Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

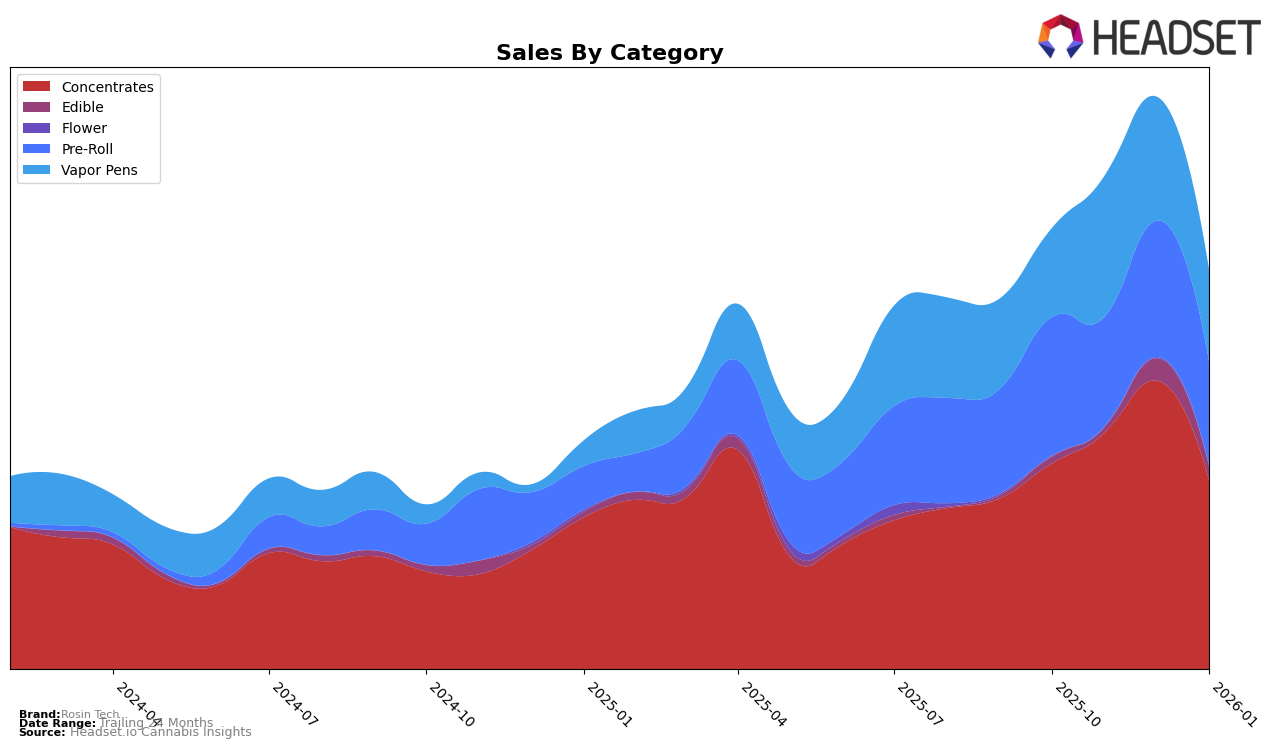

Rosin Tech has shown varied performance across different product categories in California. In the Concentrates category, Rosin Tech maintained a strong presence, experiencing a positive trend from October to December 2025, where it improved its rank from 11th to 9th. However, the brand saw a decline in January 2026, dropping to 13th place, which may suggest increased competition or seasonal fluctuations. In the Edible category, Rosin Tech was not in the top 30 until January 2026, when it finally entered the rankings at 55th place. This could indicate a strategic shift or a new product launch that helped them gain visibility in this segment.

Meanwhile, in the Pre-Roll category, Rosin Tech's performance has been less stable. They fluctuated outside of the top 50, with rankings varying from 59th to 69th between October 2025 and January 2026. Despite these fluctuations, the brand's sales figures in this category suggest a resilient demand, albeit with some volatility. In the Vapor Pens category, Rosin Tech experienced a similar trend, peaking at 54th in November 2025 before dropping to 71st by January 2026. This downward movement could be attributed to market dynamics or shifts in consumer preferences. Overall, Rosin Tech's presence in multiple categories highlights its diverse product offerings, but the brand's varying ranks suggest there are challenges to address for sustained growth across all segments.

Competitive Landscape

In the competitive landscape of California's concentrates market, Rosin Tech has experienced notable fluctuations in its ranking from October 2025 to January 2026. Initially ranked 11th in October 2025, Rosin Tech climbed to 9th place by December, driven by a significant increase in sales. However, by January 2026, the brand saw a decline to 13th position, indicating potential challenges in sustaining its growth momentum. In contrast, Himalaya consistently improved its rank, moving from 12th to 11th place, with a steady increase in sales, suggesting a strengthening market presence. Nasha Extracts also showed a positive trend, advancing from 14th to 12th place, although its sales growth was less consistent. Meanwhile, Greenline and Loud + Clear remained outside the top 10, with fluctuating ranks that reflect their ongoing struggle to capture a larger market share. These dynamics highlight the competitive pressures Rosin Tech faces, underscoring the importance of strategic adjustments to regain its upward trajectory in the California concentrates market.

Notable Products

In January 2026, Dosi Papaya Hash Hole Infused Pre-Roll (1g) took the top spot for Rosin Tech, with a sales figure of 984 units, marking its debut in the rankings. Pink Biscotti Hash Infused Pre-Roll (1g) improved its position from fourth in December 2025 to second place. Gelonade Hash Infused Pre-Roll (1g) entered the rankings at third place, while French 75 Hash Infused Pre-Roll (1g) dropped from first in December 2025 to fourth. Garlic Glue Hash Infused Pre-Roll (1g) saw a decline from second to fifth place. This shift in rankings highlights a dynamic change in consumer preferences for Rosin Tech's pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.