Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

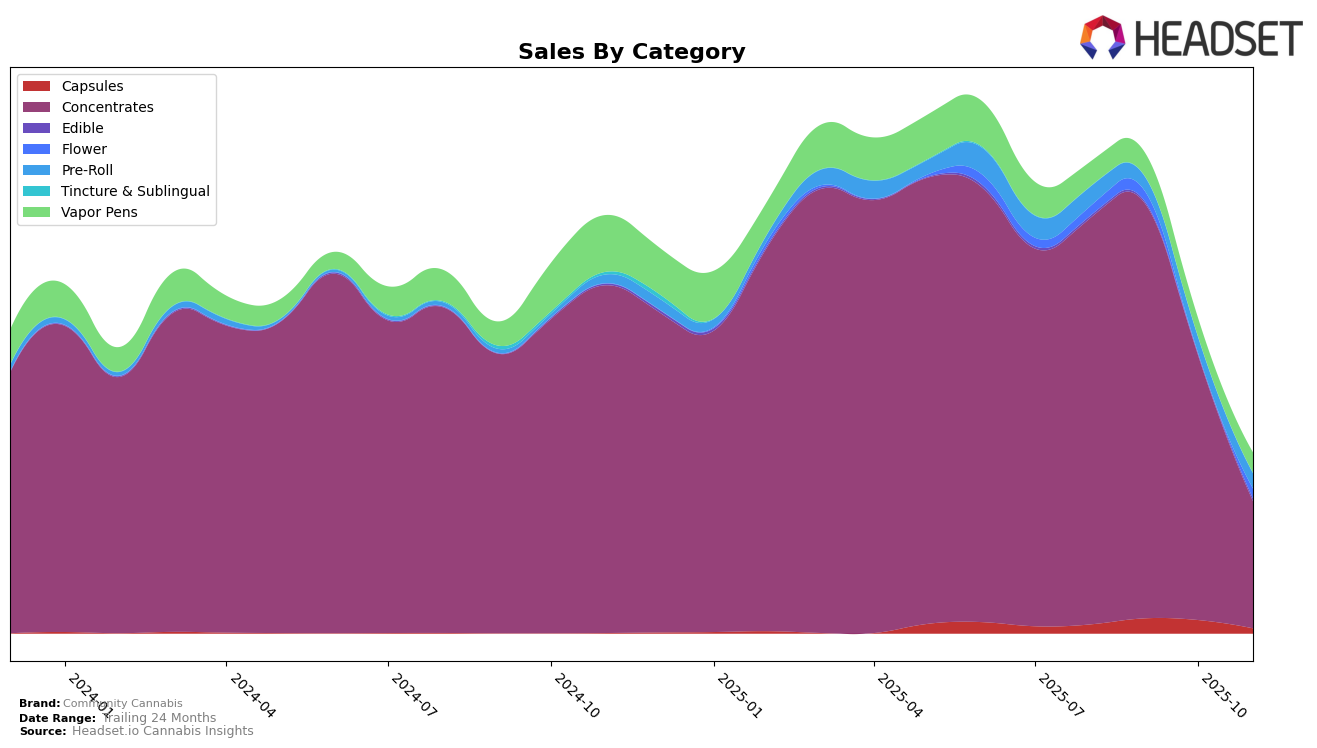

The performance of Community Cannabis in California has shown varied results across different product categories. In the Capsules category, the brand made a notable entry into the top 30 rankings in September 2025, holding the 13th position, but then dropped to 16th in November 2025. This downward movement might indicate increased competition or a shift in consumer preferences. In Concentrates, Community Cannabis had a strong start in August and September, maintaining the 10th position, but experienced a sharp decline by November, falling to the 30th spot. This significant drop could be attributed to a decrease in sales, as evidenced by a notable reduction in sales figures from September to November, suggesting potential challenges in maintaining market share within this category.

In Ontario, the performance of Community Cannabis in the Vapor Pens category presents a mixed picture. The brand was not in the top 30 in August, but managed to enter the rankings in September at the 100th position. However, by November, Community Cannabis climbed slightly to the 99th spot, indicating a minor upward trend in sales. Although the brand is still far from leading the category, this incremental improvement hints at potential growth opportunities in the Ontario market. The absence of a ranking in October suggests that the brand faced challenges maintaining consistent performance, which may need to be addressed to achieve sustained growth in this category.

Competitive Landscape

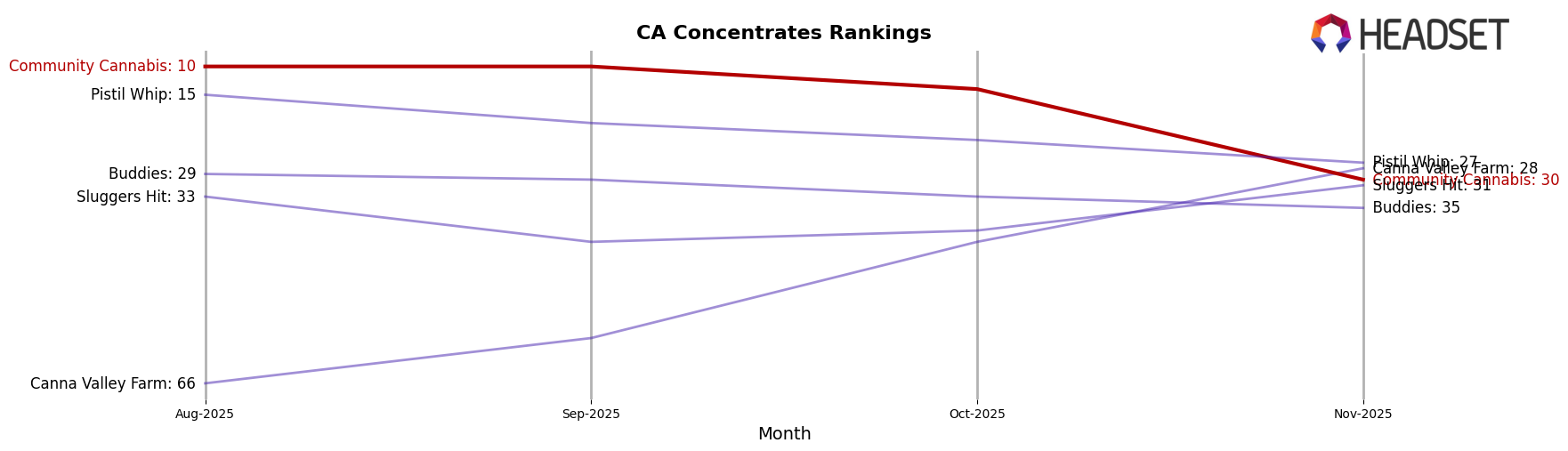

In the competitive landscape of California's concentrates category, Community Cannabis has experienced a notable shift in its market position from August to November 2025. Initially holding a strong 10th rank in August and September, Community Cannabis saw a decline to 14th in October and further to 30th in November. This downward trend in rank is reflected in their sales, which decreased significantly over the same period. In contrast, Canna Valley Farm demonstrated a remarkable upward trajectory, moving from 66th in August to 28th in November, with sales increasing consistently. Similarly, Pistil Whip showed resilience, maintaining a relatively stable position, improving from 15th in August to 27th in November, despite fluctuations in sales. Meanwhile, Buddies and Sluggers Hit remained outside the top 20, indicating a more challenging market presence. These dynamics suggest that while Community Cannabis faces challenges in maintaining its earlier stronghold, competitors like Canna Valley Farm are capitalizing on market opportunities to enhance their standings.

Notable Products

For November 2025, the top-performing product from Community Cannabis is the Purple Hills Pre-Roll 2-Pack (2g) in the Pre-Roll category, maintaining its number one rank from October with notable sales of $1,278. Honey Bananas Cold Cure Live Rosin (1g) in the Concentrates category secured the second position, marking its debut in the rankings. Rainbow Pushpop Cold Cure Rosin (1g) followed closely in third place, also making its first appearance. Cookie Dough Cold Cure Live Rosin (1g) and Gasoline Alley Shake (7g) in the Flower category rounded out the top five, with both products emerging in the rankings for the first time. This month saw a significant reshuffle in product rankings, with several new entries making a strong impact.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.