Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

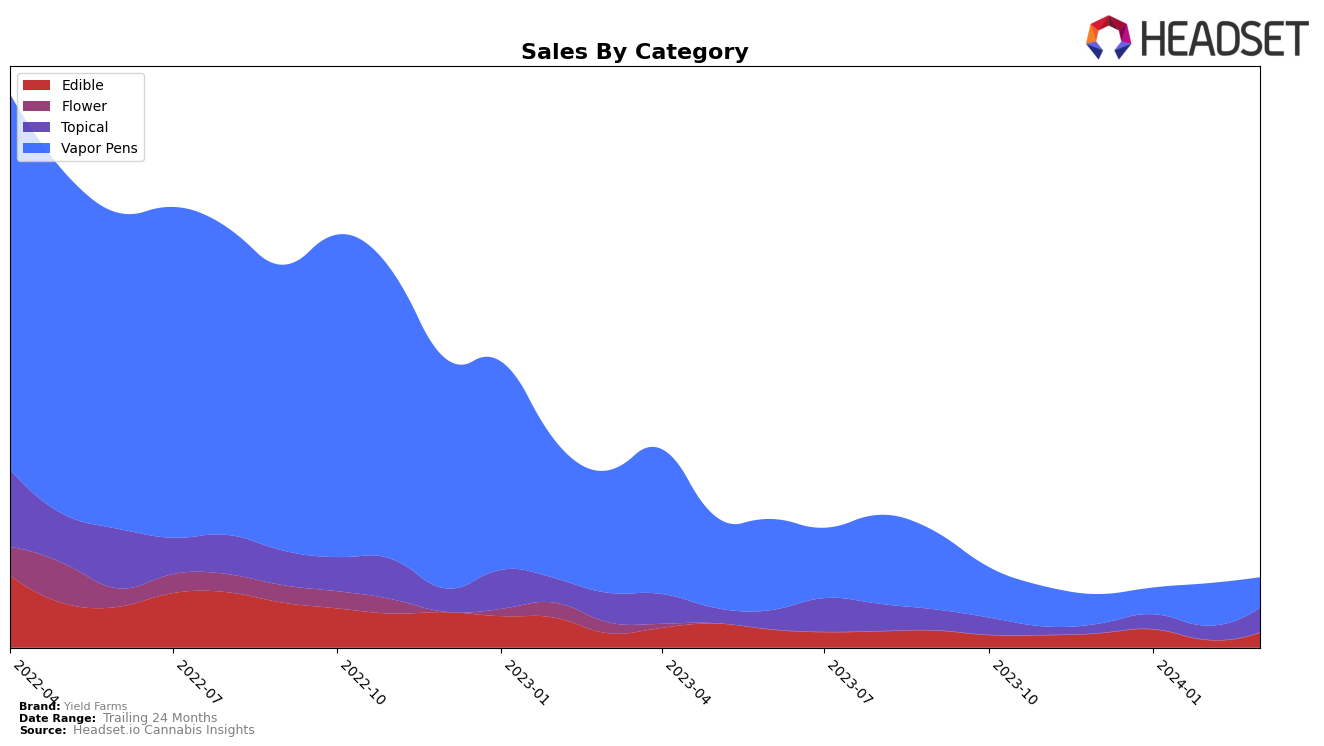

In the edible category within Washington, Yield Farms has shown a consistent presence, albeit with slight fluctuations in their ranking over the months. Starting at rank 52 in December 2023 and peaking at rank 48 in January 2024, their position wavered slightly back to rank 52 in February before settling at rank 50 in March 2024. This trajectory, while showcasing their ability to maintain a spot in the competitive landscape, also highlights a struggle to significantly improve their standing or break into a higher echelon of brands within the state. Sales figures mirror this journey, with an initial increase from 1139 units in December 2023 to 1471 units in January 2024, followed by a dip and a subsequent recovery, albeit not surpassing their January peak.

Conversely, in the topical category, Yield Farms has demonstrated a more favorable performance trajectory in Washington. Their rankings have seen a steady improvement, moving from the 20th position in December 2023 to the 14th by March 2024. This upward movement indicates a growing acceptance and preference for their topical products among consumers in the state. The sales data strongly supports this positive trend, with a significant jump from 735 units sold in December 2023 to an impressive 2012 units by March 2024. This performance not only underscores the brand's growing dominance in the topical category but also suggests a potential for further growth and market penetration in the coming months.

Competitive Landscape

In the competitive landscape of the Topical category in Washington, Yield Farms has shown a notable upward trajectory in its ranking and sales over the recent months, moving from 20th in December 2023 to 14th by March 2024. This improvement is significant when compared to its competitors. For instance, Bodhi High maintained a consistent rank of 12th, indicating stable but not improving performance. Meanwhile, Heylo fluctuated in the rankings but ended up at 16th, just behind Yield Farms by March 2024. Discovery Garden and SnacMe also showed movements in their rankings, with Discovery Garden experiencing a slight drop and SnacMe moving ahead, ending up at 13th by March 2024. Yield Farms' upward movement in both rank and sales, surpassing competitors like Heylo and closing the gap with others such as SnacMe, indicates a strong competitive momentum in the Washington Topical market, suggesting that its strategies and product offerings are resonating well with consumers.

Notable Products

In March 2024, Yield Farms saw the CBD Elixer Mixer Transdermal Gel 3-Pack (300mg CBD) from the Topical category rise to the top position with impressive sales of 152 units, marking a significant increase from its steady second-place rank in the previous months. Following closely, the Sky High Ranch Cheese Crackers 10-Pack (100mg) from the Edible category, which had previously dominated the rankings, dropped to second place with a notable decrease in sales. The Super Lemon Haze Cartridge (1g) from the Vapor Pens category maintained a strong presence by securing the third rank, highlighting its consistent popularity among consumers. The Dutch Treat Cartridge (1g), also from Vapor Pens, showed a promising improvement, moving up to the fourth position in March from its fifth rank in February, indicating a growing interest in this product. Lastly, the introduction of the Sundae Driver CO2 Cartridge (1g) into the market made a notable entry by securing the fifth rank, showcasing the dynamic nature of consumer preferences within the Yield Farms product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.