Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

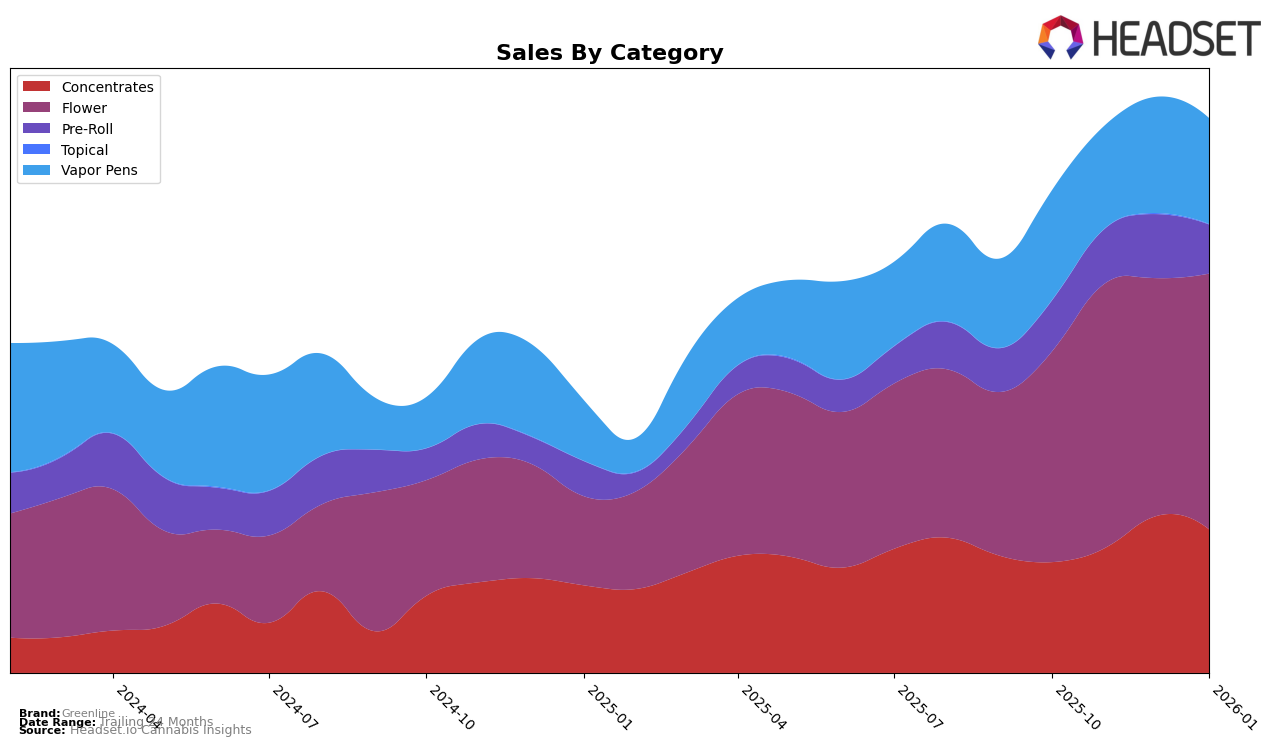

Greenline's performance in the California concentrates category has shown a positive trend over recent months, with the brand climbing from the 18th position in October 2025 to 14th by December 2025, before settling at 15th in January 2026. This upward movement indicates a strengthening presence in the concentrates market, supported by a notable increase in sales from $183,831 in October to $260,403 in December. In contrast, Greenline's performance in the flower category has been more volatile, with rankings fluctuating between 51st and 69th place. Despite these fluctuations, sales figures suggest a recovery from a dip in December, with January sales figures approaching those seen in November.

In the pre-roll category, Greenline's presence in California has been inconsistent, with the brand failing to appear in the top 30 rankings in both October 2025 and January 2026, indicating a challenging market environment. However, the brand did achieve a peak ranking of 87th in November, suggesting potential for growth if strategic adjustments are made. Meanwhile, in the vapor pens category, Greenline has maintained a steady ranking in the 57th to 62nd range, with sales remaining relatively stable throughout the observed months. This consistency suggests a loyal customer base that could be leveraged for further market penetration. While these insights provide a snapshot of Greenline's current market dynamics, there are additional nuances and trends that could further illuminate the brand's performance trajectory.

Competitive Landscape

In the competitive landscape of the California flower category, Greenline has shown a notable improvement in its rankings over recent months. Starting from a rank of 69 in October 2025, Greenline climbed to 51 by January 2026, indicating a positive trend in its market positioning. This upward movement is significant when compared to competitors like Lolo, which experienced a decline from rank 33 to 45 over the same period. Meanwhile, Seed Junky Genetics made a remarkable leap from being outside the top 20 to rank 53 in January 2026, suggesting a strong competitive presence. Gramlin, despite starting at a high rank of 7, saw a significant drop to 60, which might indicate shifting consumer preferences or market dynamics. Lights Out has shown consistent improvement, moving from rank 67 to 48, surpassing Greenline in January 2026. These shifts highlight the dynamic nature of the market and underscore the importance for Greenline to maintain its growth momentum to enhance its competitive edge.

Notable Products

In January 2026, Greenline's top-performing product was Orange Tree Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from December 2025 with sales reaching 2,940. Orange Tree (3.5g) in the Flower category held steady in second place, despite a slight decrease in sales from the previous month. New entries in the top five include Block Crasher Badder (1g) and Orange Wreck Diamonds & Sauce (1g) in the Concentrates category, ranking third and fourth respectively. Jack Herer Liquid Diamond Cartridge (1g) in the Vapor Pens category rounded out the top five. These changes highlight a growing consumer interest in concentrates and vapor pens, shifting the focus slightly away from traditional flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.