Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

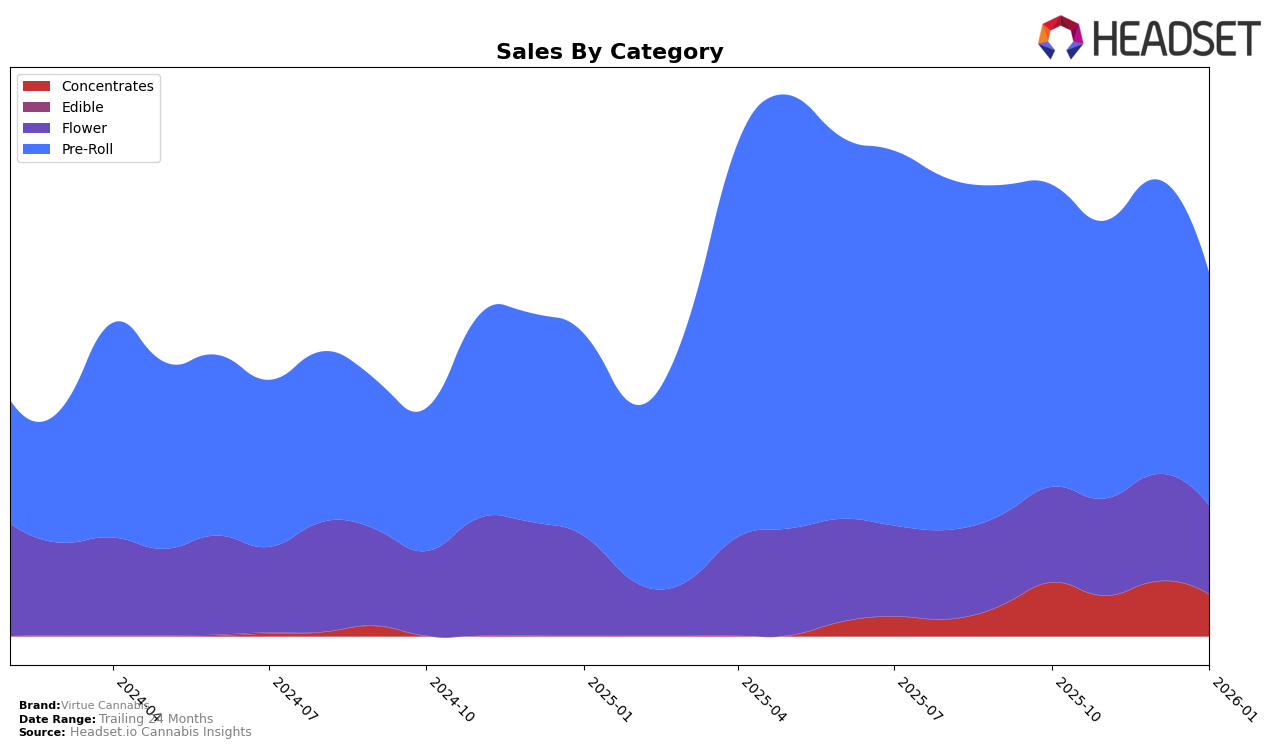

Virtue Cannabis has shown varied performance across different categories and regions. In Alberta, the brand experienced significant fluctuations in the Concentrates category, where its rank dropped from 7th in October 2025 to 15th in November, only to climb back to 9th in December before settling at 13th in January 2026. The sales figures reflect these movements, with a notable peak in December. Meanwhile, in the Flower category, Virtue Cannabis consistently hovered just outside the top 30, with its ranking slightly improving from 36th in October to 34th in December, before slipping again in January. This indicates a stable yet challenging position in Alberta's competitive Flower market.

In British Columbia, Virtue Cannabis made a notable entry into the Pre-Roll category rankings by November 2025, starting at 93rd and improving to 72nd by January 2026. This upward trajectory suggests growing consumer interest and market penetration in the region. However, in Saskatchewan, the brand only appeared in the Pre-Roll category rankings in December 2025, debuting at 38th and slightly declining to 40th in January 2026, indicating a nascent presence with room for growth. The absence of ranking data in earlier months suggests that Virtue Cannabis was not yet a significant player in these markets at that time, highlighting both challenges and opportunities for expansion.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Virtue Cannabis has experienced notable fluctuations in its market position, which could impact its strategic planning and sales efforts. From October 2025 to January 2026, Virtue Cannabis saw a decline in rank from 15th to 20th, indicating increased competition and a potential need for strategic adjustments. During this period, BoxHot consistently outperformed Virtue Cannabis, despite its own fluctuating ranks, suggesting that BoxHot's market strategies may offer insights for Virtue Cannabis. Meanwhile, Bold and Good Buds maintained relatively stable positions, with Bold slightly improving its rank, which could imply that these brands are capturing market share that Virtue Cannabis might aim to reclaim. The sales trends further highlight the competitive pressure, as Virtue Cannabis's sales decreased significantly by January 2026, while competitors like BoxHot managed to maintain higher sales figures. This competitive analysis suggests that Virtue Cannabis may need to innovate or adjust its market approach to regain its standing in the Alberta Pre-Roll market.

Notable Products

In January 2026, the top-performing product from Virtue Cannabis was the Fruitloops Diamond Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, maintaining its number one rank from the previous two months with sales of 3,795 units. The Banjo Pre-Roll 3-Pack (1.5g) rose to the second position, improving from its third-place position in November and December 2025. The Galactic Glue Pre-Roll 3-Pack (1.5g) experienced a decline, dropping from second place in December to third in January. The Black Triangle Kush Pre-Roll 3-Pack (1.5g) held steady in the fourth position across the last four months. Notably, Mac 10 Caviar (1g) entered the rankings for the first time in January 2026, debuting at fifth place in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.