Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

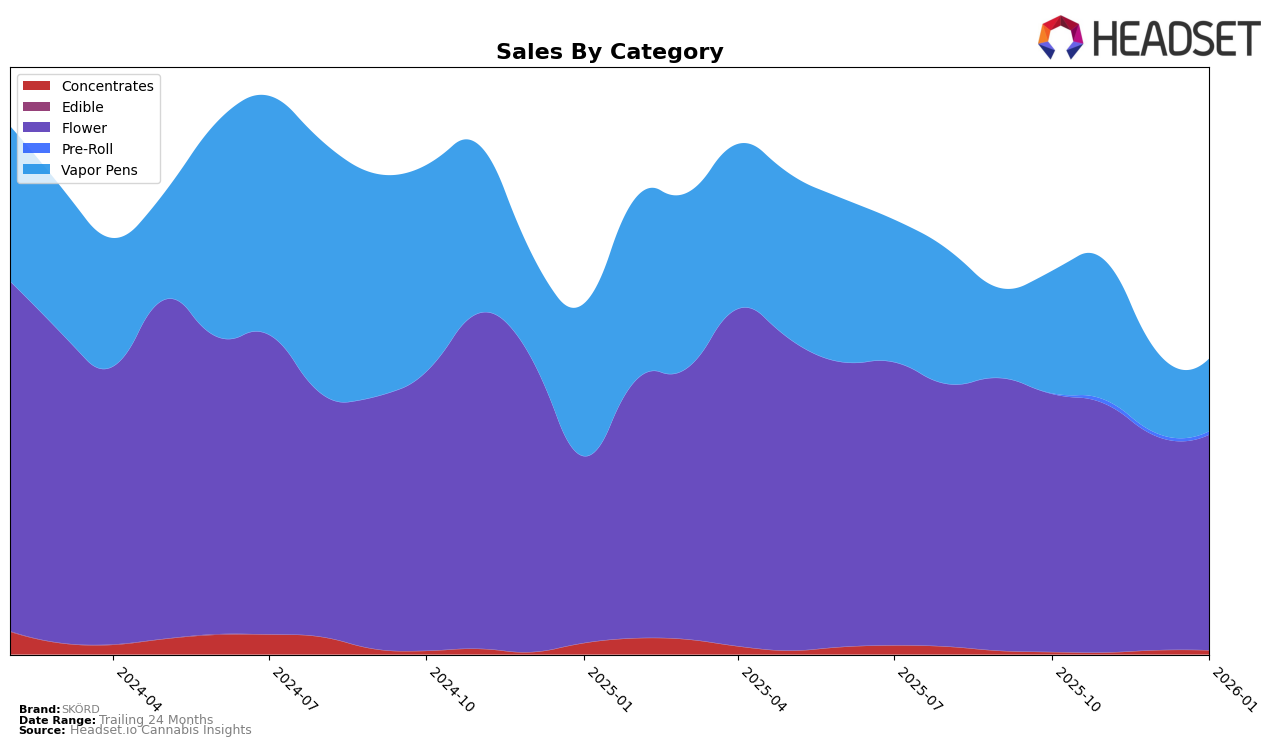

SKÖRD's performance in the Washington market reveals some notable trends across different product categories. In the Flower category, SKÖRD maintained a presence in the top 30 brands, albeit with some fluctuations. Starting at the 18th position in October 2025, the brand saw a slight decline to 21st in November, dropping further to 29th by December. January 2026 saw a marginal improvement to 27th place, which indicates a potential stabilization after a period of decline. This trend suggests that while SKÖRD remains a recognized player in the Flower category, it faces significant competition that affects its ranking. The fluctuations in ranking are mirrored by a decrease in sales from October to December, although there was a slight uptick in January, hinting at a possible recovery.

In contrast, SKÖRD's performance in the Vapor Pens category in Washington shows a different trajectory. The brand did not achieve a top 30 ranking in any of the months from October 2025 to January 2026, highlighting a challenging environment in this category. The rankings of 37th in October and 32nd in November, followed by a drop to 49th and 51st in December and January, respectively, indicate a struggle to maintain a competitive edge. This decline is reflected in the sales figures, which show a consistent decrease over the months. The absence from the top 30 suggests that SKÖRD might need to reassess its strategies in the Vapor Pens category to enhance its market position and drive sales growth.

Competitive Landscape

In the competitive landscape of the Washington flower market, SKÖRD has experienced notable fluctuations in its ranking and sales over the past few months. Starting from October 2025, SKÖRD was ranked 18th, but it saw a decline to 21st in November and further dropped to 29th in December, before recovering slightly to 27th in January 2026. This downward trend in rank is mirrored by a decrease in sales, although there was a slight recovery in January. In contrast, Forbidden Farms also experienced a decline, dropping from 13th to 25th over the same period, indicating a potential market-wide challenge. Meanwhile, Mini Budz showed a remarkable improvement, climbing from 32nd in October to 26th in January, suggesting a shift in consumer preferences or successful marketing strategies. These dynamics highlight the competitive pressures SKÖRD faces and underscore the importance of strategic adjustments to regain its standing in the Washington flower market.

Notable Products

In January 2026, Animal Cocktail (3.5g) emerged as the top-performing product for SKÖRD, leading the rankings in the Flower category with impressive sales of 938 units. Dark Rainbow (3.5g) climbed to second place, marking a significant improvement from its fourth position in November 2025. The Dark Rainbow Ceramic Reserve PHO Cartridge (1g) secured the third spot in the Vapor Pens category, maintaining a strong presence despite not ranking in the previous two months. Cake Donut (3.5g) fell to fourth place after leading in November 2025, indicating a shift in consumer preference. Reserve - Paytons Pie (3.5g) rounded out the top five, showing a decline from its third position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.