Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

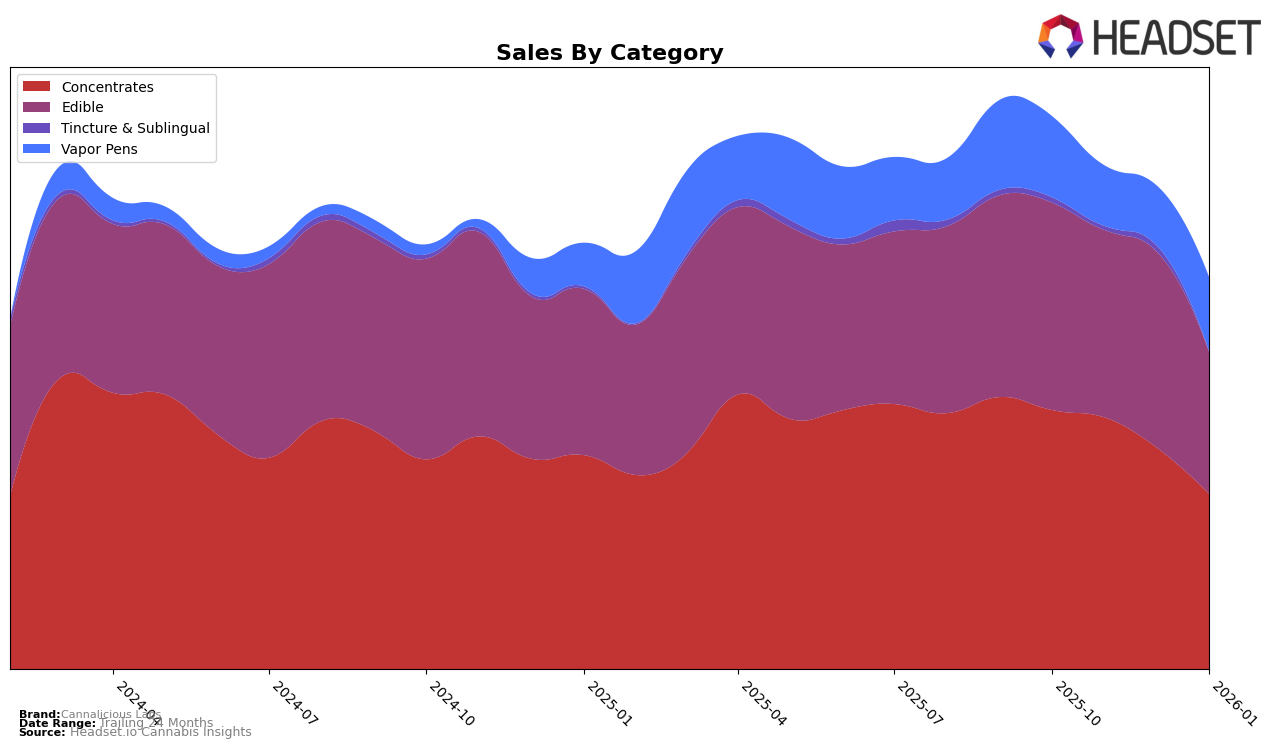

Cannalicious Labs has experienced notable fluctuations in its performance across different product categories in Michigan. In the Concentrates category, the brand has seen a steady decline in its rankings from 2nd place in October 2025 to 6th place by January 2026. This downward trend is mirrored in their sales figures, which show a consistent decrease over the same period. In contrast, their performance in the Edible category has been relatively stable, with rankings hovering around the 12th to 15th positions. However, the Tincture & Sublingual category presents a mixed picture; while Cannalicious Labs maintained a 5th place ranking from October through December, they did not make it into the top 30 in January 2026, indicating a potential area of concern or a shift in market dynamics.

In the Vapor Pens category, Cannalicious Labs has shown a varied performance trend. Initially ranked 38th in October, the brand dropped out of the top 50 in November and December, only to rebound to 36th place by January 2026. This resurgence suggests a potential recovery or strategic shift that could be explored further. The brand's performance across these categories indicates both challenges and opportunities, with the Concentrates category showing a clear need for strategic intervention to arrest the declining trend. Meanwhile, the Vapor Pens category might offer a growth opportunity if the upward movement in rankings continues. Such insights could be crucial for stakeholders looking to understand the brand's positioning and potential in the evolving cannabis market of Michigan.

Competitive Landscape

In the competitive landscape of Michigan's concentrates market, Cannalicious Labs has experienced a notable shift in its ranking and sales trajectory from October 2025 to January 2026. Initially holding a strong position at rank 2, Cannalicious Labs saw a gradual decline, dropping to rank 6 by January 2026. This decline in rank correlates with a decrease in sales over the same period, indicating potential challenges in maintaining market share. Meanwhile, Society C and Wojo Co have shown resilience, with Wojo Co advancing to rank 2 in December 2025, suggesting a competitive edge in product offerings or market strategies. Additionally, High Minded made a significant leap from rank 16 in November 2025 to rank 8 by January 2026, reflecting a successful strategy that has boosted its sales. As Cannalicious Labs navigates this competitive environment, understanding these dynamics and the strategies of rising competitors could be crucial for regaining its earlier market position.

Notable Products

For January 2026, Cannalicious Labs' top-performing product was Watermelon Rest RSO High Dose Gummies 10-Pack (200mg), maintaining its first-place ranking from December 2025 with sales of 7504 units. The Mixed Berry RSO Rest Gummies 10-Pack (200mg) held steady at the second position, though its sales decreased compared to previous months. Recovery - Mango RSO Gummies 10-Pack (200mg) consistently ranked third from October 2025 through January 2026. New entrants in the rankings include Lemon Bar Kush Distillate Disposable and Smart Puff - Grape Goji Distillate Disposable, which debuted at fourth and fifth positions, respectively, in January 2026. Overall, the edible category continues to dominate the top rankings, while vapor pens have newly emerged in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.