Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

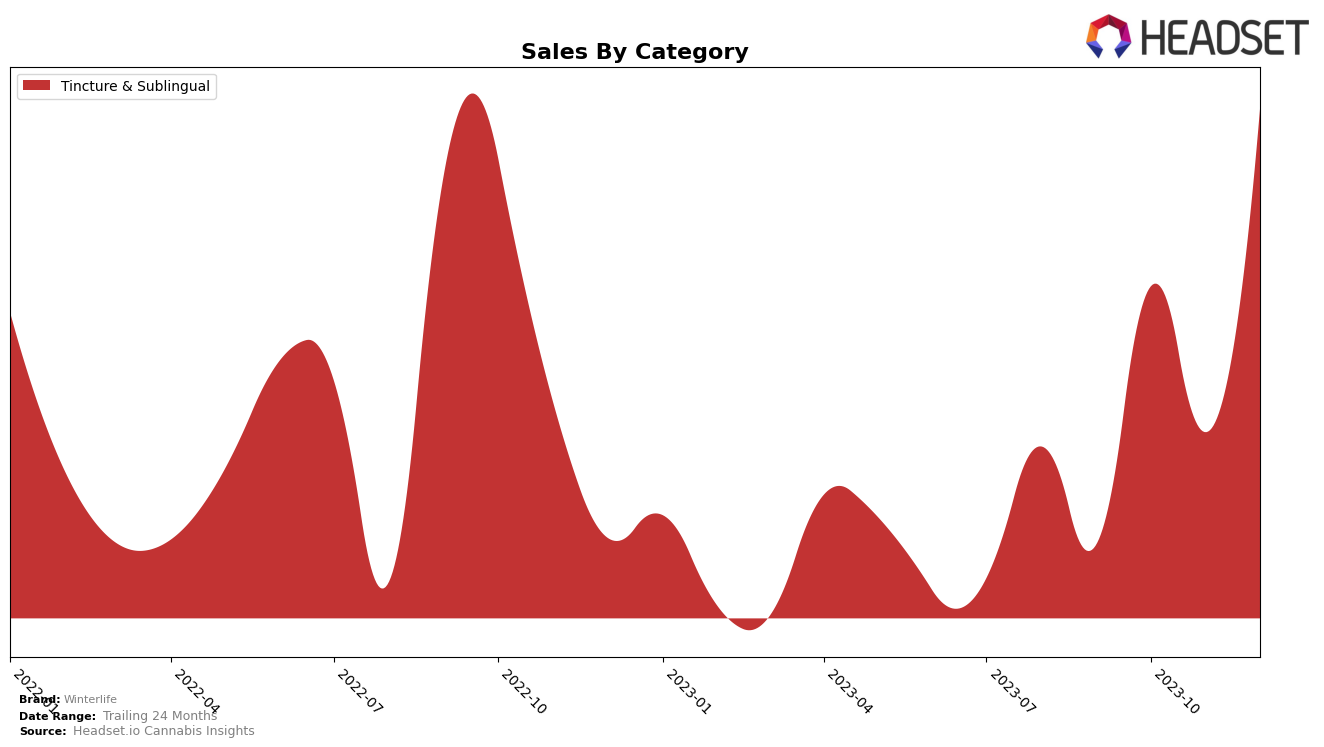

Winterlife, a prominent cannabis brand, has been making significant strides in the Colorado market, particularly in the Tincture & Sublingual category. The brand's ranking has seen a positive trend, rising from 18th place in September 2023 to 11th place by December 2023. This upward trajectory indicates a strong market performance and a growing consumer preference for Winterlife's products in this category. However, the brand's ranking fluctuated slightly in October and November, which could suggest a competitive market environment or varying consumer demands during these months.

When it comes to sales, Winterlife has shown a robust performance in the latter part of 2023. Although the brand started with modest sales in September, it managed to quadruple its figures by December. This significant increase in sales, coupled with the improved ranking, underscores Winterlife's growing dominance in the Tincture & Sublingual category within the Colorado market. However, the brand's absence from the top 20 in certain months indicates room for improvement and the need for sustained efforts to maintain its market position.

Competitive Landscape

In the Tincture & Sublingual category in Colorado, Winterlife has shown a steady rise in rank from 18th in September to 11th in December 2023, indicating a positive trend in market position. This upward trajectory in rank is mirrored by a notable increase in sales over the same period. In comparison, Dixie Elixirs fluctuated between the 13th and 18th positions, while marQaha maintained a consistent rank around 9th place. Ripple (formerly Stillwater Brands) and Green Treets also held steady ranks, at 10th and around 12th respectively. It's important to note that a missing rank for any month indicates that the brand was not in the top 20 for that month. Overall, Winterlife's consistent growth in both rank and sales suggests a strong competitive stance within this market segment.

Notable Products

In December 2023, Winterlife's top-performing product was the CBD/THC 1:1 Polar Bear's Peppermint Tincture, which falls under the Tincture & Sublingual category. This product maintained its top rank consistently from September to December. Notably, sales for this product increased from 11 units in September to 34 units in December, representing a significant growth in demand. The absence of other products in this summary does not imply their underperformance, but rather, emphasizes the outstanding performance of the Polar Bear's Peppermint Tincture. The consistent top ranking and increasing sales trend of this product highlight its popularity and success in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.