Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

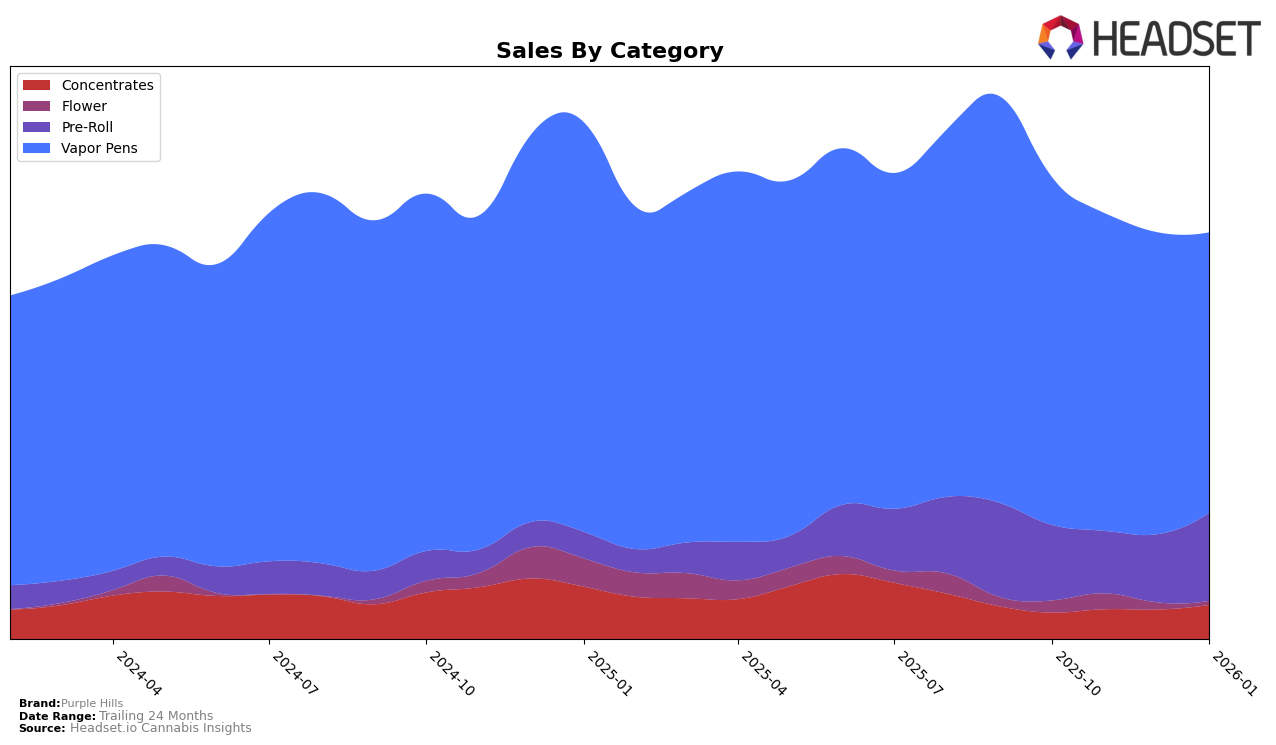

In the Ontario market, Purple Hills has shown notable shifts across different product categories. Within the Concentrates category, the brand has experienced a positive upward movement, climbing from a rank of 32 in October 2025 to 27 by January 2026. This improvement suggests a strengthening presence in the Concentrates market. However, in the Vapor Pens category, Purple Hills has maintained a relatively stable position, hovering around the 13th to 17th rank over the same period. This stability indicates a consistent demand for their Vapor Pens, although there is a slight downward trend in sales from October to January, which might warrant further attention from the brand.

Conversely, Purple Hills' performance in the Pre-Roll category in Ontario has been mixed. The brand was outside the top 30 rankings initially, sitting at 79th in October 2025, but has made significant strides, reaching the 61st position by January 2026. This improvement suggests a growing consumer interest in their Pre-Rolls, possibly driven by changes in product offerings or marketing strategies. The sales figures corroborate this positive movement, with a noticeable increase from November 2025 to January 2026. While the brand's overall performance in Ontario shows promise, especially in Concentrates and Pre-Rolls, the consistent ranking in Vapor Pens might suggest a plateauing market share in that category.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Purple Hills has experienced a slight decline in its market position from October 2025 to January 2026, moving from the 13th to the 17th rank. This shift can be attributed to the dynamic movements of competitors such as Kolab, which maintained a consistent rank of 16th despite a fluctuation in sales, and Fuego Cannabis (Canada), which improved its rank from 19th to 15th, reflecting a significant increase in sales during this period. Meanwhile, Iris and SUPER TOAST also demonstrated upward trends, with Iris breaking into the top 20 by January 2026. These shifts indicate a competitive pressure on Purple Hills, suggesting a need for strategic adjustments to regain its footing in the Ontario vapor pen market.

Notable Products

In January 2026, Purple Hills' top-performing product was the Indica Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for the fourth consecutive month with sales of 5555 units. The Sativa Distillate Cartridge (1g) also held steady in the second position, continuing its consistent performance from previous months. The Sour Gorilla Pre-Roll 2-Pack (2g) remained third, showing an increase in sales to 3056 units, the highest among pre-rolls. Entering the rankings for the first time, the Tropical Cooler Pre-Roll 5-Pack (5g) secured the fourth position, indicating strong initial demand. The Orangeade Live Resin Cartridge (1g) saw a slight drop to fifth place, experiencing a decrease in sales compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.