Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

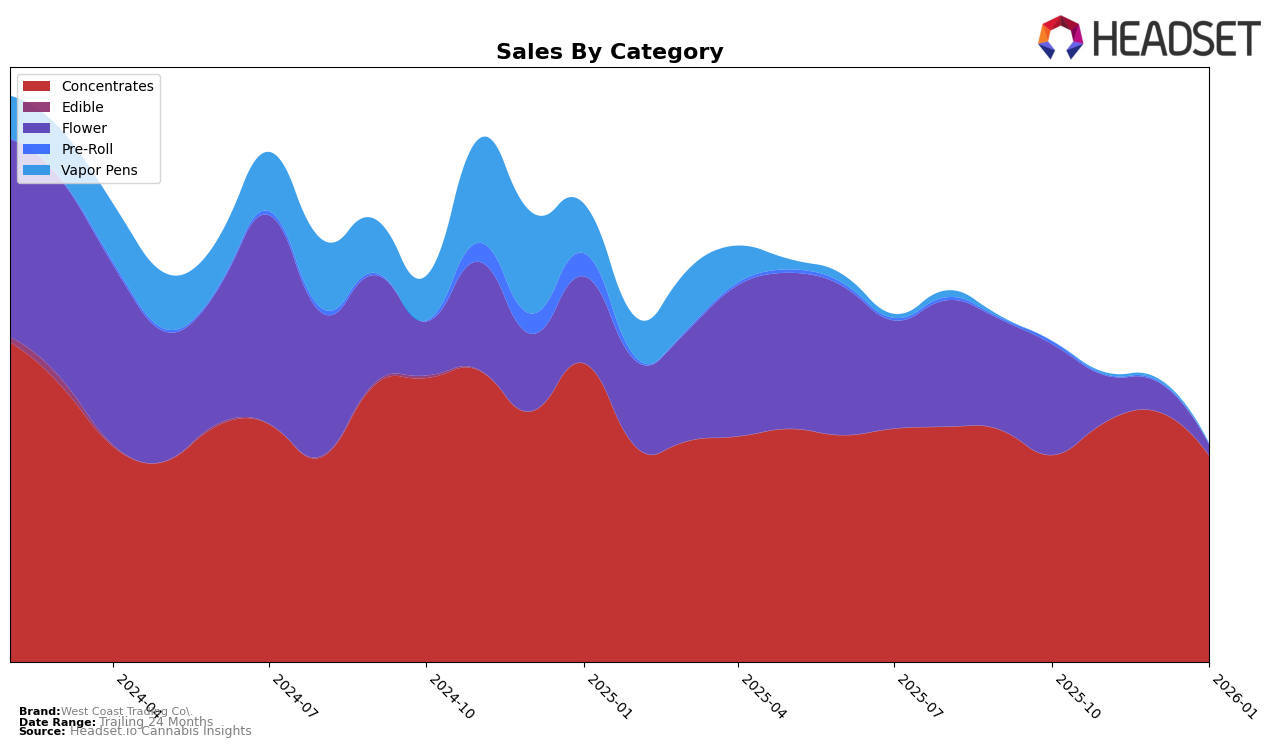

West Coast Trading Co. has shown varied performance across different categories and states, with notable activity in the concentrates category in California. In this state, the brand has maintained a consistent presence in the top 20 rankings over the past few months, fluctuating slightly between the 14th and 18th positions. Notably, their sales peaked in November 2025, demonstrating a positive trend during the last quarter of 2025, although they experienced a slight dip in January 2026. This indicates a robust yet slightly volatile market presence in California, with potential areas for growth and stabilization.

However, West Coast Trading Co.'s absence from the top 30 in other states suggests a more localized success, with room for expansion into new markets. The brand's ability to sustain a top position in California's competitive concentrates category is commendable, yet the lack of ranking in other states highlights a potential area for strategic development. This disparity suggests that while the brand has carved out a niche in California, there may be untapped opportunities in other regions that could be explored to enhance its market footprint. Such insights could be pivotal for stakeholders looking to understand the brand's market dynamics and strategize future growth.

Competitive Landscape

In the competitive landscape of California's concentrates market, West Coast Trading Co. has experienced a dynamic shift in its ranking and sales performance over the recent months. As of October 2025, the brand held a solid position at rank 15, showing a consistent presence in the top 20 through December 2025, before experiencing a slight dip to rank 18 in January 2026. This fluctuation is notable when compared to competitors like Cream Of The Crop (COTC), which improved its rank from 22 to 19 over the same period, and Master Makers, which climbed from rank 21 to 16. Despite this, West Coast Trading Co. maintained a robust sales performance, peaking in December 2025 before a slight decline in January 2026, still outperforming brands like Casual Cannabis and Have Hash in terms of sales volume. These insights suggest that while West Coast Trading Co. remains a strong contender, the competitive pressure is increasing, necessitating strategic adjustments to sustain its market position.

Notable Products

In January 2026, the top-performing product for West Coast Trading Co. was Super Glue Badder (1g) in the Concentrates category, achieving the number one rank with sales of 1128 units. Golden Strawberry Badder (1g) maintained its strong performance, holding steady at the second position with 705 units sold, following a rise from fifth in November 2025. Papaya Bomb Badder (1g) secured the third spot, although its sales decreased compared to December 2025. Modified Grapes Diamonds (1g) and Mac Tre Badder (1g) entered the top five for the first time, ranking fourth and fifth, respectively. This indicates a shift in consumer preference towards diverse concentrate options from West Coast Trading Co.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.