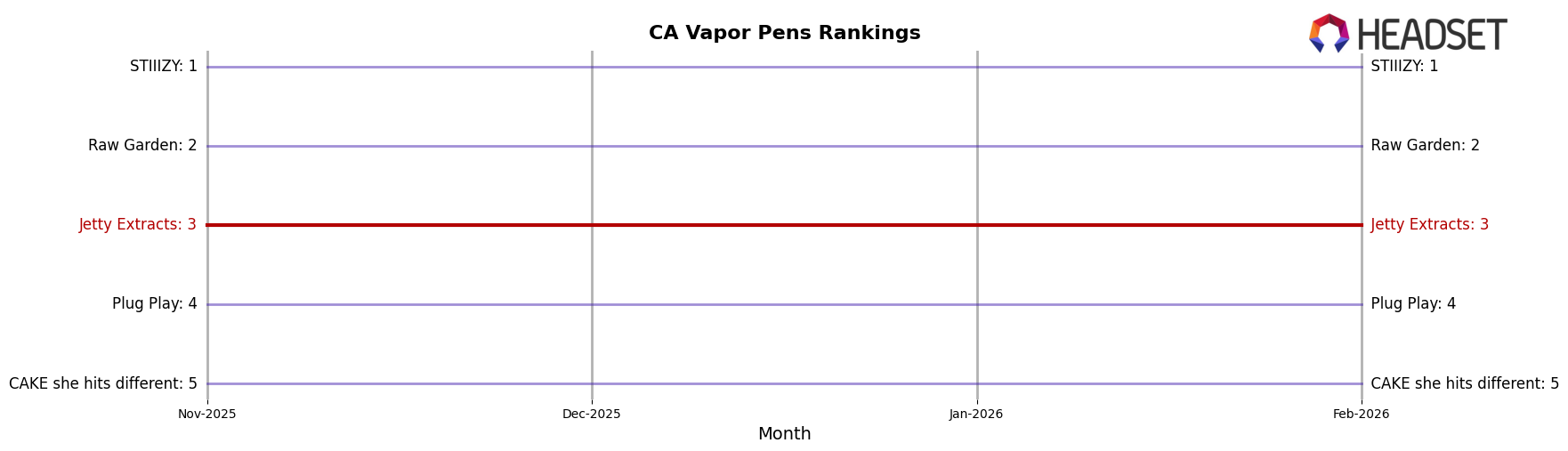

Jetty Extracts has demonstrated a consistent performance in the California market, particularly in the vapor pen category. The brand maintained a strong third-place ranking from November 2025 through February 2026, indicating a stable presence in this competitive category. In the pre-roll category, however, Jetty Extracts hovered around the 30th position, showing some fluctuations but ultimately securing the 30th spot in February 2026. The sales figures for vapor pens in California reveal a slight downward trend from December 2025 to February 2026, which could be indicative of seasonal variations or market saturation.

In Colorado, Jetty Extracts experienced more volatility in the vapor pen category rankings. Starting at the 7th position in November 2025, the brand moved up to 5th in January 2026 before dropping to 9th in February 2026. This suggests a competitive landscape where Jetty Extracts faces challenges in maintaining its rank. Meanwhile, in New York, the brand showed a positive trajectory, improving its position from 17th in November 2025 to 11th by February 2026 in the vapor pen category. This upward movement may reflect growing consumer interest or effective market strategies in the state.

Competitive Landscape

In the competitive landscape of vapor pens in California, Jetty Extracts consistently holds the third position, trailing behind STIIIZY and Raw Garden, who maintain their first and second ranks respectively from November 2025 to February 2026. Despite Jetty Extracts' stable ranking, the brand faces significant competition as STIIIZY's sales figures are consistently more than three times higher, indicating a strong market dominance. Meanwhile, Raw Garden also outpaces Jetty Extracts with sales figures that are approximately 50% higher. However, Jetty Extracts maintains a comfortable lead over Plug Play, which ranks fourth, and CAKE she hits different, which holds the fifth position. This consistent ranking suggests that while Jetty Extracts is a strong player, there is room for growth, particularly in strategies that could close the gap with the top two competitors.

Notable Products

In February 2026, Jetty Extracts maintained its top-performing product with the Pineapple Express Live Resin Cartridge (1g) leading the sales in the Vapor Pens category, despite a slight decrease in sales to 9219 units. The Blue Dream Unrefined Live Resin Cartridge (1g) consistently held its position in second place across the months. Granddaddy Purple Distillate Cartridge (1g) showed a notable improvement, moving up to third place from fifth in January. Alien OG THC Oil Cartridge (1g) debuted impressively in February, securing the fourth position. Meanwhile, the Northern Lights #5 High THC Distillate Cartridge (1g) experienced a drop to fifth place, reflecting a downward trend from its previous third-place standing.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.