Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

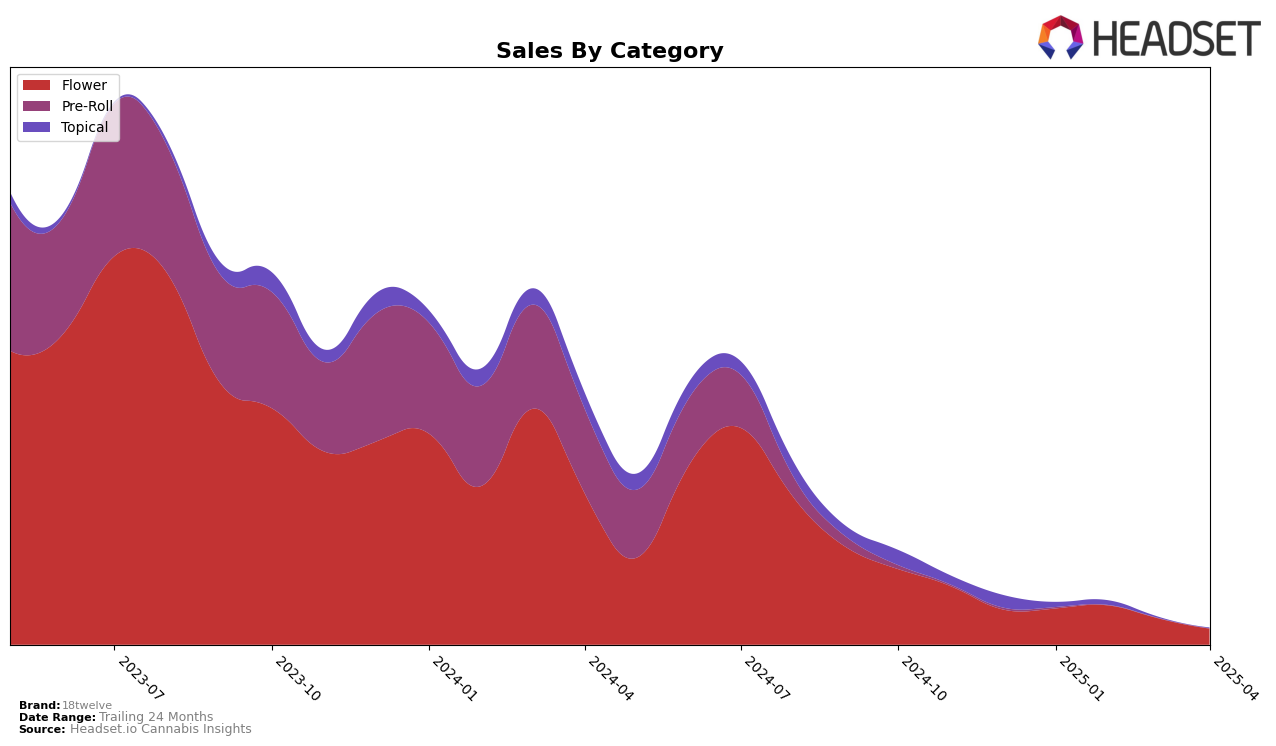

In the early months of 2025, 18twelve's performance in the British Columbia market has shown some fluctuations, particularly within the Flower category. Starting the year at the 79th position in January, the brand experienced a decline to the 91st position by February. This drop in rank was accompanied by a decrease in sales from approximately $31,481 in January to $26,059 in February, suggesting challenges in maintaining market share. Notably, 18twelve did not make it into the top 30 rankings for March and April, indicating a significant gap between their current performance and the leading brands in this category. This absence from the top rankings could be seen as a critical area for improvement as they strategize to enhance their market presence.

The data suggests that while 18twelve has a foothold in the British Columbia Flower market, there are hurdles that need to be addressed to regain and improve their standing. The absence from the top 30 rankings in March and April could reflect increased competition or a shift in consumer preferences that the brand has yet to adapt to. Understanding the underlying factors for this decline, whether they be product-related, marketing, or market dynamics, could provide insights for 18twelve to strategize effectively. This analysis highlights the importance of continuous market adaptation and the potential need for innovation to capture consumer interest and improve rankings in this competitive landscape.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, 18twelve has experienced notable fluctuations in its market position, reflecting both challenges and opportunities. Starting the year at rank 79 in January 2025, 18twelve saw a decline to rank 91 by February, indicating a potential dip in market traction or increased competition. Notably, brands like Cookies and Virtue Cannabis have maintained a stronger presence, with Cookies not even appearing in the top 20, yet commanding significantly higher sales. Meanwhile, LoFi Cannabis showed resilience with a re-entry into the top 100 in March and April, suggesting a competitive edge that 18twelve might need to address. The absence of 18twelve from the top 20 in March and April further underscores the competitive pressure in this market. For 18twelve, this dynamic environment presents both a challenge to regain its earlier momentum and an opportunity to strategize for improved market penetration.

Notable Products

In April 2025, the top-performing product for 18twelve was Frozen Grapes (3.5g) from the Flower category, maintaining its consistent number one rank for the past three months with sales reaching 323 units. Grape Jam Smalls (28g), also from the Flower category, held the second position, showing a slight increase from 22 units in March to 30 units in April. Tartufo Smalls (28g) experienced a drop in rank from second to third place, with a decrease in sales to 15 units. CBD Vital Ease Cream (750mg CBD, 50g) from the Topical category was ranked fourth, having fallen from third place in March. Pucker Up (3.5g) entered the top five for the first time, securing the fifth position with 7 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.