Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

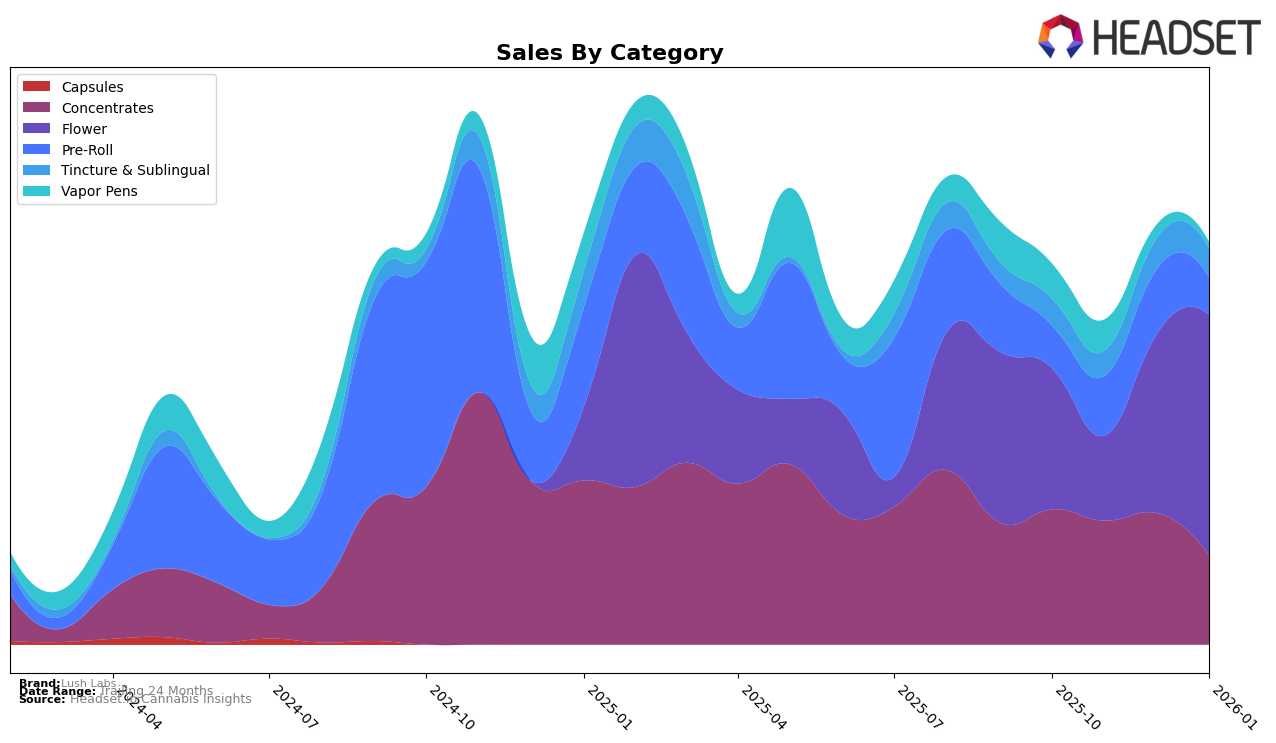

Lush Labs has demonstrated varied performance across different product categories in Missouri. In the concentrates category, the brand has struggled to maintain a strong foothold, as evidenced by its rankings dropping out of the top 30 in January 2026. This decline is further reflected in a noticeable decrease in sales from October 2025 to January 2026. Conversely, the flower category has shown a positive trajectory, with Lush Labs improving its rank from 62 in October 2025 to 57 by January 2026. This upward movement aligns with a significant increase in sales, suggesting a growing consumer preference for their flower products in this state.

Meanwhile, Lush Labs' performance in the pre-roll category in Missouri has been less consistent. The brand's ranking fluctuated, peaking at 79 in November 2025 before dropping to 90 by January 2026. This volatility in rankings is mirrored by the sales figures, which saw an initial increase but then fell sharply by the start of 2026. The brand's ability to stay within the top 90, despite these fluctuations, indicates a stable, albeit niche, consumer base for their pre-roll offerings. However, the lack of presence in the top 30 across any category suggests that Lush Labs may need to reassess its strategies to enhance its market position in Missouri.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Lush Labs has shown a promising upward trajectory in recent months. Starting from a rank of 62 in October 2025, Lush Labs improved its position to 57 by January 2026, indicating a positive trend in its market presence. This improvement is particularly notable when compared to competitors like Peak Extracts, which maintained a relatively stable but lower rank, and Flower by Edie Parker, which was absent from the top 20 in October and December 2025. Meanwhile, Monopoly Melts and Asteroid Cannabis consistently ranked higher than Lush Labs, but Lush Labs' sales growth, particularly from November 2025 to January 2026, suggests a strengthening market position. This upward momentum in both rank and sales highlights Lush Labs' potential to further close the gap with higher-ranked competitors in the Missouri Flower market.

Notable Products

In January 2026, Lush Labs' top-performing product was Complex GMO (Bulk) from the Flower category, reclaiming its number one position after a dip to fourth place in November 2025. Following closely, Runtz (Bulk) climbed to second place, a significant improvement from its fifth-place ranking in December 2025, with sales reaching 561 units. Cosmic Breath Pre-Roll (1g) dropped to third place after leading in December 2025, while Maple Madness Pre-Roll (1g) fell from second to fourth place. Highly Flammable Pre-Roll (1g) made its first appearance in the rankings at fifth place. Overall, the Flower category saw a strong performance, with both top spots occupied by bulk products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.