Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

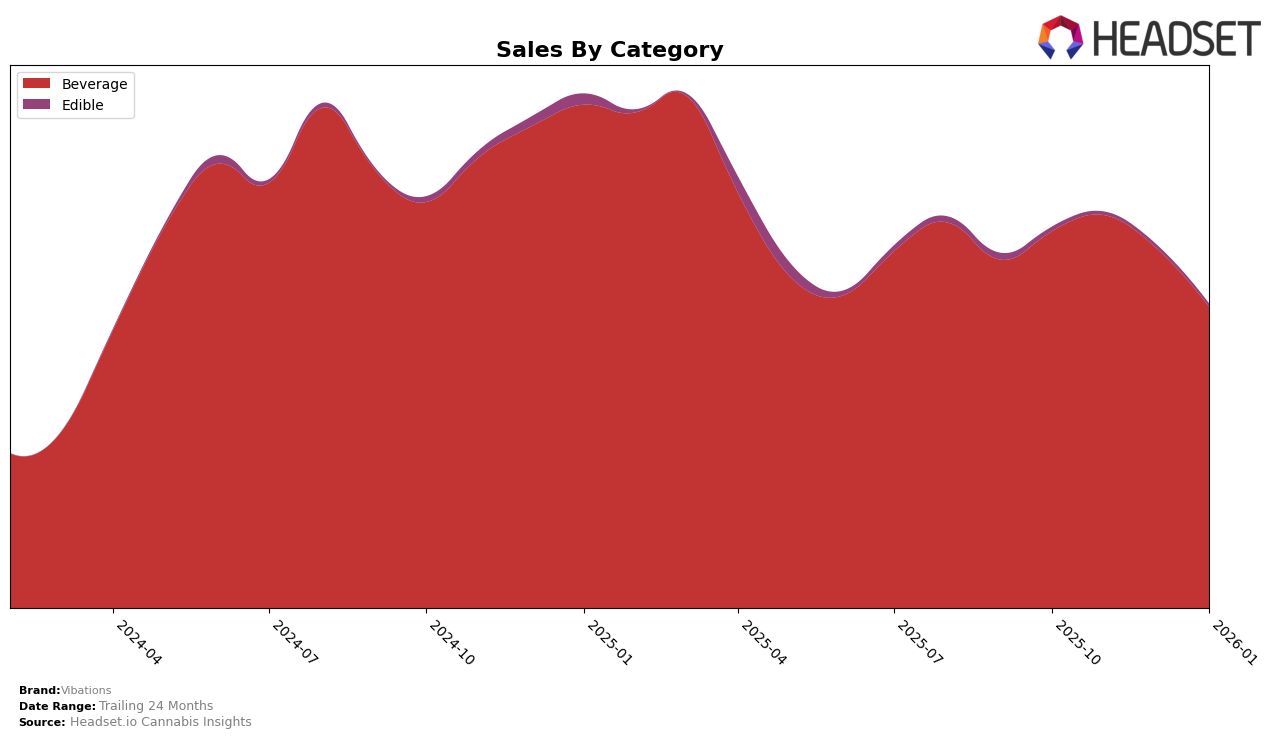

Vibations has shown varied performance across different states, with notable stability in the Illinois beverage market. Consistently ranking at number 8 from October 2025 to January 2026, Vibations demonstrates a steady presence despite a decline in sales from $48,976 in October to $38,157 in January. This suggests that while their market position remains stable, there might be underlying challenges affecting sales volume. In contrast, their performance in Massachusetts saw a slight dip in December 2025, where they fell out of the top 10 to rank 11th, before recovering to 9th in January 2026. This fluctuation might indicate competitive pressures or seasonal demand variations influencing their ranking.

In Maryland, Vibations has maintained a strong hold in the beverage category, consistently ranking 2nd from October to December 2025, before slipping to 3rd in January 2026. Despite this slight drop in ranking, Maryland remains a crucial market for Vibations, as evidenced by their impressive sales figures, which peaked in November at $130,259. The decline in January sales to $84,201 could be attributed to increased competition or changes in consumer preferences. The absence of Vibations from the top 30 in any other state or category highlights the need for strategic expansion or strengthening of their presence in other markets.

Competitive Landscape

In the Maryland beverage category, Vibations has experienced a notable shift in its competitive positioning from October 2025 to January 2026. Initially holding a steady second place, Vibations saw a decline to third place by January 2026. This change is primarily due to the rise of Sunnies by SunMed, which climbed from third to second place, indicating a strong competitive push. Despite this, Vibations remains a formidable player, consistently outperforming Dixie Elixirs and Tall, which have maintained their positions at fourth and fifth, respectively. The leading brand, Keef Cola, has consistently held the top spot, with sales figures significantly higher than those of Vibations. This competitive landscape suggests that while Vibations is facing increased competition, particularly from Sunnies by SunMed, it remains a key player in the Maryland beverage market.

Notable Products

In January 2026, the top-performing product for Vibations was the THC/THCV 2:1 Tropical Punch Drink Mix 10-Pack, which climbed to the number one rank with sales reaching 2416 units. The Strawberry Lemonade Liquid Drink Mix 10-Pack, which had consistently held the top spot from October to December 2025, fell to second place in January 2026. The CBD/THC 1:1 Half and Half Iced Tea Lemonade Powder Drink Mix maintained its position at third place, showing stability in its ranking despite a slight decrease in sales. New entries for January 2026 include the Strawberry Lemonade Drink Mix 10-Pack and the Pomegranate Blueberry Acai Tea Powder Drink Mix 10-Pack, which debuted at fourth and fifth place, respectively. The shift in rankings indicates a growing preference for the THC/THCV Tropical Punch variant among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.