Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

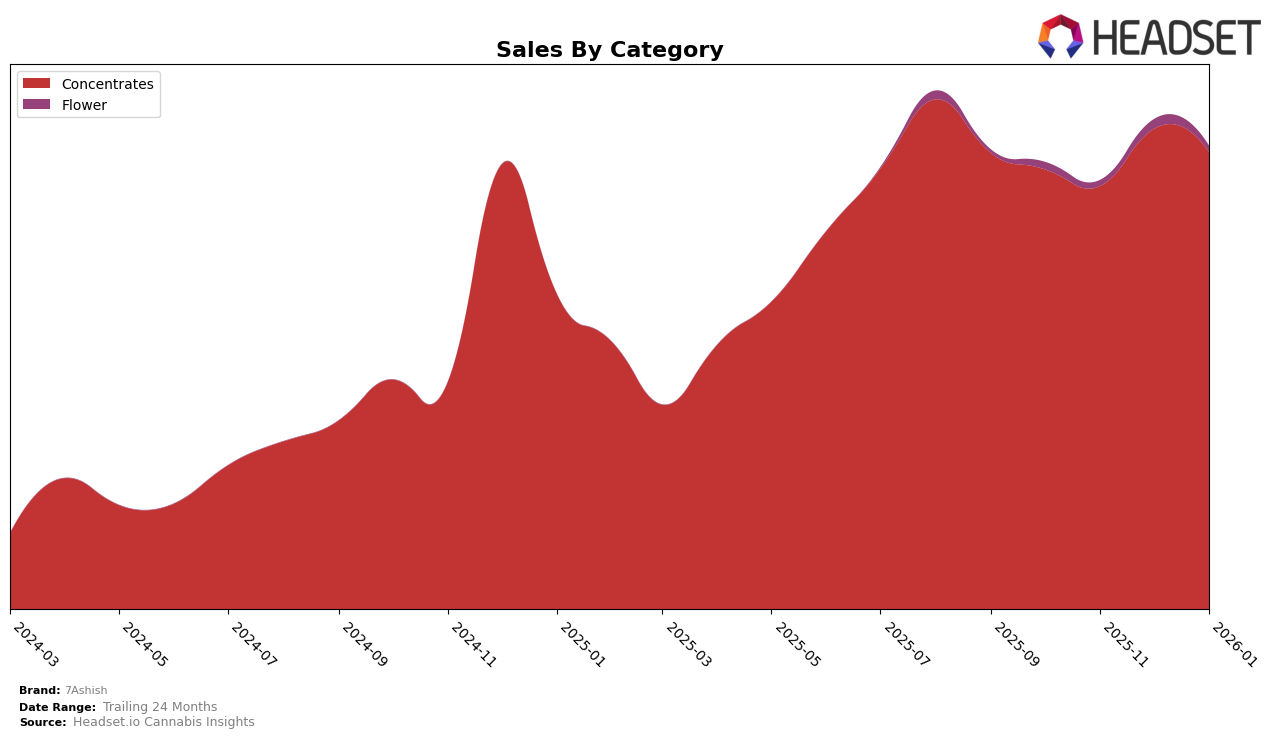

In the highly competitive cannabis market, 7Ashish has demonstrated notable performance in the Concentrates category within Ontario. Starting from October 2025, the brand ranked 30th, briefly slipping out of the top 30 in November, but quickly regained its position by December. By January 2026, 7Ashish improved its standing to 28th. This upward trend indicates a positive momentum for the brand, suggesting that their strategies in Ontario are beginning to resonate with consumers, despite the initial setback in November.

The sales figures for 7Ashish in Ontario reveal a fluctuating but overall stable revenue stream. In October 2025, the brand achieved sales of approximately $60,926, which slightly dipped in November but rebounded in December, maintaining a consistent performance into January 2026. The ability to recover and improve their ranking highlights the brand's resilience and adaptability in a competitive market. However, the absence of 7Ashish from the top 30 in November serves as a reminder of the challenges faced in sustaining a strong market presence.

Competitive Landscape

In the competitive landscape of concentrates in Ontario, 7Ashish has shown a consistent presence, maintaining a rank within the top 30 brands over the past four months. Despite facing stiff competition, 7Ashish's rank improved slightly from 31st in November 2025 to 28th by January 2026. This upward trend is noteworthy, especially when compared to competitors like Purple Hills, which fluctuated between 29th and 32nd, and HASHCO, which saw a decline from 20th to 26th. Meanwhile, Sheeesh! experienced a more volatile trajectory, peaking at 21st in November before dropping to 30th in January. Although 7Ashish's sales figures remained relatively stable, the brand's ability to improve its rank amidst these fluctuations suggests a strengthening market position, potentially driven by strategic adjustments or increased consumer preference. This resilience positions 7Ashish as a brand to watch in the Ontario concentrates market.

Notable Products

In January 2026, the top-performing product for 7Ashish was Lebanese Blonde Hash (1g) from the Concentrates category, maintaining its consistent first-place ranking since October 2025, with sales reaching 3462 units. Pink Afghan Hash Kief (1g), also in Concentrates, held its second-place position over the same period, showing a steady increase in sales. Lebanese Blonde (1g) from the Flower category climbed back to third place after briefly dropping to fourth in December 2025. Black Hash (1g) remained in fourth place, while Pink Afghan Black Hash (1g) saw a notable decline from third to fourth place since its introduction in December 2025. These rankings highlight a stable preference for Concentrates, with minor shifts in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.