Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

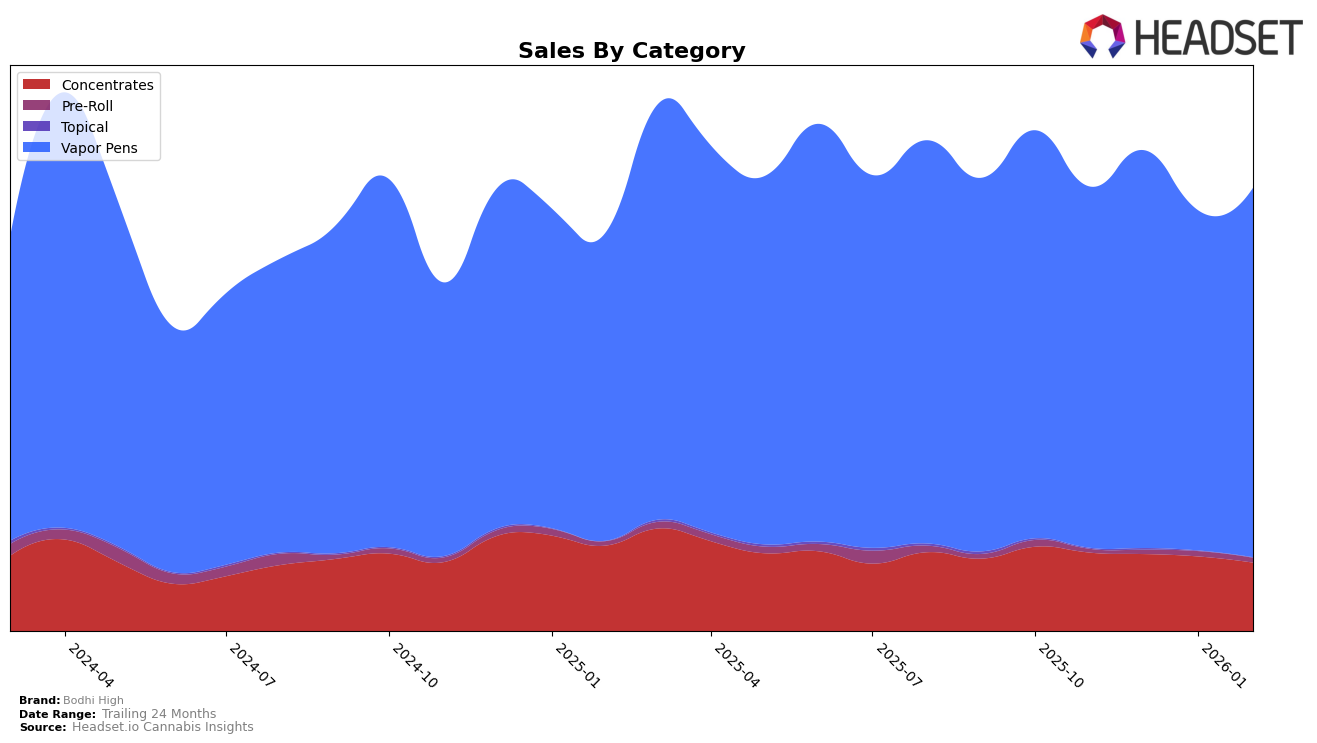

In the state of Washington, Bodhi High has shown some interesting movements across different product categories. Specifically, in the Concentrates category, the brand was not ranked in the top 30 brands for the months from November 2025 to February 2026. This could be indicative of challenges in gaining a competitive edge in this particular segment. Despite the absence from the top rankings, there is a slight upward trend as they moved from 38th to 32nd place over the four-month period, which may suggest a gradual improvement in market presence or consumer preference.

Conversely, Bodhi High's performance in the Vapor Pens category in Washington paints a more robust picture. Starting from a rank of 23rd in November 2025, the brand climbed to 16th by February 2026, signaling a strengthening position in this competitive category. This improvement is supported by a notable increase in sales from December 2025 to February 2026, despite a dip in January. Such movements highlight Bodhi High's potential focus and success in the Vapor Pens category, which could be a strategic area for the brand moving forward.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Bodhi High has shown a notable improvement in its ranking, moving from 23rd place in November 2025 to 16th place by February 2026. This upward trend indicates a positive shift in market presence, despite the competitive pressure from brands like Lifted Cannabis Co, which consistently maintained a higher rank at 14th place throughout the same period. Plume (WA) also held a steady position, ranking 15th in February 2026, just one spot ahead of Bodhi High. Meanwhile, Buddies and Slusheez experienced fluctuations, with Buddies dropping from 15th to 17th and Slusheez moving from 19th to 18th. Despite these shifts, Bodhi High's sales figures suggest a resilient performance, as it managed to increase sales from $292,566 in November 2025 to $299,335 in February 2026, contrasting with the declining sales of Lifted Cannabis Co, which saw a significant drop from $600,488 to $440,129 over the same period. This data highlights Bodhi High's potential to climb further in the rankings if the current trajectory continues.

Notable Products

In February 2026, Bodhi High's top-performing product was the NYC Diesel Original Live Resin Cartridge, maintaining its number one rank from January with a sales figure of $652. The ZkittleBerry Live Resin Cartridge made a notable leap to the second position, up from fifth in January, indicating a significant increase in popularity. The Lemon Drop Live Resin Cartridge, although previously ranked first in November 2025, fell to third place in February. Birthday Cake Live Resin Cartridge consistently held the fourth position from December 2025 through February 2026. Strawberry Cough Ultra Pure Live Resin Cartridge entered the rankings in February, debuting at fifth place, suggesting a new interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.