Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

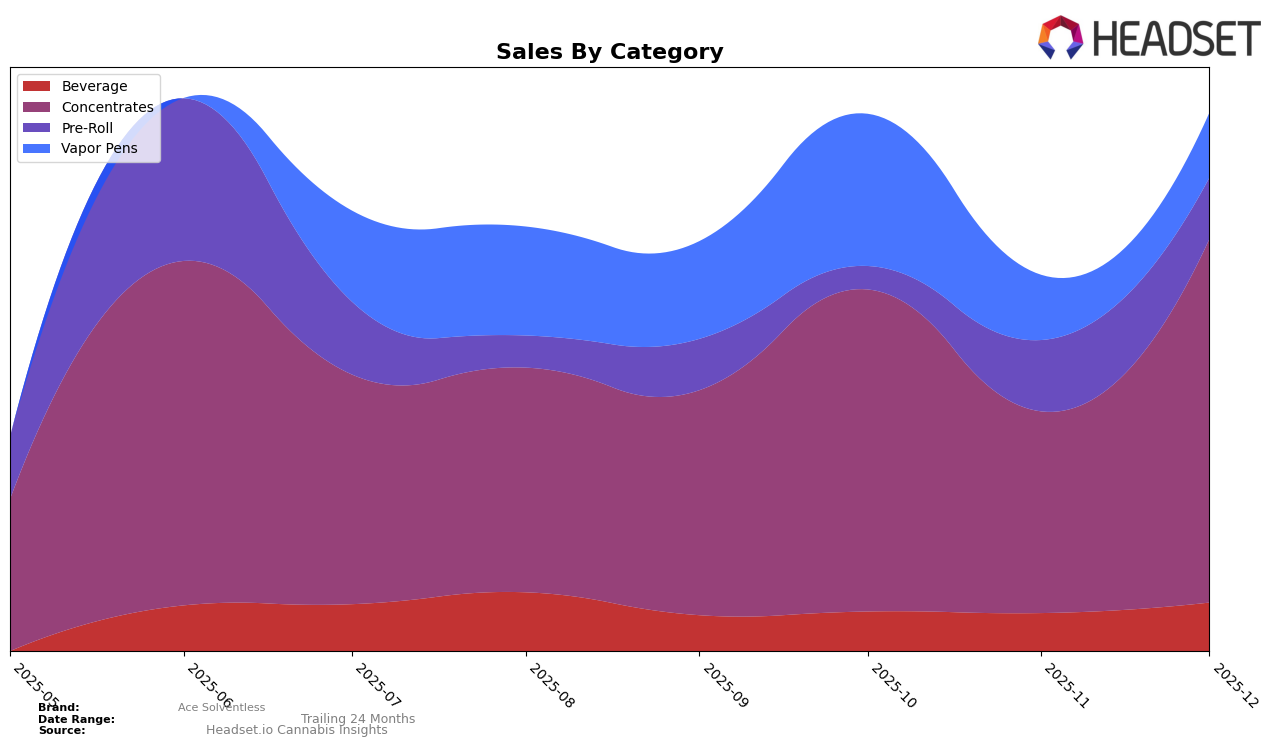

Ace Solventless has shown a dynamic performance across different categories and states, with some notable movements in rankings. In the Concentrates category within Missouri, the brand has exhibited fluctuating yet promising progress. Starting from a rank of 35 in September 2025, Ace Solventless improved its position to 32 by October, experienced a slight dip to 34 in November, and then climbed back to 32 in December. This back-and-forth movement indicates a competitive market presence and the brand's resilience to maintain its standing among the top players in the state, despite not breaking into the top 30. The upward trend in sales from October to December, particularly the notable increase in December, reflects a positive reception of their products during the holiday season.

In contrast, Ace Solventless's performance in the Vapor Pens category in Missouri has not been as strong, with the brand not making it into the top 30 rankings for the months tracked. The brand did manage to secure the 80th position in October 2025, which suggests a considerable gap to bridge in order to compete effectively in this category. The absence of ranking data for other months highlights the challenge Ace Solventless faces in establishing a significant market share in Vapor Pens. However, the initial sales figure in this category suggests there is potential for growth if strategic adjustments are made to enhance their market appeal and distribution reach.

Competitive Landscape

In the Missouri concentrates market, Ace Solventless has shown a commendable improvement in its ranking over the last few months of 2025, climbing from 35th in September to 32nd by December. This upward trajectory suggests a positive reception among consumers, likely driven by strategic marketing or product enhancements. Comparatively, CAMP Cannabis experienced fluctuations, moving from 31st to 28th and then back to 31st, indicating a less stable market presence. Meanwhile, Safe Bet and Lush Labs maintained relatively stable but lower ranks, with Safe Bet consistently hovering around the 30th position and Lush Labs dropping slightly from 30th to 33rd. Notably, Heartland Holistics entered the top 50 in November, suggesting emerging competition. Ace Solventless's ability to improve its rank amidst these dynamics highlights its growing influence and potential for increased sales in the Missouri concentrates market.

Notable Products

In December 2025, the top-performing product from Ace Solventless was Jackpot Liquid Gold Solventless Infused Syrup (150mg) in the Beverage category, which climbed to the number 1 rank with sales reaching 172 units. Grandpa's Stash Hash Infused Pre-Roll (2.5g) held the second position in the Pre-Roll category, experiencing a slight sales decrease from November. Zhit My Pantz Cold Cure Live Rosin (2g) entered the rankings for the first time in December, securing the third spot in the Concentrates category. Sewer Water Hash Rosin Sesh Stick Disposable (0.5g) improved its ranking to fourth place in the Vapor Pens category, showing a notable increase in sales from previous months. Grape Gas Cold Cure Live Rosin (2g) also made its debut in the rankings, finishing fifth in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.