Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

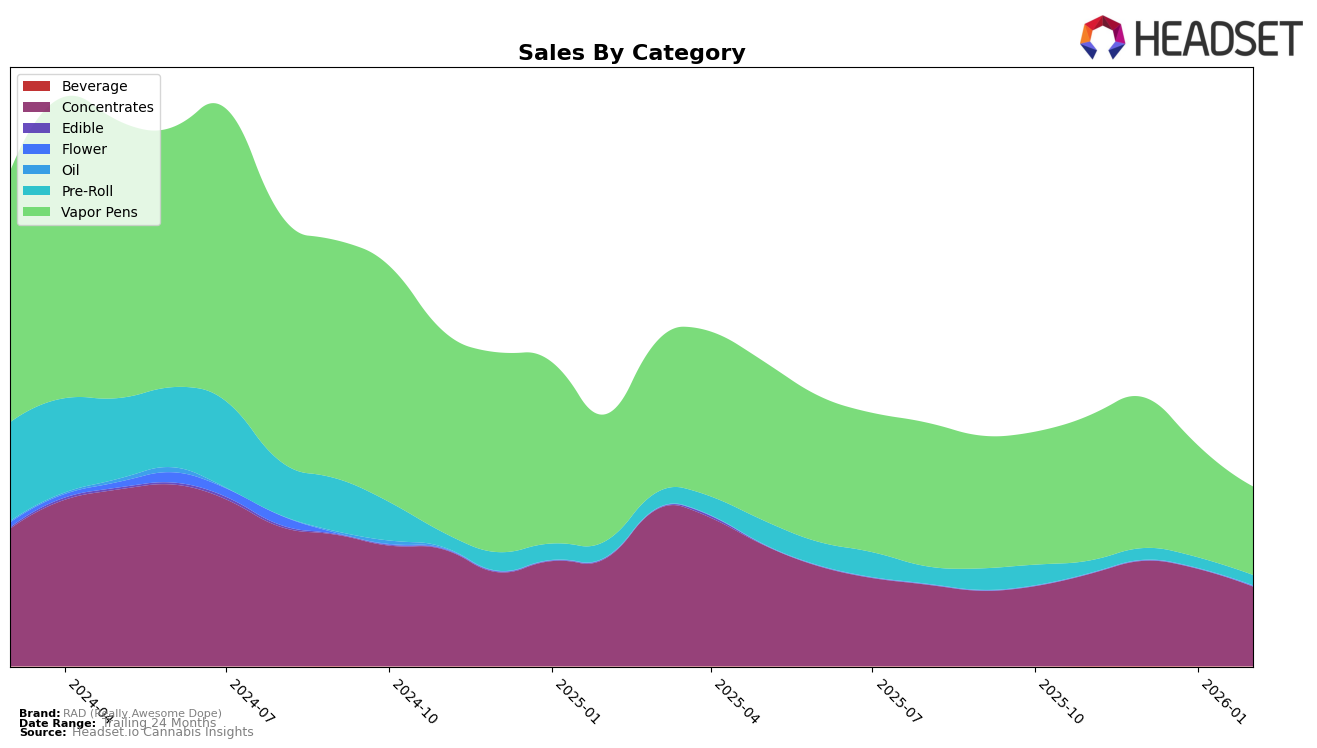

RAD (Really Awesome Dope) has shown a noteworthy performance in the Alberta market, particularly in the concentrates category where it maintained a strong presence, ranking 17th in November 2025 and improving to 13th by January 2026 before slightly dropping to 15th in February 2026. This indicates a consistent demand for their concentrates despite the slight dip in the latter months. In contrast, their vapor pens have struggled to break into the top 30, with rankings hovering in the high 70s and 80s, reflecting a challenging market environment for this category in Alberta. Meanwhile, in British Columbia, RAD's performance in the concentrates category has seen fluctuations, with a notable jump from 33rd in December 2025 to 23rd in January 2026, though it slightly fell back to 27th in February 2026. This suggests a competitive landscape in British Columbia, with RAD managing to capture consumer interest sporadically.

In Ontario, RAD has demonstrated a steady climb in the concentrates category, improving its rank from 28th in November 2025 to 24th by February 2026, suggesting a growing consumer base and possibly effective marketing strategies. The vapor pens category, however, presents a different scenario, where RAD's position has remained relatively stable but outside the top 30, indicating room for growth. Saskatchewan presents a mixed picture; RAD's concentrates initially showed promise, ranking 11th in November 2025, but they fell out of the top 30 by February 2026. Notably, the pre-roll category showed potential, with a rank of 63rd in November 2025, but did not maintain a presence in subsequent months, suggesting either a shift in consumer preference or increased competition. The vapor pens category in Saskatchewan saw a decline from 22nd in November 2025 to 30th by February 2026, highlighting challenges in maintaining a competitive edge in this segment.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, RAD (Really Awesome Dope) has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. In November 2025, RAD was ranked 41st, but by February 2026, it had slightly improved to 45th, despite a dip in sales. Notably, Trippy Sips maintained a stronger position, starting at 37th in November and ending at 47th in February, although their sales also declined. Meanwhile, Palmetto consistently ranked higher than RAD, despite a downward trend in sales, suggesting a more stable market position. Potluck showed a remarkable improvement, jumping from 52nd in November to 43rd in February, surpassing RAD in the latest month. Bold was not in the top 20 for several months but re-entered at 48th in February, indicating potential volatility in the market. These shifts highlight the competitive pressure RAD faces, emphasizing the need for strategic adjustments to enhance its market share and ranking in the Ontario vapor pen category.

Notable Products

In February 2026, RAD (Really Awesome Dope) saw the Blue Razz Distillate Cartridge (1g) maintain its top position in the Vapor Pens category, despite a decrease in sales to 1998 units. Fruity Gobbstomper Distillate Cartridge (1g) held steady at the second position, showing consistent performance across the months. Blood Honey x Sticky Bananas Shatter (1g) ranked third in the Concentrates category, maintaining its position from January 2026. Sour Diesel THCa Live Diamonds (1g) entered the rankings at fourth place, indicating a rise in popularity. Peach Shockwave Distillate Cartridge (1g) dropped to fifth place, showing a continuous decline in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.