Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

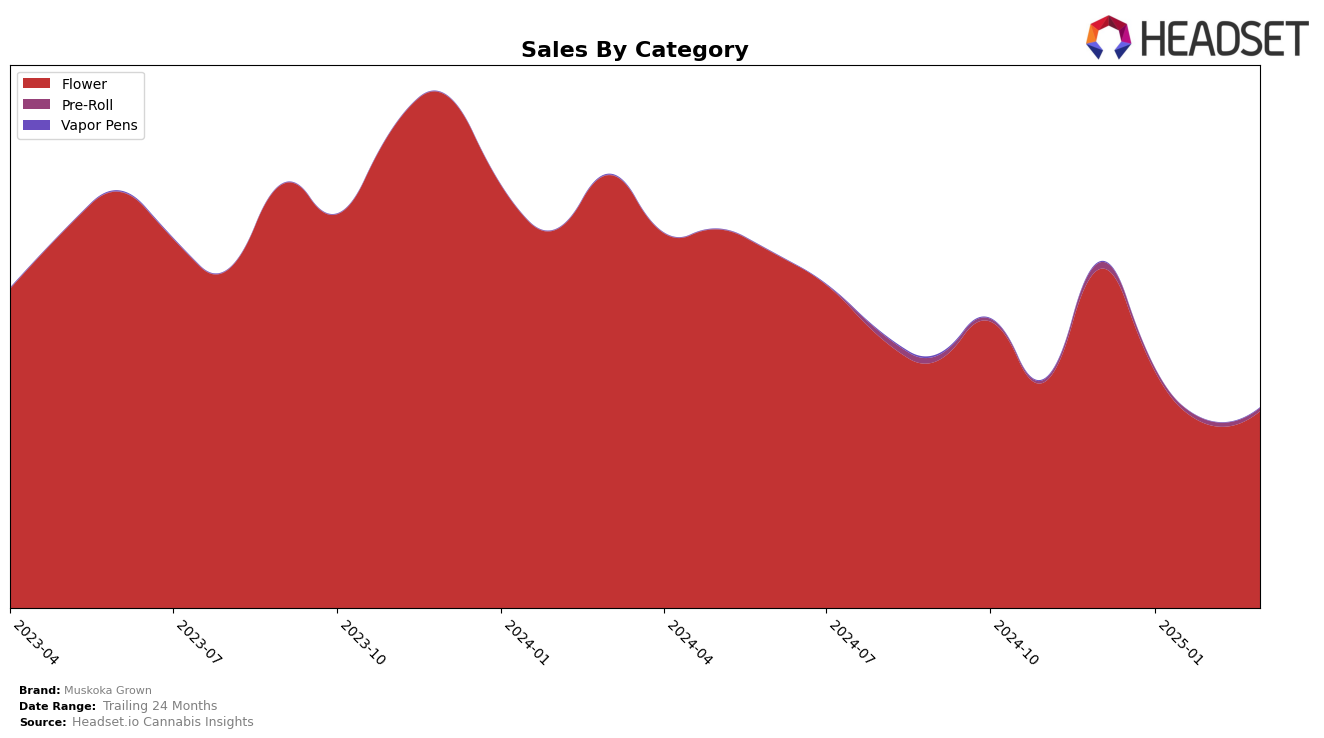

Muskoka Grown has experienced varied performance across different provinces, particularly in the Flower category. In Alberta, the brand did not make it into the top 30 rankings from December 2024 through March 2025, indicating challenges in gaining traction. This contrasts with their performance in Ontario, where they maintained a consistent presence in the top 30, even reaching the 30th position in both December 2024 and March 2025. This stability in Ontario suggests a stronger brand presence and customer base compared to other regions. In Saskatchewan, Muskoka Grown's ranking fluctuated significantly, dropping out of the top 30 by March 2025, which highlights potential market volatility or competitive pressures in the province.

Examining sales trends, Muskoka Grown saw a notable decline in sales in Alberta, with figures dropping from $186,630 in December 2024 to $101,025 by March 2025. This downward trend could be attributed to increased competition or shifts in consumer preferences. In Ontario, however, the brand managed to increase sales from February to March 2025, indicating a potential recovery or successful marketing efforts. Saskatchewan's sales plummeted, reflecting the brand's exit from the top 30 rankings by March 2025. These movements suggest that while Muskoka Grown has a solid foothold in Ontario, it faces significant challenges in other provinces, which may require strategic adjustments to improve performance outside of its strongest market.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Muskoka Grown has maintained a relatively stable position, fluctuating slightly between the 30th and 33rd ranks from December 2024 to March 2025. Despite this stability, the brand faces stiff competition from brands like Endgame, which consistently ranks higher, although it experienced a dip in March 2025. Additionally, Tenzo and EastCann have shown notable improvements, with both brands climbing in rank by March 2025, potentially threatening Muskoka Grown's market position. While Muskoka Grown's sales have seen a decline from December 2024 to February 2025, they rebounded slightly in March 2025, indicating a potential recovery. However, the brand must strategize effectively to counter the upward momentum of competitors like Dime Bag (Canada), which has shown a significant rise in rank and sales, particularly in the latter months of the period.

Notable Products

In March 2025, Mighty Mini's (28g) from Muskoka Grown retained its top position in the Flower category, achieving the highest sales figure of 1731 units. Sugar Cookies (28g) followed closely in second place, maintaining a consistent presence in the top three despite a slight drop from the previous month. Lakeside Kush (28g) climbed to the third position, marking a significant improvement from its fifth-place ranking in February. Berry Smasher (14g) re-entered the top five, securing the fourth spot after not ranking in February. Meanwhile, Sugar Cookies (3.5g) experienced a decline, moving from second to fifth place over the past month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.