Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

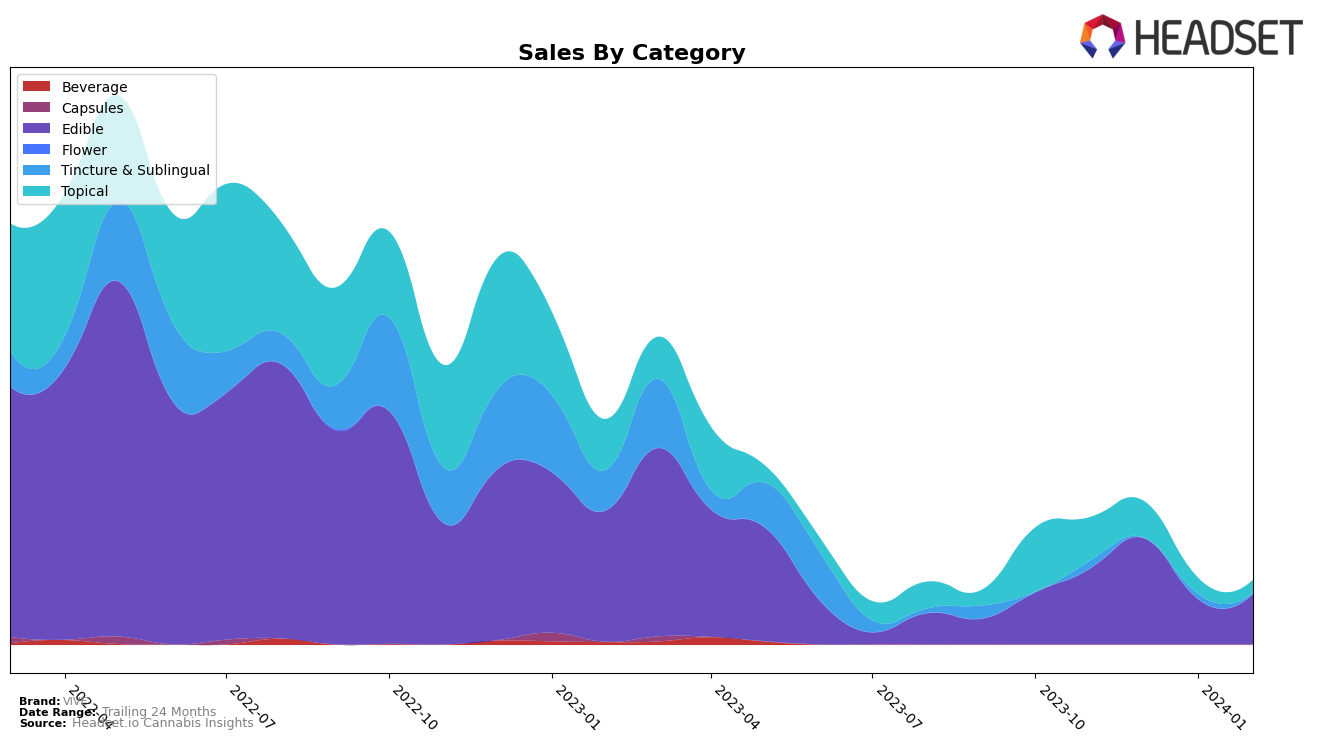

In Michigan, the cannabis brand VIVE has shown varied performance across different categories, indicating a fluctuating presence in the competitive landscape. In the Tincture & Sublingual category, VIVE held the 25th position in November 2023 but was absent from the top 30 in December, suggesting a potential decline or increased competition during that month. However, it managed to re-enter the rankings in January 2024 at the 26th position, indicating a slight recovery or adaptation in strategy. This absence from the rankings in December is noteworthy, as it highlights the challenges brands may face in maintaining consistent visibility in a highly competitive market. The sales figures, with a noticeable drop from November 2023 to January 2024, further underline the importance of understanding market dynamics and consumer preferences.

Similarly, in the Topical category within the same state, VIVE's performance demonstrated a downward trend over the observed months. Starting at the 22nd position in November 2023, it experienced a gradual decline, moving to 25th in December, then to 29th in January 2024, and slightly improving to 26th in February 2024. This trajectory suggests that while VIVE is managing to maintain a presence within the top 30 brands, it is facing challenges in climbing or even maintaining its rankings consistently. The sales in this category also reflect a declining trend, which could be indicative of various factors including market saturation, consumer preference shifts, or increased competition. For brands like VIVE, understanding these trends and adapting strategies accordingly is crucial for sustaining and improving market position.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Michigan, VIVE has experienced fluctuations in its ranking and sales over the recent months. Initially ranked 22nd in November 2023, VIVE saw a slight decline to 25th in December, before dropping further to 29th in January 2024, and then slightly improving to 26th in February. This trend indicates a challenging environment for VIVE, as it navigates through the competitive pressures from both established and emerging brands. Notably, Leilani Bee showed remarkable resilience and growth, moving from 23rd to 20th, and then to 24th, outperforming VIVE in terms of rank improvement and sales, especially with a significant sales jump in January 2024. Conversely, CBD Living made an impressive leap from 38th to 21st, highlighting the dynamic nature of the market and the potential for rapid shifts in consumer preference. Other competitors like Fatty's and Urban Roots Hemp Co also showed varying degrees of movement within the rankings, underscoring the competitive challenge VIVE faces in maintaining and improving its market position amidst fluctuating sales and the shifting landscape of the topical cannabis category in Michigan.

Notable Products

In February 2024, VIVE's top-performing product was the CBD Original Honey Stick (10mg CBD) from the Edible category, maintaining its number one rank consistently since November 2023, with sales figures in February reaching 100 units. Following closely, the CBD Ribbons Gummies (2000mg CBD) also in the Edible category, saw a significant rank improvement, moving up to the second position from being unranked in January, with a notable sales increase to 26 units. The CBD Broad Spectrum Salve (500mg CBD 2oz, 60ml) from the Topical category held steady at third place across November 2023 to February 2024, showcasing stable consumer demand. Interestingly, the CBD Peach Rings Gummies (2000mg CBD) entered the rankings in January 2024 and secured the fourth rank by February, indicating a growing interest in diverse edible options. These rankings highlight VIVE's strength in the Edible category and suggest a consistent consumer preference for their products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.