Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

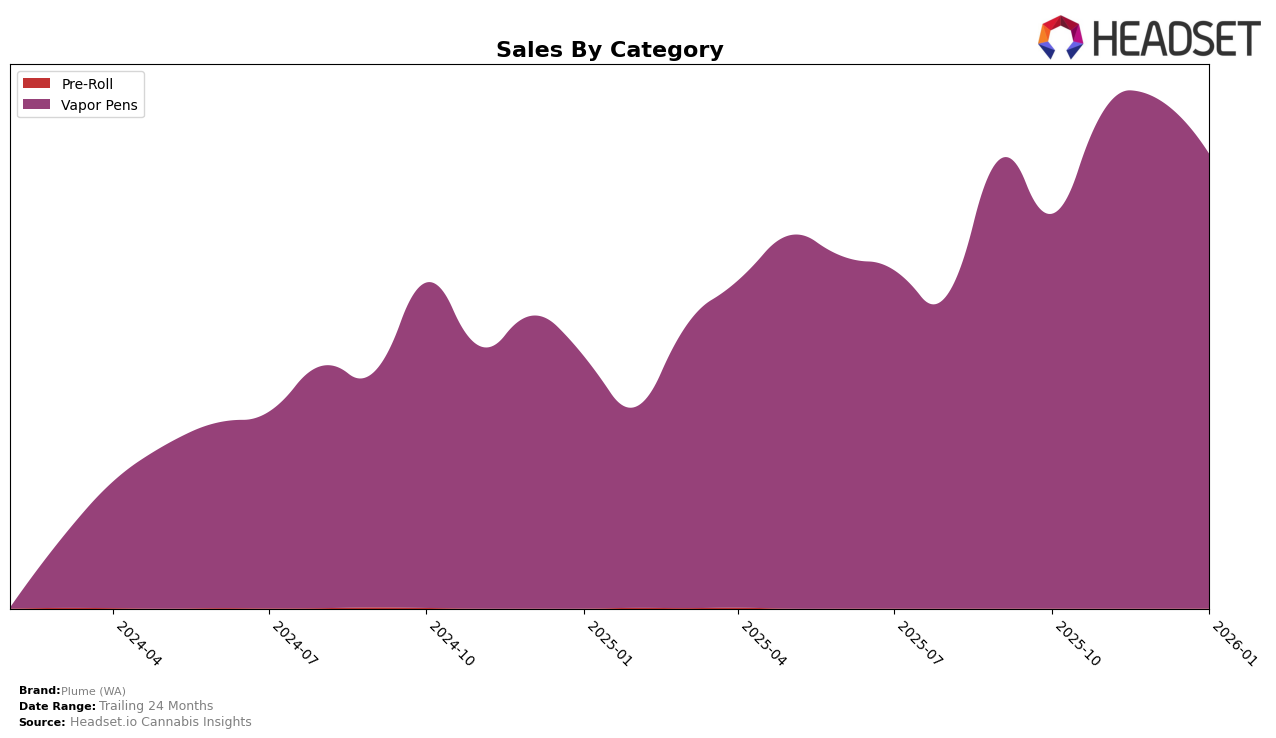

Plume (WA) has shown a consistent upward trajectory in the Vapor Pens category within the state of Washington. Over the span from October 2025 to January 2026, the brand climbed from the 20th position to the 15th, indicating a steady improvement in its market presence. This upward movement is accompanied by a notable increase in sales, peaking in December 2025. The brand's ability to ascend the rankings in such a competitive category suggests a strong consumer preference and possibly effective strategic initiatives in the state. However, it is worth noting that the performance in other states remains undisclosed, which could imply opportunities for expansion or areas needing improvement.

While Plume (WA) has made impressive gains in Washington, the absence of rankings in other states or provinces suggests that the brand has not yet broken into the top 30 in additional markets. This could be perceived as a limitation in their geographical reach or market penetration outside of Washington. The consistent climb in rankings within a single state, however, provides a solid foundation from which Plume (WA) could potentially expand its influence. The data leaves room for exploration into how the brand can leverage its success in Washington to capture a larger market share in other regions, but specific strategies or performance metrics in those areas remain to be seen.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Plume (WA) has shown a promising upward trajectory in rankings, moving from 20th in October 2025 to 15th by January 2026. This improvement is notable given the competitive pressure from brands like Fire Bros., which consistently held higher ranks, albeit with a slight decline from 11th to 13th over the same period. Slusheez also demonstrated a stable presence, maintaining a rank close to Plume (WA) and showing a similar upward trend. Meanwhile, Lifted Cannabis Co and Regulator remained behind Plume (WA) in terms of rank, with Regulator experiencing a downward trend. Plume (WA)'s sales figures reflect this positive momentum, with a notable increase from October to December 2025, before a slight dip in January 2026. This suggests that while Plume (WA) is gaining ground, continuous strategic efforts are necessary to maintain and further this growth amidst strong competition.

Notable Products

In January 2026, the top-performing product for Plume (WA) was Gelato Jack Live Resin Disposable (1g) from the Vapor Pens category, reclaiming its top spot after sliding to third place in December 2025. This product achieved sales of 908 units, demonstrating its consistent popularity. Papaya Runtz Hash Rosin Disposable (1g) secured the second position, a slight drop from its first-place ranking in November 2025. Rainbow Zkittlez Solventless Hash Rosin Disposable (1g) climbed to third place, maintaining a strong presence in the top ranks. Notably, Northern Lights Cured Resin Cartridge (1g) entered the rankings for the first time in January 2026, debuting at fifth place, indicating a potential rise in consumer preference for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.