Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

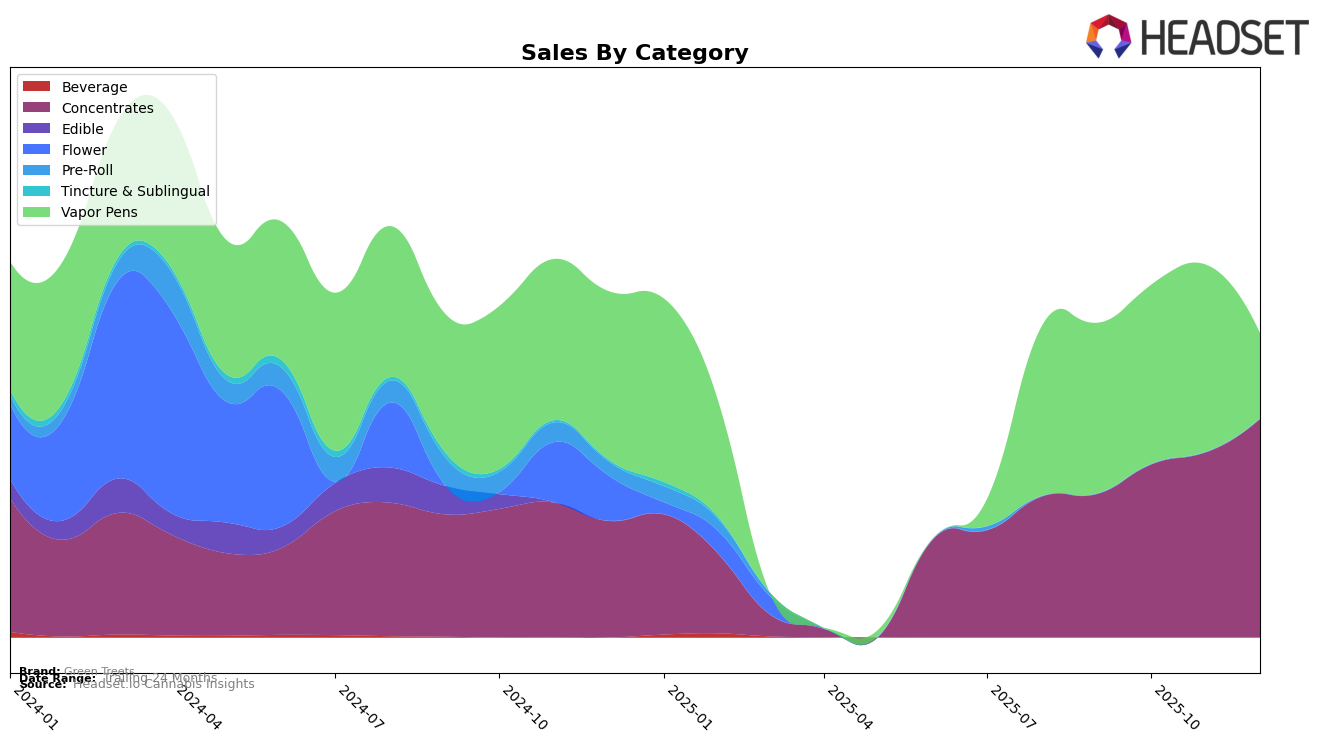

In the state of Colorado, Green Treets has shown a notable upward trajectory in the Concentrates category. Starting from a rank of 33 in September 2025, the brand improved its position to 27 by December 2025. This positive movement reflects a consistent increase in sales, with a particularly strong performance in December. On the other hand, the Vapor Pens category tells a different story. Although Green Treets started with a rank of 56 in September and slightly improved to 54 by November, there was a decline to rank 64 in December. This drop could indicate increased competition or shifting consumer preferences in the Vapor Pens market.

It's interesting to note that Green Treets was not in the top 30 brands for either category in Colorado during the analyzed months, which suggests there is room for growth and potential to capture a larger market share. The brand's strong performance in the Concentrates category, as evidenced by its rank improvement, could be leveraged to explore strategies that might help boost its presence in the Vapor Pens category. The sales data also points to a significant increase in Concentrates sales from October to December, indicating a promising trend that could be further capitalized upon moving into the next year.

Competitive Landscape

In the competitive landscape of Colorado's concentrates category, Green Treets has shown a notable upward trajectory in its rankings from September to December 2025. Starting at rank 33 in September, Green Treets climbed to rank 27 by December, indicating a positive trend in market presence and consumer preference. This upward movement contrasts with competitors like Seed and Smith (LBW Consulting), which maintained a consistent rank of 28 from October to December, and The Greenery Hash Factory, which experienced a slight decline from rank 23 in October to 25 in December. Notably, AO Extracts experienced a significant fluctuation, peaking at rank 13 in November before dropping to 26 in December. These dynamics suggest that while Green Treets is steadily improving its market position, it faces competition from brands with varying performance trends, highlighting the importance of strategic marketing and product differentiation to capitalize on its recent gains.

Notable Products

In December 2025, the top-performing product for Green Treets was Pleasure Stank Daddy Sugar Wax (1g) from the Concentrates category, which climbed to the number one position with sales of 680 units. Soothe - Purple Punch Distillate Cartridge (1g) ranked second, making a notable entry in the Vapor Pens category. Focus - Orange Life Wax (1g) secured the third spot in Concentrates, marking its debut in the top rankings. Soothe - Wedding Cake Distillate Cartridge (1g) improved its standing to fourth place from fifth in November, showing consistent performance in Vapor Pens. Mai Tai Sugar Wax (1g) entered the list at fifth place in the Concentrates category, rounding out the top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.