Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

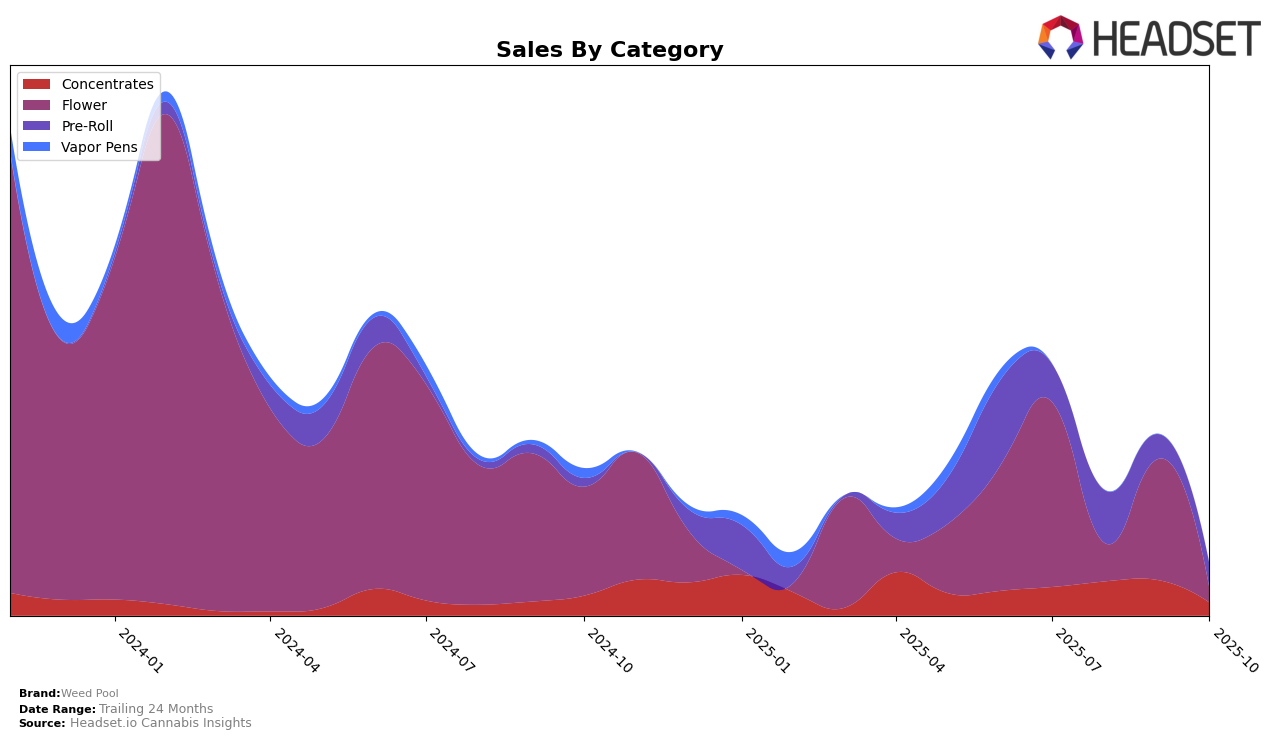

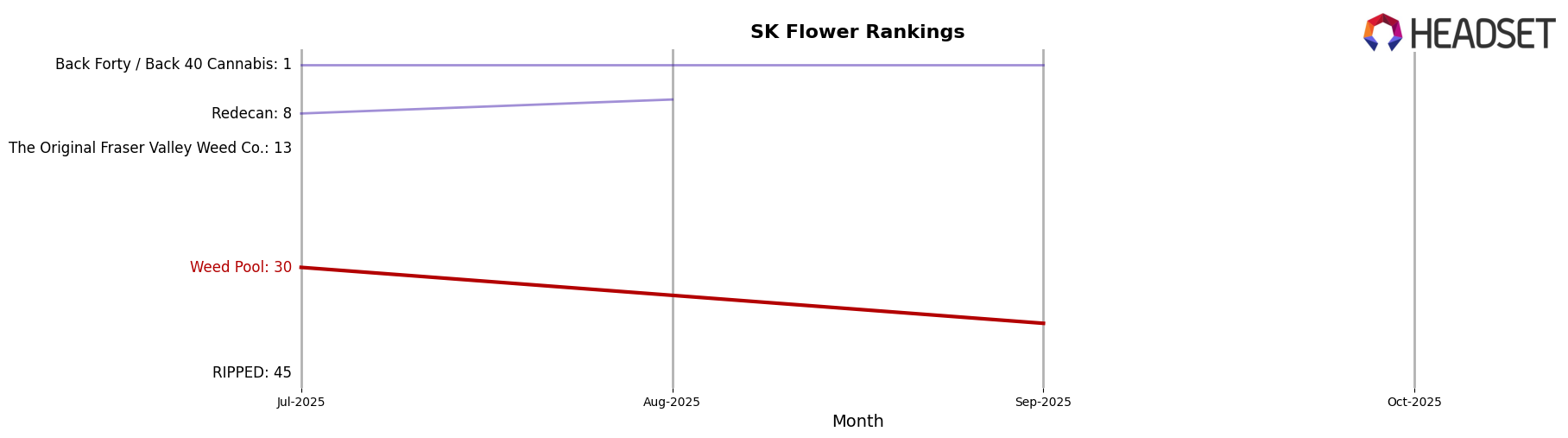

Weed Pool has experienced varying degrees of success across different categories and regions. In the Flower category within Saskatchewan, Weed Pool managed to secure the 30th position in July 2025 but unfortunately fell out of the top 30 by September and October. This indicates a decline in their market presence within this category, which could be attributed to increased competition or shifting consumer preferences. The drop from the rankings suggests a potential area of concern for the brand, highlighting the need for strategic adjustments to regain their footing in this competitive market.

In the Pre-Roll category, Weed Pool did not make it into the top 30 rankings in Saskatchewan for the months analyzed, with their highest position being 66th in August 2025. This absence from the top tier underscores a significant challenge for the brand in capturing consumer interest in this category. Such a position suggests that despite some sales activity, Weed Pool needs to enhance its market strategies or product offerings in the Pre-Roll segment to improve its standing and compete more effectively against other brands. The lack of presence in the top rankings could be a catalyst for the company to reassess its market approach and identify opportunities for growth.

Competitive Landscape

In the competitive landscape of the flower category in Saskatchewan, Weed Pool has faced significant challenges in maintaining its market position. Over the months from July to October 2025, Weed Pool's rank fluctuated, starting at 30th in July, disappearing from the top 20 in August, and reemerging at 38th in September, only to drop out again in October. This inconsistency in rank highlights the brand's struggle to secure a stable foothold in a competitive market. In contrast, Back Forty / Back 40 Cannabis has demonstrated dominance, holding the top position in July and September, which suggests a strong consumer preference and potentially higher sales figures compared to Weed Pool. Meanwhile, Redecan showed a positive trend, improving from 8th to 6th place between July and August, before dropping out of the top 20, indicating a temporary surge in popularity. These dynamics suggest that Weed Pool may need to reassess its strategies to compete more effectively against these leading brands in Saskatchewan's flower market.

Notable Products

In October 2025, Weed Pool's top-performing product was Dante's Inferno Pre-Roll 5-Pack (2.5g), which climbed to the number one spot, selling 146 units. RS-11 x Dripz Pre-Roll 10-Pack (5g) maintained a strong position at number two, despite a slight decline in sales compared to the previous month. El Gordo Traditional Hash (2g) slipped to third place, showing a consistent demand despite a drop in sales. Blueberry Kush (7g) made a notable entry into the rankings at fourth place, while Mango Cream (7g) appeared for the first time at fifth place. Overall, the shift in rankings indicates a competitive pre-roll segment, with new entries in the flower category gaining traction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.