Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

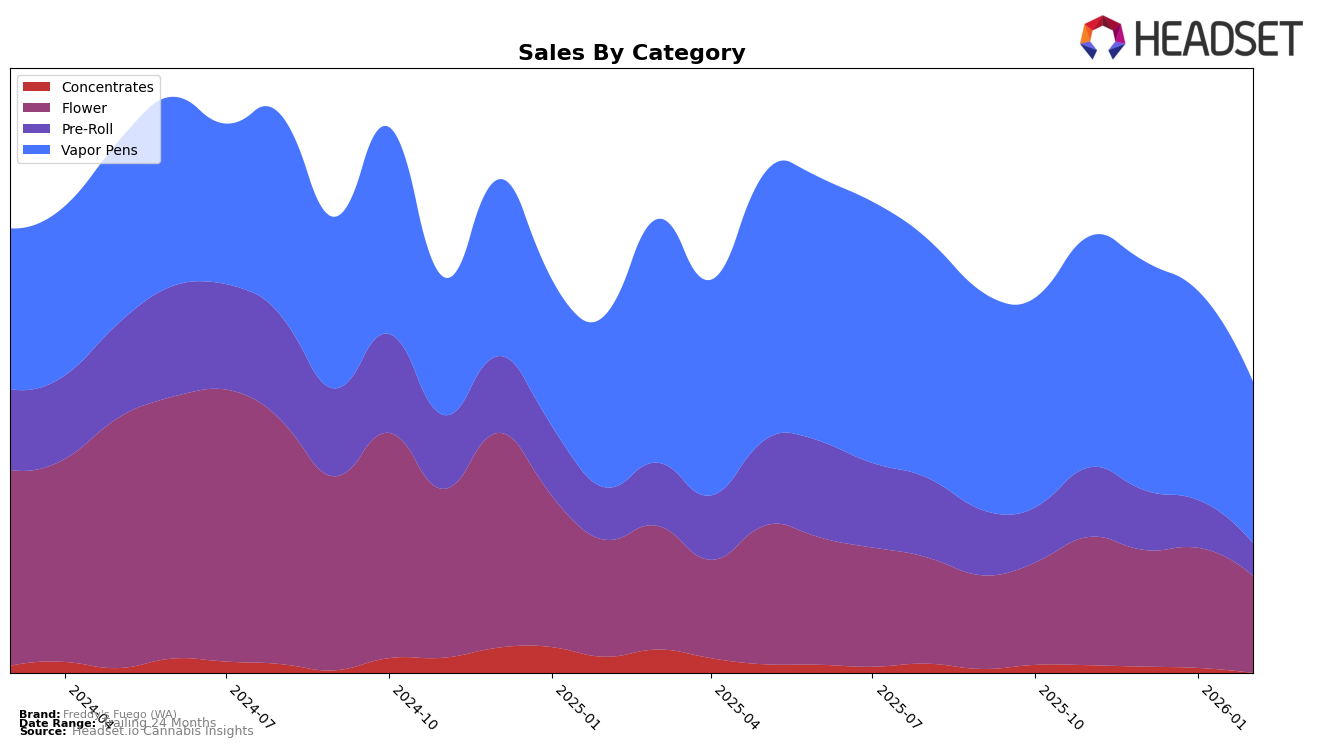

Freddy's Fuego (WA) has shown varied performance across different cannabis product categories in Washington. In the Concentrates category, the brand has struggled to break into the top 30, with rankings hovering in the 50s over the last few months, indicating a challenging market presence. In contrast, the Flower category shows more promise, with Freddy's Fuego improving its rank from 47th in December 2025 to 35th by January 2026, before slightly slipping to 41st in February 2026. This fluctuation suggests a competitive landscape but also highlights potential for growth if the brand can capitalize on its strengths in this category.

When examining the Pre-Roll category, Freddy's Fuego has seen a downward trend, starting at 38th place in November 2025 and falling to 47th by February 2026. This decline could point to increasing competition or shifting consumer preferences. The Vapor Pens category, however, tells a different story, with the brand maintaining a relatively stable position around the early 20s, despite a slight drop in sales from November 2025 to February 2026. This consistency suggests a strong foothold in the Vapor Pens market, offering a potential avenue for Freddy's Fuego to focus its efforts for sustained growth in Washington.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Freddy's Fuego (WA) has experienced notable fluctuations in its ranking over recent months, which could impact its market positioning and sales trajectory. Despite a slight dip in rank from 21st in November 2025 to 23rd by February 2026, Freddy's Fuego (WA) maintains a competitive edge against brands like Forbidden Farms, which consistently hovers around the 20th position but has seen a decline in sales. Meanwhile, Mama J's has shown a remarkable climb from 70th to 25th, suggesting a strong upward trend that could pose a future threat. Additionally, Regulator has experienced a drop from 16th to 22nd, indicating potential vulnerabilities that Freddy's Fuego (WA) could capitalize on. Overall, while Freddy's Fuego (WA) faces challenges from emerging competitors, its consistent presence in the top 25 highlights its resilience in the Washington vapor pen market.

Notable Products

In February 2026, Big Baby (3.5g) from Freddy's Fuego (WA) maintained its position as the top-performing product in the Flower category with sales of $634. Freddy's Flagship - Carrot Cake (3.5g) followed closely, ranking second in the same category, showing a slight drop from its first position in December 2025. The Ice Cream Mintz Pre-Roll 2-Pack (1g) improved its rank to third place in the Pre-Roll category, up from fourth in January 2026. Meanwhile, Lyon King Pre-Roll (1g) entered the rankings at fourth place, and Ice Cream Mintz HTE Cured Resin Disposable (1g) slipped to fifth in the Vapor Pens category, indicating a decrease in sales momentum. Overall, the top products showed dynamic shifts in rankings, reflecting competitive changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.