Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

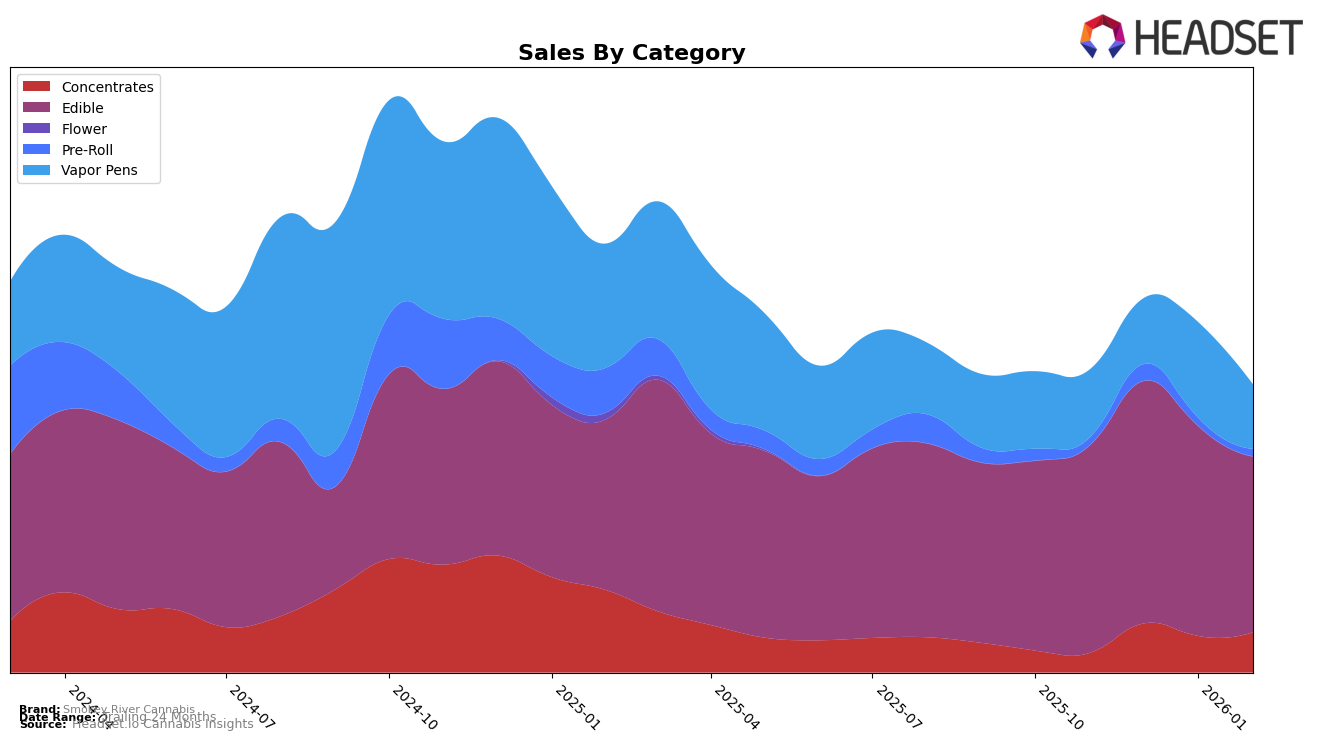

Smokey River Cannabis has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand has demonstrated a positive trend, moving up from a rank of 33 in November 2025 to 24 by February 2026, indicating a strengthening position in the market. However, in the Pre-Roll category, the brand's ranking has remained outside the top 30, consistently hovering around the mid-80s. This suggests a need for strategic improvement in this category to capture more market share. Meanwhile, the Vapor Pens category shows a fluctuating performance, with the brand achieving its best rank of 42 in January 2026, before slightly declining again in February.

In the Edible category, Smokey River Cannabis has maintained a steady presence within the top 15 in Missouri, with rankings showing minor fluctuations between 14 and 15 over the observed period. This consistency highlights a strong foothold in the Edible market, suggesting consumer preference and brand loyalty in this segment. Despite this, the brand's sales have seen a noticeable drop from December 2025 to February 2026, which could indicate seasonal trends or a shift in consumer spending patterns. Overall, while Smokey River Cannabis has shown strengths in certain categories, there are clear opportunities for growth and improvement in others, particularly in Pre-Rolls and Vapor Pens.

Competitive Landscape

In the Missouri edible market, Smokey River Cannabis has maintained a consistent presence, ranking 15th in both November 2025 and January 2026, with a slight improvement to 14th in December 2025 before returning to 15th in February 2026. This stability in rank suggests a steady performance despite fluctuations in sales, which peaked in December 2025. Notably, Ostara Cannabis consistently outperformed Smokey River Cannabis, maintaining a rank between 12th and 13th, indicating a stronger market position. Meanwhile, Dialed In Gummies also showed a stable performance, consistently ranking 14th, just ahead of Smokey River Cannabis. Dixie Elixirs and Curio Wellness hovered around similar ranks, indicating a competitive cluster in the mid-tier of the market. The data suggests that while Smokey River Cannabis is holding its ground, there is potential for growth if it can capitalize on the sales momentum seen in December 2025 to climb higher in the rankings.

Notable Products

In February 2026, the top-performing product for Smokey River Cannabis was the Strawberry Lemonade High Dose Gummies 10-Pack (1000mg), which ascended to the number one spot after consistently holding the second position in the previous months, with sales reaching 1476 units. The Dewberry Super High Dose Gummies 10-Pack (1000mg) slipped to second place after maintaining the top rank from November 2025 through January 2026. The Apple Pie High Dose Gummies 10-Pack (1000mg) climbed back to third place, showing a recovery from its fifth rank in January. Watermelon High Dose Gummies 10-Pack (1000mg) remained steady in fourth place, while Green Apple Gummies 10-Pack (1000mg) dropped to fifth, continuing its downward trend. This shift in rankings highlights a competitive landscape among the edible category of Smokey River Cannabis.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.