Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

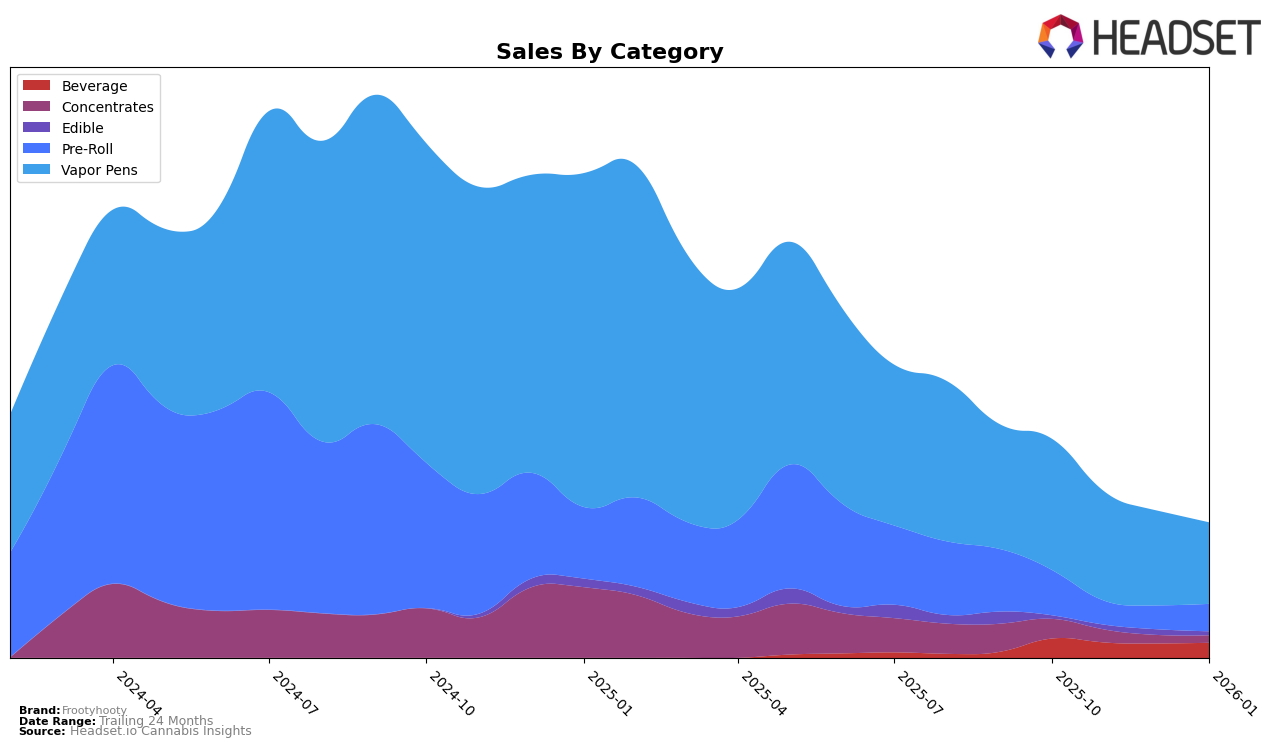

Frootyhooty's performance across different categories and regions provides an insightful look into its market dynamics. In Alberta, the brand's presence in the Concentrates category hasn't broken into the top 30, indicating potential challenges in capturing market share there. However, in the Vapor Pens category, Frootyhooty has shown some resilience, maintaining a relatively stable presence with a rank of 37 in both October 2025 and January 2026, despite some fluctuations in the intervening months. This suggests a consistent consumer base for their vapor products in Alberta, even as sales figures showed slight variations.

In Ontario, Frootyhooty has experienced varied success across categories. The brand's Beverage category has maintained a steady position in the lower 20s, with a slight improvement from rank 25 in December 2025 to 22 in January 2026, hinting at growing consumer interest. Conversely, the Vapor Pens category has seen a downward trend, with rankings dropping from 57 in October 2025 to 79 by January 2026, alongside a notable decline in sales. This could reflect increased competition or shifting consumer preferences. The absence of top 30 rankings in the Concentrates category in both Alberta and Ontario highlights areas for potential growth or strategic reevaluation.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Frootyhooty has shown resilience despite facing stiff competition. Over the months from October 2025 to January 2026, Frootyhooty maintained a relatively stable rank, fluctuating between 37th and 44th place. This stability is noteworthy given the dynamic shifts among competitors. For instance, Tasty's (CAN) experienced a notable decline, dropping from 25th to 38th place, with sales decreasing significantly over the same period. Meanwhile, GORILLA GARDEN CRAFT CANNABIS & EXTRACTS and Tuck Shop also saw fluctuations in their rankings but managed to stay ahead of Frootyhooty. Interestingly, Jays (Canada) entered the top 50 in November 2025 and showed a positive trend, surpassing Frootyhooty by January 2026. Despite these challenges, Frootyhooty's consistent sales figures suggest a loyal customer base, positioning it as a brand with potential for growth in a competitive market.

Notable Products

In January 2026, the top-performing product for Frootyhooty was Poppin Peach Splash Zero Soda (10mg THC, 12oz, 355ml) in the Beverage category, which rose to the first rank with sales of 1571 units. Following closely, Pink Lemonade Splash Zero (10mg THC, 12oz, 355ml) secured the second position, maintaining a strong presence despite a drop from its previous top spot in December 2025. Poppin Peach Full Spectrum Live Rosin Cartridge (1g) climbed to third place in the Vapor Pens category, showcasing an increase in sales compared to December 2025. Wild Watermelon Coconut Live Rosin + Disty Cartridge (1g) experienced a decline, moving from first place in November 2025 to fourth in January 2026. Meanwhile, Wild Watermelon Coconut Infused Pre-Roll 3-Pack (1.5g) held steady at the fifth rank, indicating consistent performance in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.