Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

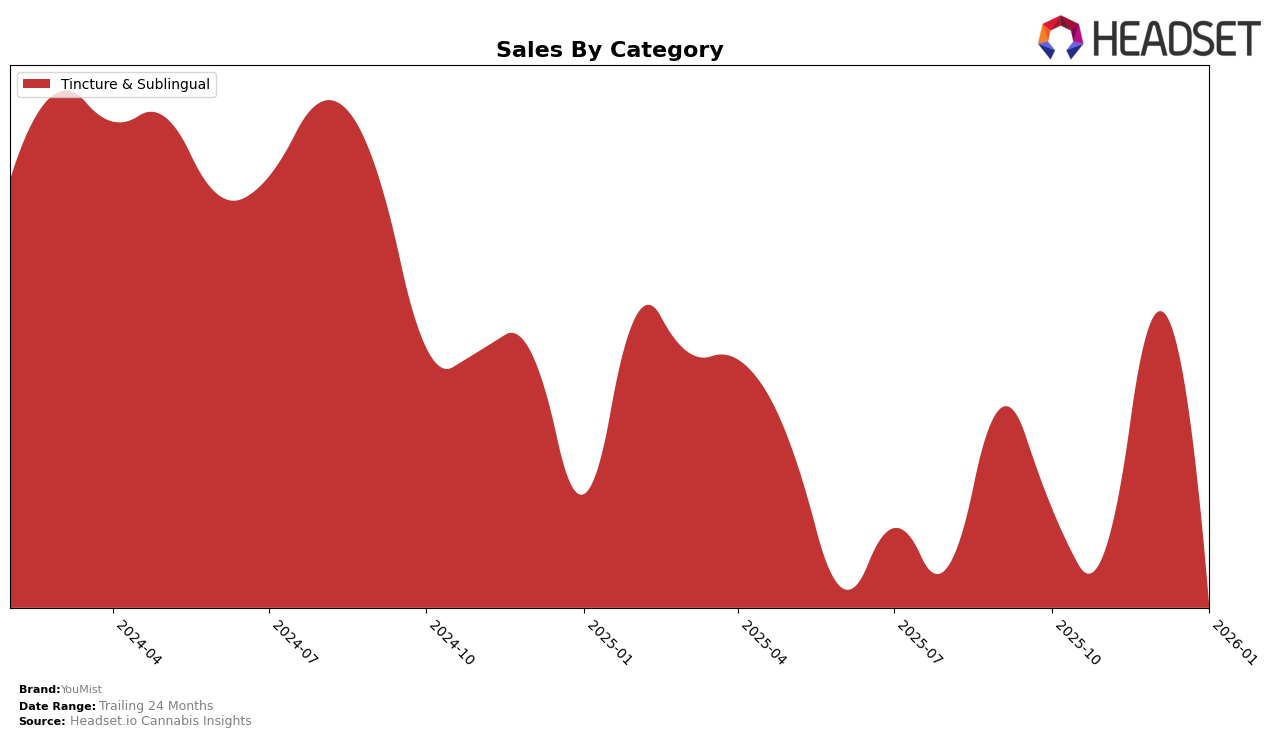

In the state of Michigan, YouMist has shown notable progress in the Tincture & Sublingual category. By December 2025, they achieved a ranking of 6th place, a significant milestone considering they were not in the top 30 in the preceding months. This upward movement indicates a growing acceptance and popularity of their products in this category within Michigan. Such a leap suggests effective market strategies or perhaps an introduction of new or improved products that resonated well with consumers in this state.

It's important to note that the absence of YouMist from the top 30 rankings in prior months highlights a period of underperformance or lesser visibility in the Michigan market. However, the December ranking suggests a successful turnaround. While we don't have specific sales figures for each month, the available data indicates a potential increase in sales volume, aligning with their improved ranking. Observing these trends can provide insights into how market dynamics and consumer preferences may have shifted in favor of YouMist's offerings during this period.

```Competitive Landscape

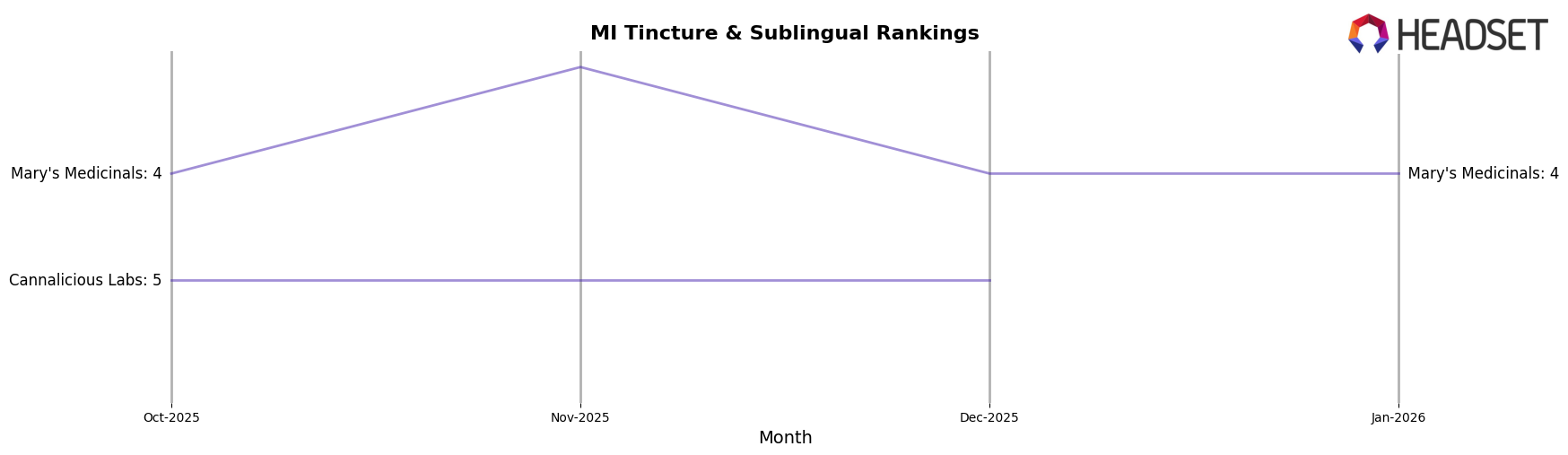

In the Michigan Tincture & Sublingual category, YouMist has shown a notable entrance into the competitive landscape by securing the 6th rank in January 2026, despite not being in the top 20 in the preceding months. This upward movement suggests a positive reception and growing consumer interest in their products. In contrast, Mary's Medicinals consistently maintained a strong position, fluctuating slightly between the 3rd and 4th ranks from October 2025 to January 2026, indicating stable demand. Meanwhile, Cannalicious Labs held steady at the 5th position through the same period, although their absence from the January 2026 rankings suggests a potential decline. These dynamics highlight YouMist's potential to capture more market share if they continue their current trajectory, especially as other brands experience fluctuations.

Notable Products

In January 2026, the top-performing product for YouMist was Sleepy Mist - CBN/THC 1:1 Mint Breath Spray (150mg CBN, 150mg THC), which achieved the number one rank with sales of 259 units, a significant increase from its consistent fifth-place ranking in the previous months. The Watermelon Mist Breathspray (200mg) climbed to second place, improving from its third-place position in December 2025. Sleepy Mist - CBD/THC 1:1 Mint Breath Spray (150mg CBD, 150mg THC), which held the top rank in October and November 2025, fell to third place in January. Monster X Energy Mist (150mg THC, 150mg CBG) maintained its fourth-place position consistently across the months. Mellow Mist- CBD/THC 1:1 Citrus Breathspray (150mg CBD, 150mg THC) rounded out the top five, dropping from third place in November to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.