Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

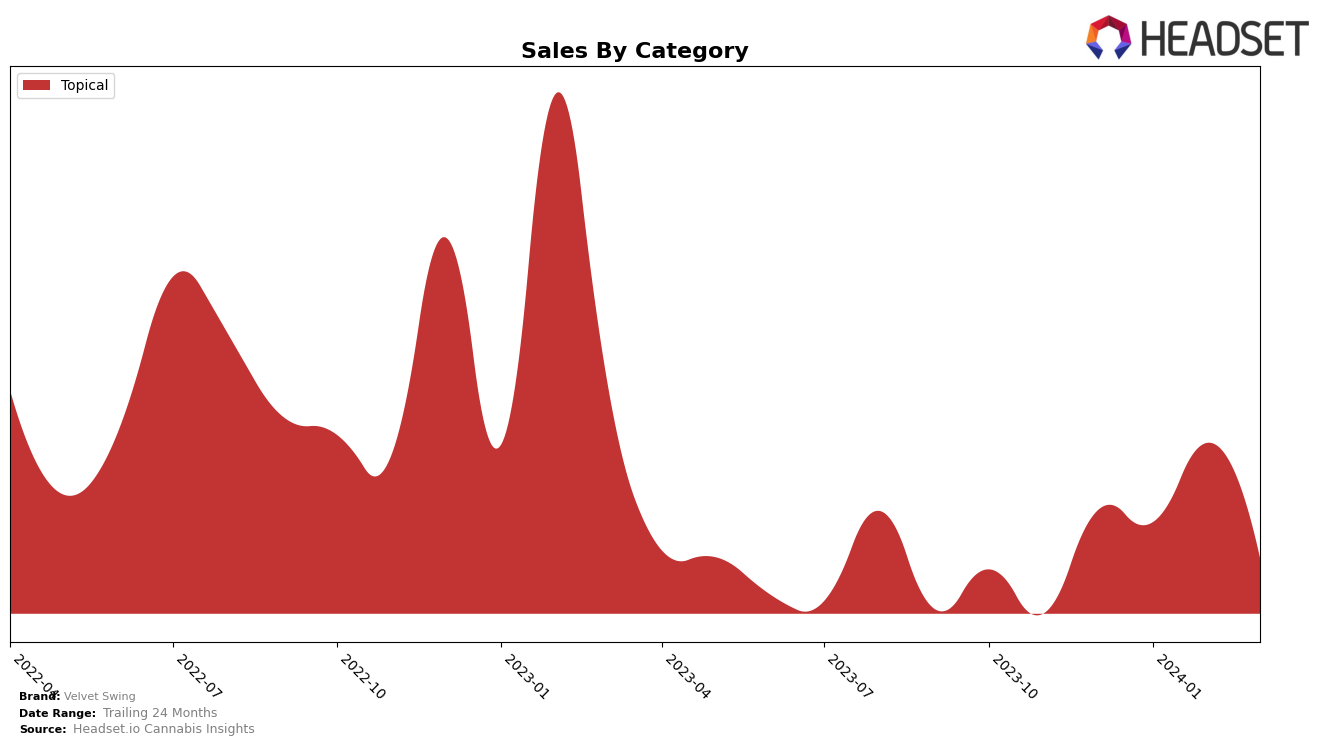

In the Topical category within Washington, Velvet Swing has shown a notable consistency in its performance, albeit with slight fluctuations. Initially ranked 10th in December 2023, the brand improved its standing to 9th in both January and February 2024, before experiencing a slight dip to 11th in March 2024. This movement indicates a competitive stance in the market, managing to remain within the top 15 brands consistently. However, the drop in March could suggest a need for strategic adjustments to maintain or improve its ranking. The sales figures reflect this journey, with a peak in February 2024 at 6023.0, suggesting a momentary increase in consumer interest or possible promotional activities that month.

Despite the slight setback in March 2024, Velvet Swing's presence in the top 30 brands for the Topical category in Washington throughout these months is commendable. The absence from a higher rank or more significant sales increase in March 2024 does highlight the competitive nature of the cannabis market in Washington. It's crucial for brands like Velvet Swing to leverage their market insights and customer feedback to innovate or market more effectively. The data suggests there's potential for growth and stability, provided the brand can navigate the competitive landscape with agility and strategic foresight.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Washington, Velvet Swing has experienced fluctuations in its ranking over the recent months, indicating a dynamic competition among brands. Initially ranked 10th in December 2023, Velvet Swing improved to 9th in January and February 2024, before slightly dropping to 11th in March 2024. This shift in rank is particularly notable in comparison to its competitors, such as Dank Czar, which saw an increase from 9th to 9th over the same period, and VI/V Six Fifths, which consistently held a higher rank (8th) and managed to maintain its position better than Velvet Swing. On the other hand, Bodhi High remained steady at 12th, and SnacMe saw a more volatile ranking but ended at 13th in March 2024. These movements suggest a competitive environment where Velvet Swing's slight decline in rank could be attributed to the varying sales performances and strategic positioning of its competitors, highlighting the importance of continuous innovation and marketing efforts to maintain or improve its market position.

Notable Products

In March 2024, the top-performing product from Velvet Swing was the CBD/THC 1:3 Enhanced Sensual Lubricant (33mg CBD, 100mg THC, 13ml, 0.44oz) within the Topical category, maintaining its number one rank consistently from December 2023 through March 2024. This product achieved sales of 241 units in March. The Enhanced Sensual Lubricant 3-Pack (33mg CBD, 100mg THC) also ranked highly in previous months but did not make it to the rankings in March 2024. The consistent performance of the CBD/THC 1:3 Enhanced Sensual Lubricant highlights its strong market presence and consumer preference. The absence of the 3-Pack from March's rankings suggests a shift in consumer interest or availability issues.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.