Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

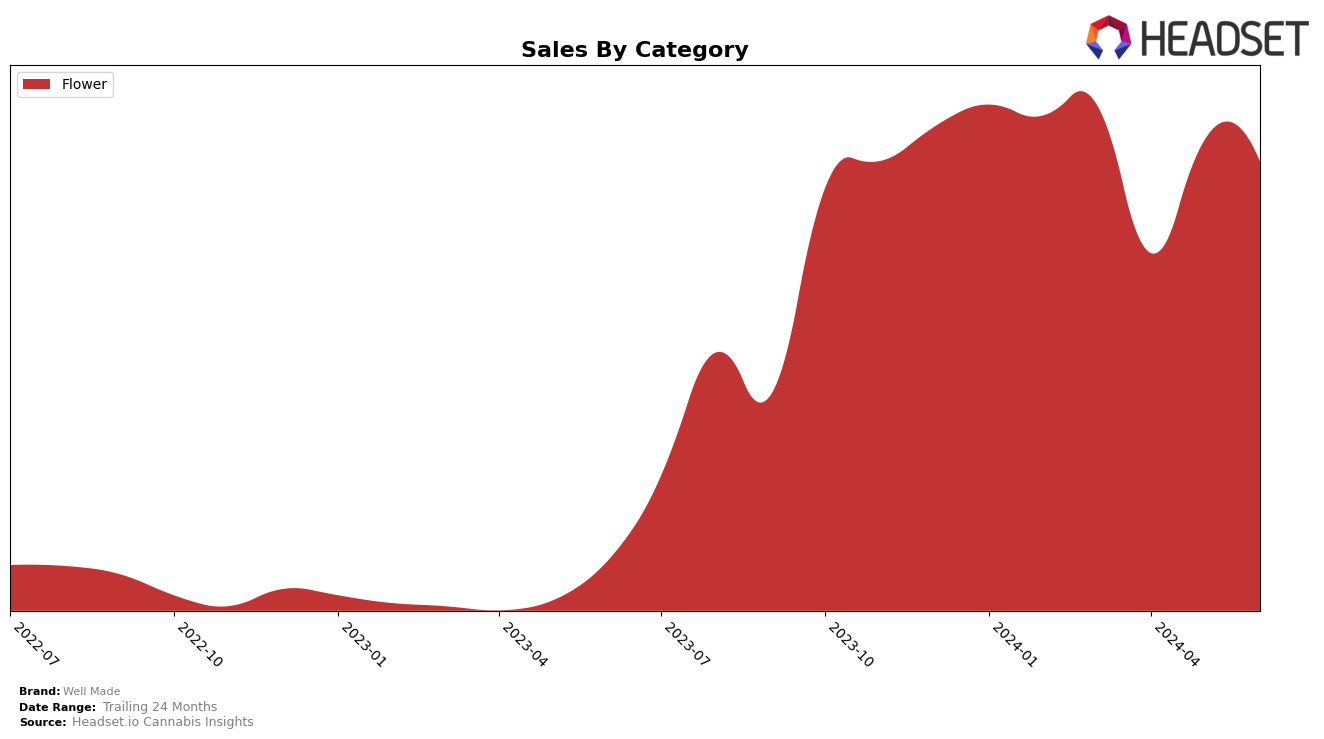

Well Made has shown varied performance across different states and categories. In Ontario, the brand has experienced fluctuations in the Flower category rankings. Starting at rank 23 in March 2024, Well Made dropped out of the top 30 in April, only to climb back to rank 26 by May and maintain that position in June. This recovery indicates resilience and a potential strategy adjustment that has helped regain market presence. The sales figures show a dip in April but a subsequent increase in May and June, suggesting a rebound in consumer interest and possibly effective promotional activities or product launches during this period.

In other states, Well Made's performance is not detailed, but the absence of rankings implies the brand did not make it to the top 30 in those regions and categories during the same period. This could be interpreted as a challenge for the brand to establish a foothold in more competitive markets or a need for a more targeted approach to gain traction. The mixed performance in Ontario highlights the dynamic nature of the cannabis market and the importance of continuous adaptation to consumer preferences and market conditions.

Competitive Landscape

In the highly competitive Ontario Flower category, Well Made has experienced notable fluctuations in its rank and sales over recent months. In March 2024, Well Made was ranked 23rd, but it saw a significant drop to 38th in April before rebounding to 26th in May and maintaining that position in June. This volatility contrasts with more stable competitors like 1964 Supply Co, which consistently hovered around the mid-20s, and Muskoka Grown, which remained in the mid-20s as well. Despite the ranking fluctuations, Well Made's sales showed a recovery trend from April to June, suggesting a potential for regaining market share. However, the brand still faces stiff competition from Wagners, which, despite a decline in rank, managed to secure higher sales figures in March. These dynamics indicate that while Well Made has the potential for growth, it must strategize effectively to stabilize its rank and capitalize on its sales recovery to outperform competitors in the Ontario market.

Notable Products

In June 2024, the top-performing product for Well Made was Chemfire Kush (28g) in the Flower category, maintaining its number one rank from May 2024 with sales of 2890 units. Mac Daddy Purpz (28g), also in the Flower category, held the second position, consistent with its rank in May 2024, despite a slight drop in sales to 2666 units. Notably, Chemfire Kush (28g) reclaimed the top spot in May 2024 after being ranked second in March and April 2024. Conversely, Mac Daddy Purpz (28g) dropped to the second position in May 2024 after leading in March and April 2024. These shifts highlight a competitive dynamic between these two leading products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.