Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

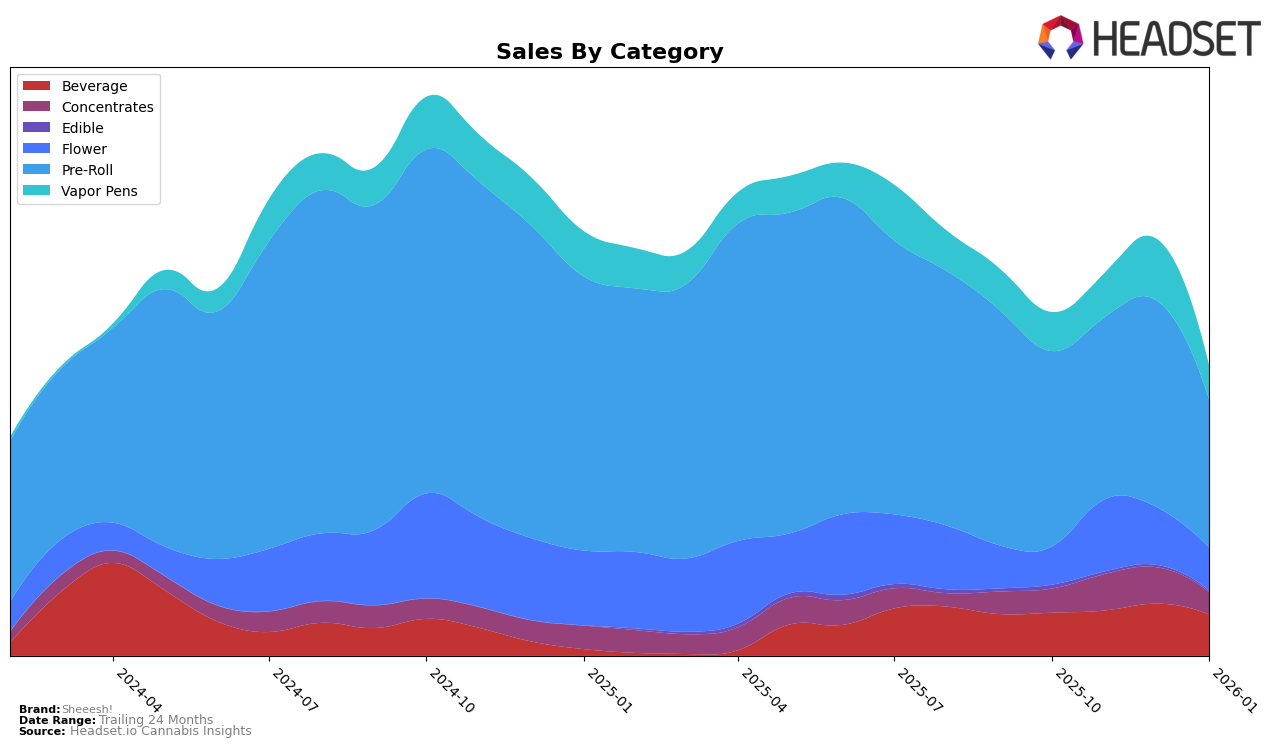

Sheeesh! has shown varied performance across different product categories and regions. In Alberta, the brand has seen fluctuations in its rankings within the Flower and Pre-Roll categories. Notably, in the Flower category, Sheeesh! was not in the top 30 brands, with rankings consistently above 50, peaking at 58 in November 2025. A significant drop was observed in the Pre-Roll category, where the brand fell from rank 47 in December 2025 to 72 in January 2026, indicating a challenging market environment. Conversely, in the Vapor Pens category, Sheeesh! managed to climb to a rank of 33 in December 2025, although it slipped back to 41 by January 2026. This suggests a potential area for growth if the brand can capitalize on the positive momentum seen in December.

In British Columbia and Ontario, Sheeesh! has experienced mixed results. In British Columbia, the brand has not been in the top 30 for the Flower category, with rankings dropping from 67 in November 2025 to 79 in January 2026. However, in the Beverage category, Sheeesh! achieved a commendable rank of 14 in December 2025, maintaining a strong presence. In Ontario, the brand consistently performed well in the Beverage category, ranking between 11 and 13 over the four-month period, indicating a stable market position. However, the Vapor Pens category saw a decline, with the brand falling to rank 72 by January 2026, suggesting potential challenges in maintaining market share in this competitive segment.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Sheeesh! has experienced some fluctuations in its ranking and sales performance over the past few months. While maintaining a steady rank of 49th in October and November 2025, Sheeesh! dropped slightly to 51st in December, before recovering back to 49th in January 2026. This indicates a relatively stable position amidst a competitive market. However, brands like Jays (Canada) have shown more dynamic movements, improving from 47th to 41st in December before settling at 47th in January, suggesting a stronger upward momentum. Meanwhile, Shatterizer has seen a decline from 37th in October to 48th in January, which could present an opportunity for Sheeesh! to capitalize on any potential market share loss by Shatterizer. Additionally, Bold and Community Cannabis c/o Purple Hills have remained outside the top 50, indicating less immediate competition for Sheeesh! in terms of rank. Despite these movements, Sheeesh! needs to focus on strategies to enhance its market position and sales, especially as competitors show varying trends in their rankings.

Notable Products

In January 2026, SMURF Infused Pre-Roll (1g) maintained its position as the top-performing product for Sheeesh!, continuing its streak at rank 1 with sales of 8,738 units. Cherry D Live Rosin Cola (10mg THC, 12oz, 355ml) also held steady at rank 2, consistently performing well across recent months. Banjorine Dream Rosin Fizz Soda (10mg THC, 355ml) improved its rank from 4 in October 2025 to 3 in January 2026, despite a slight dip in sales. Banjo Berry Rosin Strawberry Lemonade Soda (10mg THC, 12oz, 355ml) saw a decline in both rank and sales, dropping from 3 in October 2025 to 4 in January 2026. O.G. Hash (2g) maintained its rank at 5, experiencing a decrease in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.