Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

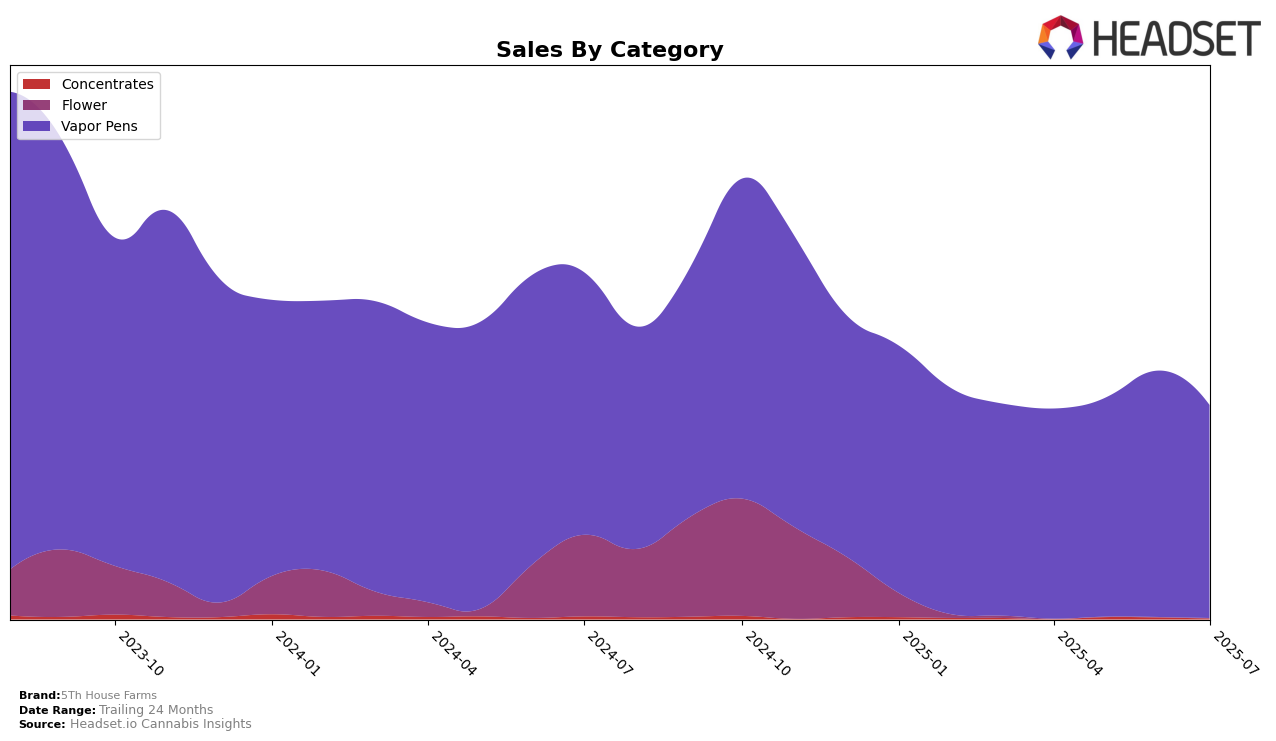

5Th House Farms has shown a consistent presence in the Vapor Pens category within Washington. Starting in April 2025, the brand was ranked 30th, and by June, it had climbed to 27th before slightly dropping back to 29th in July. This movement indicates a competitive performance, with the brand managing to maintain its position within the top 30, albeit with some fluctuations. The sales figures reflect a peak in June, suggesting a possible seasonal trend or successful marketing strategy that month. However, the slight decline in July indicates the brand might need to reassess its approach to sustain its growth trajectory.

The absence of 5Th House Farms from the top 30 rankings in other states or categories could be seen as a potential area for growth or concern, depending on the strategic goals of the brand. Their performance in Washington's Vapor Pens category highlights their ability to maintain a foothold in a competitive market, but the lack of ranking in other areas might suggest opportunities for expansion or diversification. The brand's strategy moving forward could benefit from exploring these untapped markets or strengthening its presence in existing ones to capitalize on its established reputation in Washington.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, 5Th House Farms has shown a steady performance, maintaining a consistent rank around the high 20s over the months from April to July 2025. Notably, 5Th House Farms improved its rank from 30th in April to 27th in June, before slightly dropping to 29th in July. This fluctuation is indicative of a competitive market, where brands like SKÖRD and Kelso Kandy (aka Kelso Kreeper) have also been vying for top positions, with SKÖRD consistently ranking higher than 5Th House Farms. Meanwhile, The Farmers Market (WA) has shown a notable upward trend, climbing from 50th in April to 27th by July, potentially posing a future threat to 5Th House Farms' market share. Despite these challenges, 5Th House Farms' sales peaked in June, suggesting strong consumer demand that could be leveraged for future growth.

Notable Products

In July 2025, the top-performing product from 5Th House Farms was Gorilla Glue #4 Distillate Cartridge (1g), which reclaimed its top spot in the Vapor Pens category with sales reaching 959 units. Sour Diesel Distillate Cartridge (1g) debuted strongly at the second position, indicating a successful product launch or marketing campaign. Zkittles Distillate Cartridge (1g) followed closely in third place, while Strawberry Cough and Mimosa Distillate Cartridges ranked fourth and fifth, respectively. Notably, Gorilla Glue #4 had a consistent presence, having been the top product for most months, except for a slight dip in June when it ranked second. This steady performance highlights its ongoing popularity and consumer preference within the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.