Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

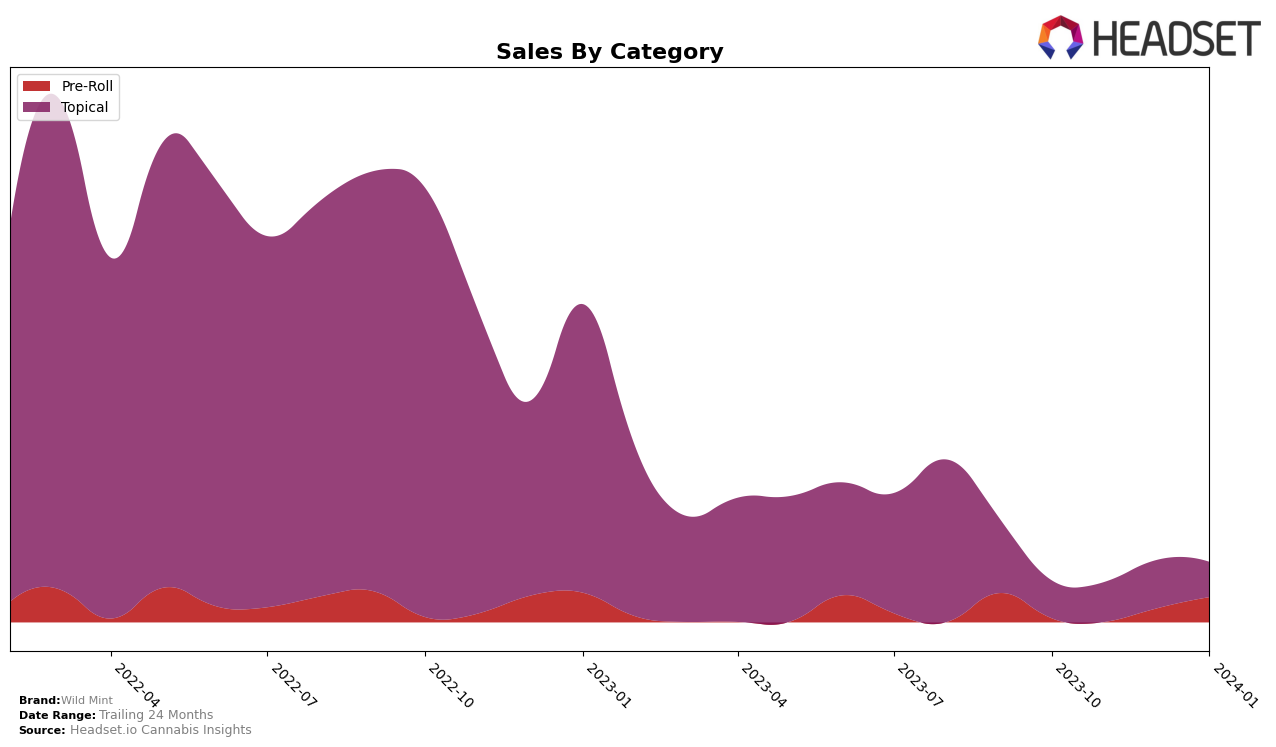

In the ever-evolving cannabis market, Wild Mint's performance in the Topical category within Washington has shown a notable consistency, albeit with slight fluctuations. Ranking within the top 20 from October 2023 through January 2024, Wild Mint experienced a small dip in its ranking, moving from 16th in October to 17th by January 2024. This slight decline in rank, despite an increase in sales from October to December, suggests a competitive market landscape where even modest sales gains can be overshadowed by the performance of other brands. Notably, the brand's sales peaked in December 2023, with 1427 units sold, indicating a potential seasonal preference for their products, before experiencing a decrease in January 2024 to 1036 units. This pattern of sales, juxtaposed with the rankings, provides a nuanced view of Wild Mint’s position within the Topical category in Washington, hinting at the challenges and dynamics of maintaining market share in a competitive environment.

While the provided data focuses solely on Wild Mint's activity within the state of Washington, it offers valuable insights into the brand's market performance and positioning. The absence of information regarding Wild Mint's performance across other states or provinces, or within different cannabis product categories, leaves room for speculation about the brand's overall market strategy and reach. The fluctuation in both sales and rankings, despite being confined to a single category and state, underscores the importance of strategic positioning and adaptation to market trends for cannabis brands. Wild Mint's journey through the ranks, coupled with its sales performance, exemplifies the nuanced dance of gaining and retaining consumer favor amidst a sea of competitors. This snapshot, while limited, is a testament to the brand's resilience and potential areas for strategic adjustments to enhance its market standing further.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Washington, Wild Mint has demonstrated a consistent presence within the top 20 brands, indicating a stable demand for their products. However, a closer look at the rankings from October 2023 to January 2024 reveals subtle shifts that could influence Wild Mint's market position. Notably, Yield Farms showed a remarkable recovery in January 2024, moving up to 15th rank, surpassing Wild Mint which slid to the 17th position. This fluctuation suggests Yield Farms' potential to capture a larger market share, possibly at Wild Mint's expense. Conversely, SnacMe, despite experiencing a slight decline, remained ahead of Wild Mint, underscoring the competitive pressure from brands that have managed to sustain higher sales volumes. Meanwhile, Verdelux and Flex-All lingered at the lower end of the rankings, suggesting that while they are competitors, their current impact on Wild Mint's market position is less pronounced. This competitive analysis highlights the importance of monitoring not only sales but also rank changes, as they provide valuable insights into consumer preferences and potential shifts in brand dominance within the topical cannabis market in Washington.

Notable Products

In January 2024, Wild Mint saw Juicy Joint Infused Pre-Roll (0.8g) maintaining its top position in sales with a significant lead, recording sales of 227 units. Following closely were CBD Pain Relieving Salve (50mg CBD, 1.5oz) and Muscle and Joint Warming Salve (1.5oz), both in the Topical category, each securing the second spot with equal sales figures, though the exact numbers are not disclosed. The CBD Plain Jane Unscented Pain Relieving Lotion (1.5oz) claimed the third rank, showcasing its rising popularity among consumers. Notably, the CBD:THC Help Essential Oil Roller (1312mg CBD, 71mg THC) made its way to the fourth position, indicating a growing interest in CBD:THC combination products. These rankings highlight a consistent consumer preference for topicals, with the exception of the leading Juicy Joint Infused Pre-Roll, and suggest a stable market presence for Wild Mint's diverse product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.