Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

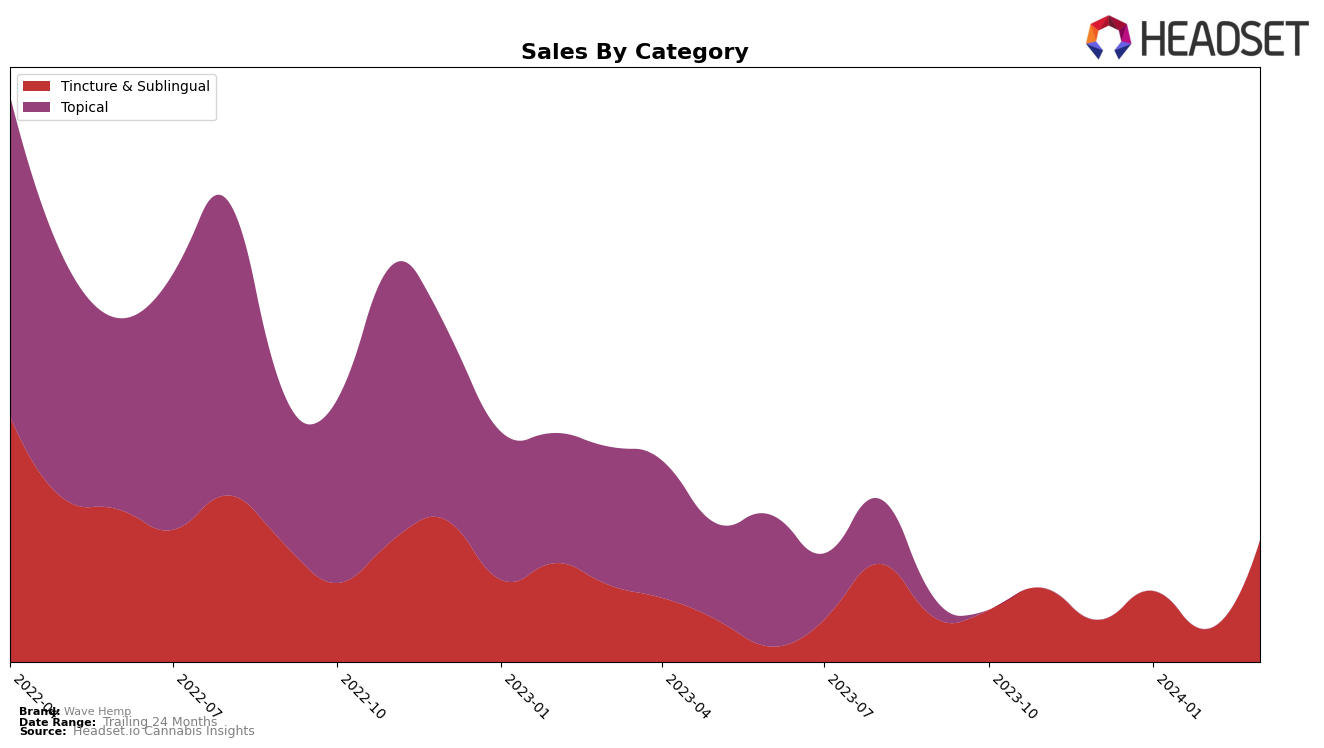

In the competitive landscape of the Massachusetts cannabis market, Wave Hemp has shown notable performance in the Tincture & Sublingual category. Starting at the 18th rank in December 2023 and making a significant leap to the 13th position by March 2024, Wave Hemp demonstrates a promising upward trajectory. This improvement is particularly impressive considering the brand was not among the top 30 in previous months, indicating a robust increase in consumer interest and sales. The sales figures, jumping from 623 units in December 2023 to a remarkable 1807 units in March 2024, underscore the growing market acceptance and preference for Wave Hemp's offerings in this category.

However, the journey hasn't been without its fluctuations. Despite the overall positive trend, there was a slight dip in February 2024, where the brand fell from the 15th to the 16th rank before rebounding strongly in March. This volatility highlights the competitive challenges within the Massachusetts market, where consumer preferences can shift rapidly, and brands must continuously innovate and engage with their audience to maintain and improve their standings. While Wave Hemp's performance in the Tincture & Sublingual category is commendable, the brand's ability to navigate the market's ebbs and flows will be crucial for its sustained growth and success in Massachusetts and potentially beyond.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Massachusetts, Wave Hemp has shown a notable trajectory in terms of its ranking and sales performance. Starting from December 2023, Wave Hemp was ranked 18th, but by March 2024, it improved its position to 13th, demonstrating a positive trend amidst fierce competition. This upward movement is particularly impressive when considering the performances of its competitors. For instance, MXR, despite a strong start, saw a decline from 8th to 15th place by March 2024, indicating a volatile market position. On the other hand, Gibby's Garden and INSA maintained relatively stable rankings within the top 15, with Gibby's Garden even securing a higher rank in March compared to December. Farm to Fam also experienced fluctuations, highlighting the competitive and dynamic nature of the market. Wave Hemp's consistent improvement in rank and sales, despite not disclosing exact figures, suggests a growing consumer interest and potential challenges for competitors as it continues to gain market share in Massachusetts.

Notable Products

In Mar-2024, Wave Hemp's top-performing product was the CBD Natural Tincture (1000mg CBD, 30ml) within the Tincture & Sublingual category, maintaining its number one rank from previous months with impressive sales figures reaching 68 units. Following closely, the CBD Peppermint Tincture (1000mg CBD, 30ml), also in the Tincture & Sublingual category, secured the second position, marking a notable return to the rankings and showcasing its popularity among consumers. The rankings for these products have remained relatively stable, with the CBD Natural Tincture consistently holding the top spot across previous months. The significant sales figure for the leading product underscores the high demand and preference for natural CBD options among Wave Hemp's clientele. This analysis highlights the enduring popularity and consumer trust in Wave Hemp's tincture products, especially the natural variant, within the competitive cannabis market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.