Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

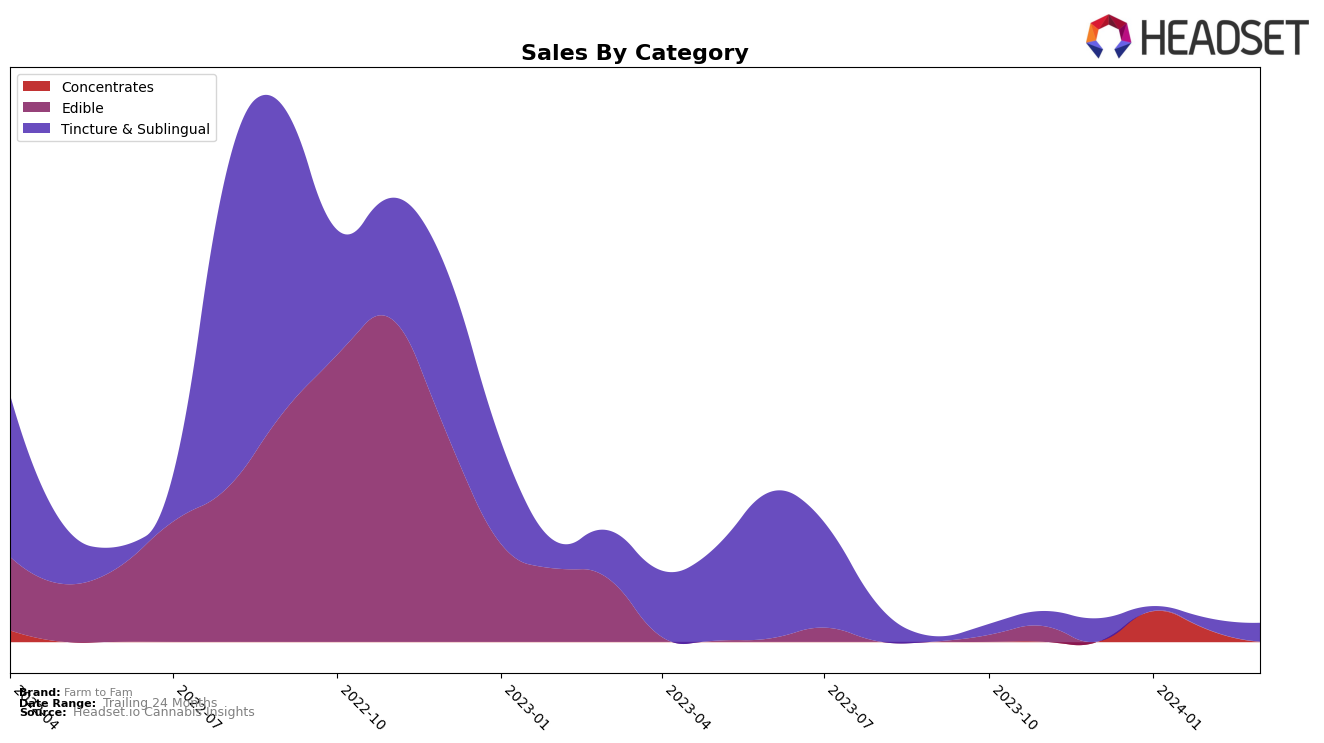

In Massachusetts, Farm to Fam has shown a mixed performance across different cannabis product categories. Notably, in the Tincture & Sublingual category, the brand maintained a strong presence within the top 20 rankings from December 2023 through March 2024, fluctuating slightly but showing resilience and consumer preference with rankings of 13th in December, 17th in January, 15th in February, and 14th in March. This consistency in ranking, alongside a significant sales increase from January's 425 units to 1,729 units in March, indicates a growing trust and preference for Farm to Fam's offerings in this category. However, it's essential to highlight that while the brand has maintained a strong position in the Tincture & Sublingual category, the detailed sales figures and the strategic moves behind this performance are nuanced and indicative of a broader market strategy.

Conversely, Farm to Fam's journey in the Concentrates category within the same state presents a different narrative. The brand did not secure a spot in the top 30 brands in December 2023, which could be seen as a significant setback. However, it made an appearance in the rankings in January 2024 at the 72nd position and saw a slight decline to the 80th position by February, without any ranking data available for March. This trajectory suggests challenges in gaining a solid foothold within the highly competitive Concentrates market. The sales figures, peaking at 2,901 units in December before dropping to 1,140 units in February, reflect the volatility and the brand's struggle to maintain consistent growth in this category. This contrast between the two categories underscores the brand's varying success and the importance of strategic positioning and product quality in different market segments.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Massachusetts, Farm to Fam has experienced fluctuations in its market position, highlighting the dynamic nature of consumer preferences and market competition. Initially ranked 13th in December 2023, Farm to Fam saw a decline to 17th in January 2024, before partially recovering to 14th by March 2024. This trajectory suggests challenges in maintaining consistent sales and market share, particularly when compared to competitors like INSA and Wave Hemp, which have shown more stability or improvement in their rankings during the same period. Notably, MXR and Zzzonked have experienced significant volatility, with MXR dropping from 8th to 15th and Zzzonked from 8th to 16th from December 2023 to March 2024. This indicates a highly competitive market where brands are closely contested, and small shifts in consumer preference or distribution can lead to notable changes in rank and sales. For Farm to Fam, the key to improving its market position may lie in understanding these market dynamics and adapting its strategies to better meet consumer demands and navigate the competitive pressures.

Notable Products

In March 2024, Farm to Fam's top product was Chill - Indica RSO Tincture (150mg) from the Tincture & Sublingual category, regaining its top position with 31 sales after being ranked second in the previous two months. The Hybrid Full Spectrum RSO Syringe (1g) from the Concentrates category, which had previously held the top spot in January and February, did not make the sales board in March, indicating a significant shift in consumer preference. Unfortunately, there was no sales data available for the RSO Sativa Tincture (150mg THC, 30ml) in March, making it impossible to track its performance. This shift highlights a dynamic change in the market demand within Farm to Fam's product range. Overall, these changes underscore the fluctuating nature of consumer preferences in the cannabis industry, with the Chill - Indica RSO Tincture (150mg) standing out as the clear favorite for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.