Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

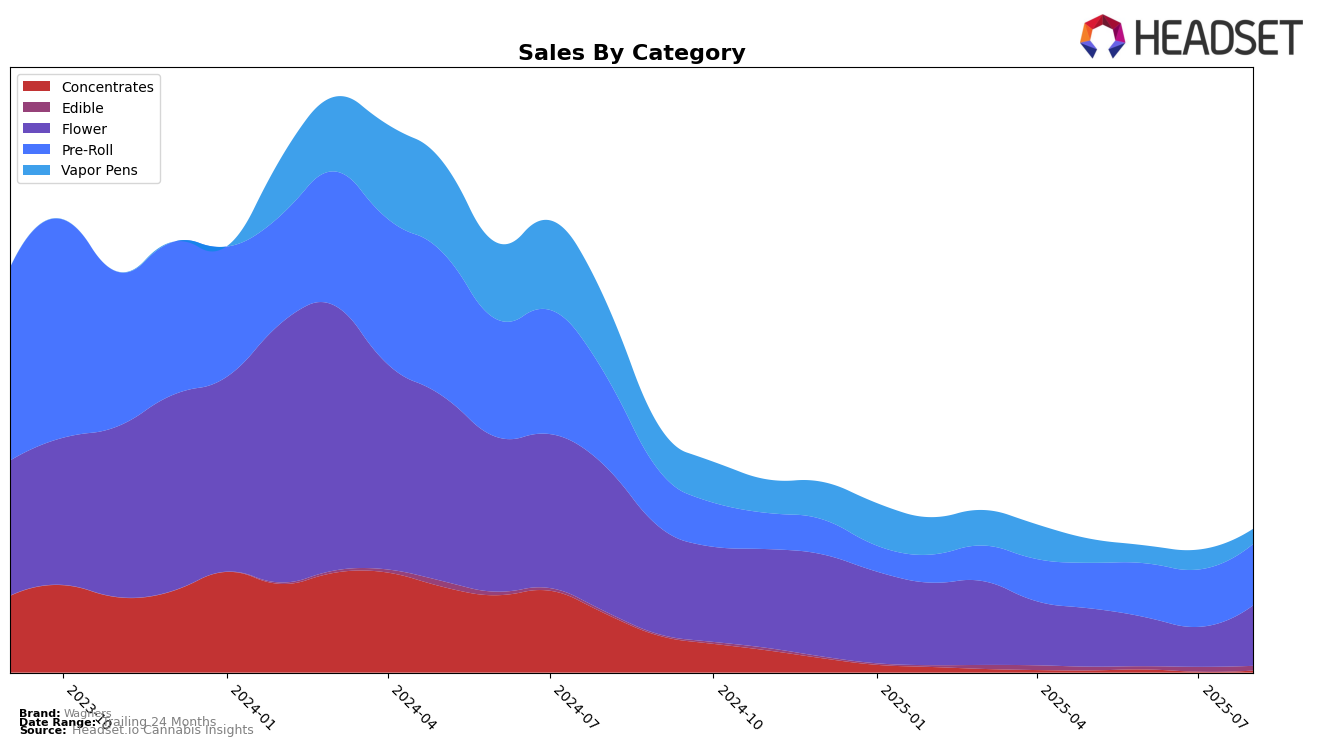

Wagners has shown a varied performance across different categories in Ontario. In the Edible category, Wagners made a notable re-entry into the top 30 in July 2025, securing the 28th position, and maintained this rank through August. This is a positive sign, indicating a resurgence in consumer interest or possibly an effective marketing strategy. In contrast, their performance in the Vapor Pens category has seen a decline, dropping from 53rd in May to 68th in August. This downward trend suggests challenges in maintaining market share, perhaps due to increased competition or changing consumer preferences.

In the Flower category, Wagners demonstrated resilience by climbing back to the 56th position in August, after a dip to 69th in July. This rebound could be attributed to strategic adjustments or product enhancements that resonated well with consumers. Meanwhile, in the Pre-Roll category, Wagners maintained a steady presence, holding the 67th rank in both July and August, which suggests a stable demand for their pre-roll products. However, the absence of Wagners in the top 30 for some categories in certain months highlights areas for potential growth and improvement, indicating that while some categories are thriving, others may require strategic attention to boost performance.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Wagners has shown a notable upward trend in rankings and sales from May to August 2025. Starting at rank 78 in May, Wagners improved to rank 67 by July and maintained this position in August, reflecting a strategic gain in market presence. In contrast, Bold remained relatively stable, hovering around rank 63 to 66, while Nugz (Canada) made a significant leap from rank 100 in May to 63 in August, surpassing Wagners in the latter months. Meanwhile, LowKey and Tasty's (CAN) experienced fluctuations, with LowKey dropping from rank 55 in June to 69 in August, and Tasty's (CAN) declining from rank 56 in May to 68 in August. Despite these shifts, Wagners' consistent improvement in sales, culminating in a 35% increase from May to August, underscores its growing appeal and competitive edge in the Ontario pre-roll market.

Notable Products

In August 2025, Wagners' top-performing product was Cherry Jam Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its consistent first-place ranking from previous months with sales reaching 14,033 units. Pink Bubba Pre-Roll 3-Pack (1.5g) held its second-place position in the same category, showing a notable increase in sales from previous months. Cherry Jam Super Sour Blasters Gummies 2-Pack (10mg) ranked third in the Edible category, consistent with its performance in July 2025. Pink Bubba (7g) continued to hold the fourth spot in the Flower category, showing a significant increase in sales figures. Pink Bubba Milled (7g) remained fifth in its category since June 2025, indicating stable performance over the summer months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.