Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Gramlin's performance in the California market shows varied results across different product categories. In the Concentrates category, the brand made a notable leap from being ranked 37th in October 2025 to 24th in November 2025, indicating a positive trend, although it didn't maintain a top 30 position in subsequent months. Similarly, the Edible category showed a minor improvement, rising from 26th to 25th over the same period. The Pre-Roll category, however, did not see significant movement, as Gramlin remained outside the top 30 in both October and November 2025. This lack of ranking in later months might suggest challenges in maintaining market presence in certain categories.

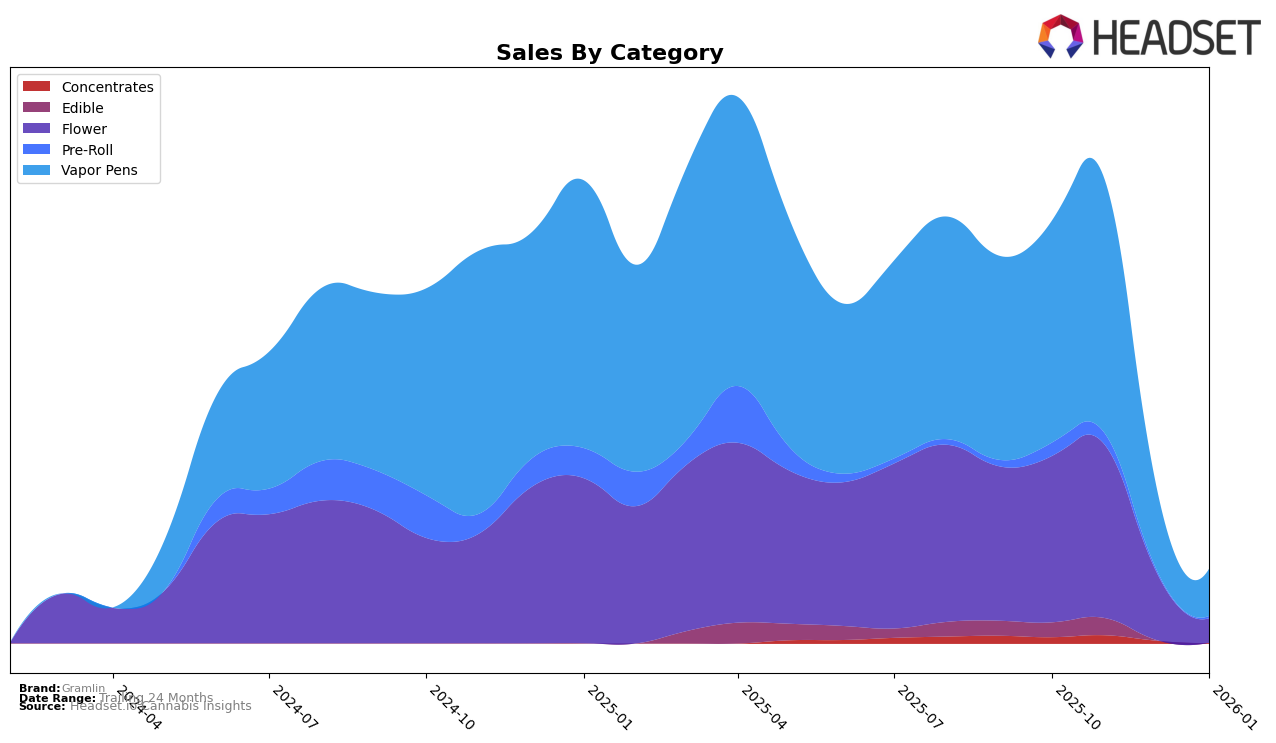

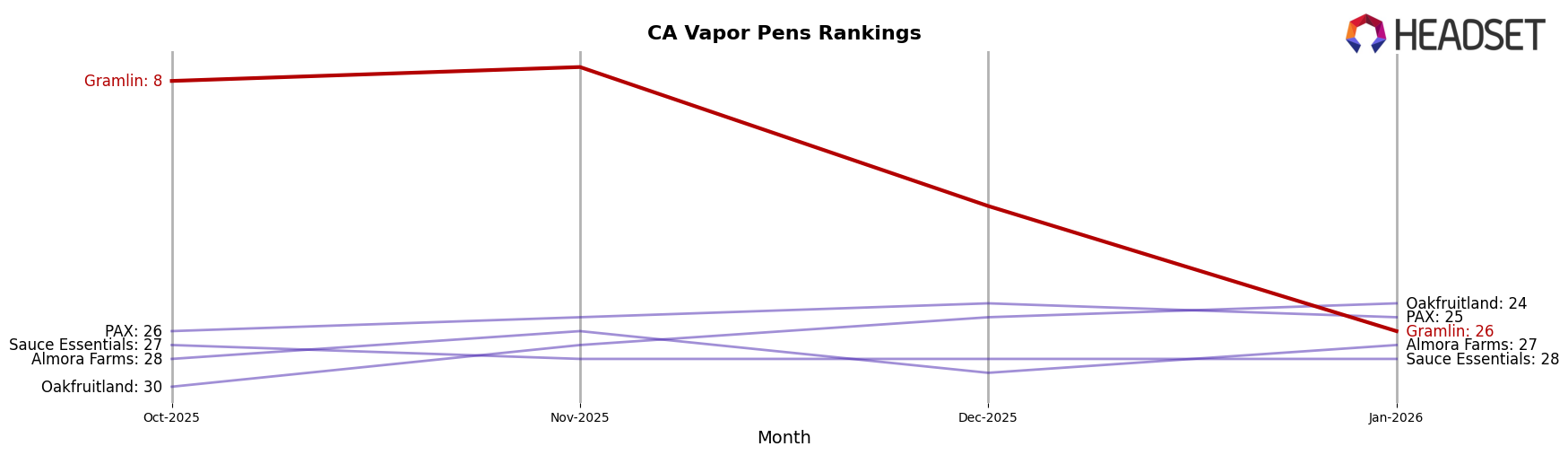

In contrast, Gramlin's Flower and Vapor Pens categories in California experienced different trajectories. The Flower category saw a sharp decline from 7th in October 2025 to 60th by January 2026, indicating a significant drop in performance. Meanwhile, Vapor Pens, which started strong at 8th in October 2025, experienced a decline to 26th by January 2026, reflecting a downward trend over the months. Despite these fluctuations, the Vapor Pens category had a notable peak in sales in November 2025, showcasing a momentary strong performance. These shifts highlight the dynamic nature of Gramlin's market positioning across different product segments.

Competitive Landscape

In the competitive landscape of the California vapor pen market, Gramlin has experienced significant fluctuations in its ranking and sales over the past few months. After holding strong positions in October and November 2025, ranked 8th and 7th respectively, Gramlin saw a dramatic drop to 17th in December and further down to 26th by January 2026. This decline contrasts sharply with competitors such as PAX and Oakfruitland, who have shown more stable or improving rankings during the same period. For instance, Oakfruitland improved from 30th in October to 24th by January, indicating a positive trend. Meanwhile, PAX maintained a relatively stable position, hovering around the mid-20s. The volatility in Gramlin's ranking is mirrored in its sales, which plummeted from over three million in October to just over six hundred thousand by January, suggesting potential challenges in market strategy or consumer preference shifts. This dynamic environment underscores the importance for Gramlin to reassess its competitive strategies to regain its footing in the California vapor pen market.

Notable Products

In January 2026, the top-performing product for Gramlin was Blue Dream Distillate Disposable (1g) in the Vapor Pens category, which climbed to the first rank despite a decrease in sales to 4,175 units. Strawberry Cough Distillate Disposable (1g) followed closely in second place, having dropped from the top spot it held in December 2025. Strawberry Banana Distillate Disposable (1g) secured the third rank, showing an upward trend from fifth place previously. Raspberry OG Distillate Disposable (1g) slipped to fourth, while Pineapple Express Distillate Disposable (1g) rounded out the top five, experiencing a notable drop from its consistent first-place ranking in October and November 2025. These shifts indicate dynamic changes in consumer preferences within the Vapor Pens category for Gramlin.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.