Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

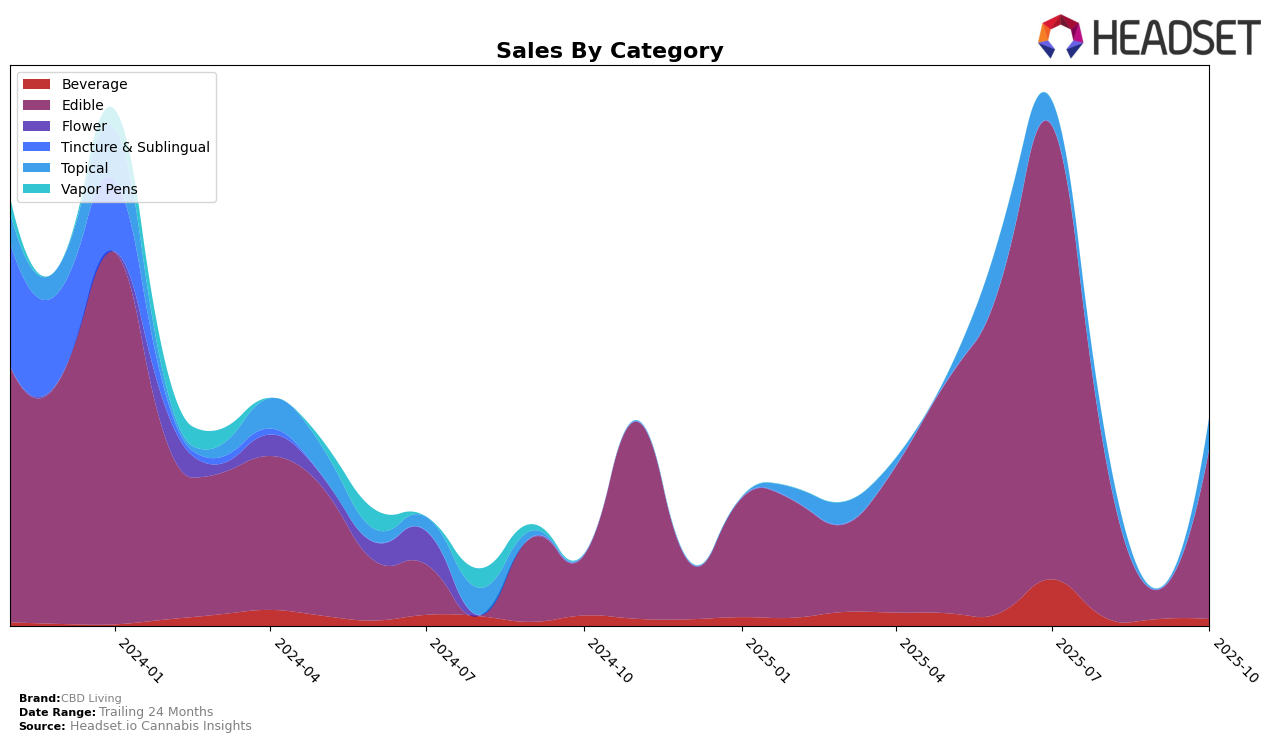

CBD Living's performance across various categories and states showcases a diverse landscape of market presence and consumer interest. In the Michigan market, the brand was ranked 95th in the Edible category in July 2025, with sales reaching $15,238. However, in the following months, the brand did not make it into the top 30 rankings, indicating a potential decline in market presence or increased competition. This drop in ranking could be a reflection of shifting consumer preferences or the entrance of new competitors in the Michigan edible market.

Despite the absence of CBD Living in the top 30 rankings for subsequent months, this does not necessarily imply a negative trajectory across all regions or categories. The brand's performance in other states or categories might tell a different story, suggesting opportunities for growth or areas where they maintain a strong foothold. Notably, the lack of rankings in the top 30 for August, September, and October could highlight the volatility and competitive nature of the cannabis market, where brands must continuously innovate and adapt to retain consumer interest and market share.

Competitive Landscape

In the Michigan edible category, CBD Living experienced a notable absence from the top 20 rankings from August to October 2025, after securing the 95th position in July. This suggests a potential decline in market presence or sales performance relative to its competitors. In contrast, Big Pete's Treats maintained a consistent presence, ranking 71st in August and 88th in both September and October, indicating a more stable market position. Meanwhile, Hyman entered the rankings in October at 97th, suggesting a new competitive entry. Motor City Cannabites and Green Gruff also showed fluctuating ranks, with Motor City Cannabites peaking at 91st in July and Green Gruff at 94th. These dynamics highlight the competitive pressures CBD Living faces, emphasizing the need for strategic adjustments to regain and sustain its market position in Michigan's edible segment.

Notable Products

In October 2025, the top-performing product from CBD Living was the CBD Mobility Bacon Flavor Dog Chews 30-Pack (300mg CBD), maintaining its first-place ranking from September with a notable sales figure of 270 units. The CBD Freeze Roll On (750mg CBD) climbed to the second position, showing a resurgence after being absent in August and September rankings. The CBD Black Cherry Sparkling Water (25mg CBD) held the third position, slightly dropping from its second-place ranking in September. The CBD Strawberry Lavender Sparkling Water (25mg CBD) remained stable in fourth place, consistent with its September ranking. Lastly, the CBD Mango Guava Sparkling Water (25mg CBD) rounded out the top five, slipping slightly from its fourth-place ranking in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.