Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

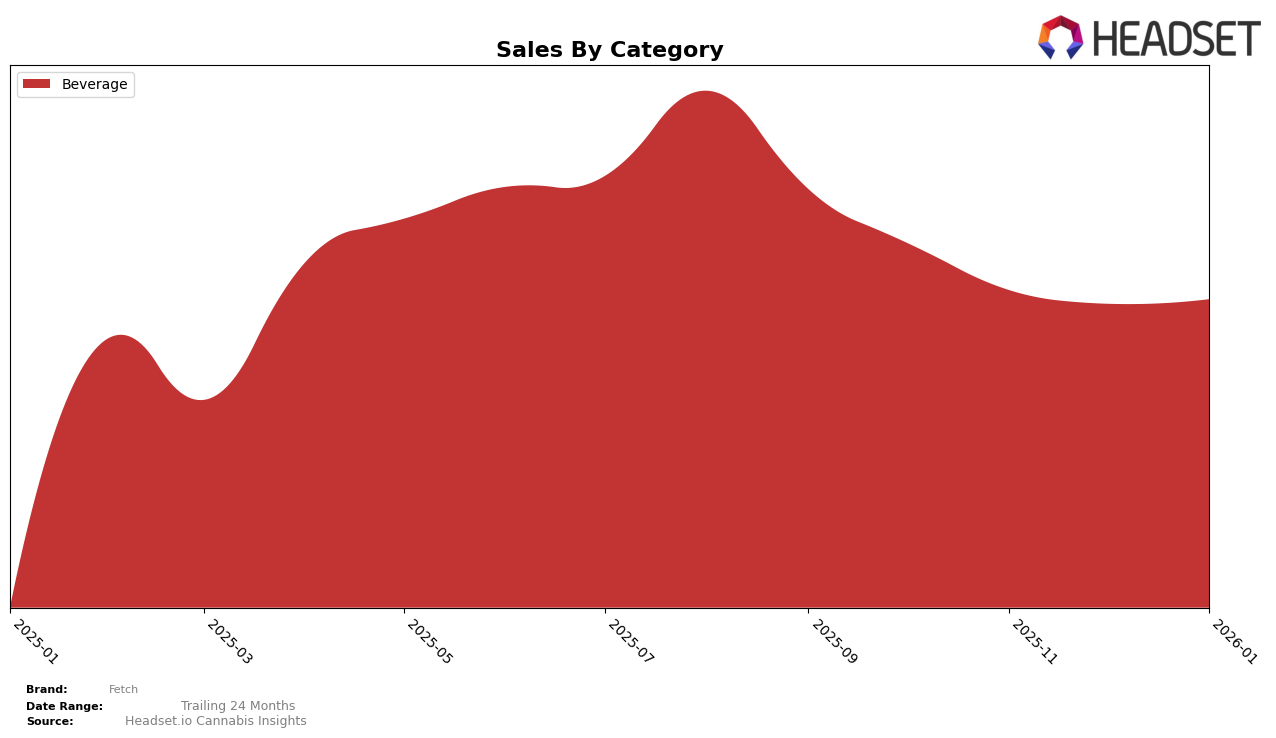

Fetch has shown varied performance across different states and categories, indicating a dynamic market presence. In the Beverage category in Alberta, Fetch maintained a steady position, ranking 15th in both December 2025 and January 2026. This consistency suggests a stable consumer base and effective market strategy within this region. However, it's noteworthy that Fetch did not appear in the top 30 rankings in November 2025, which could signal a temporary dip in popularity or market share during that month. Such fluctuations highlight the competitive nature of the cannabis beverage market in Alberta.

In Ontario, Fetch's performance in the Beverage category has been more volatile. The brand moved from 24th place in October 2025 to 23rd in November, only to drop to 27th in December before climbing back to 24th by January 2026. This oscillation in rankings could reflect changes in consumer preferences or competitive pressures. Despite these shifts, Fetch's sales in Ontario show a downward trend from October to December 2025, before slightly recovering in January 2026. This pattern may indicate seasonal influences or strategic adjustments by Fetch to regain its footing in the Ontario market.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Fetch has experienced fluctuating rankings, reflecting a dynamic market environment. Fetch's rank shifted from 24th in October 2025 to 23rd in November, dropped to 27th in December, and rebounded to 24th in January 2026. This volatility suggests challenges in maintaining consistent market positioning. Notably, Frootyhooty demonstrated resilience, improving its rank from 23rd in October to 22nd by January, indicating a potential threat to Fetch's market share. Meanwhile, Summit (Canada) and Aspire also showed competitive sales figures, with Aspire re-entering the top 20 in December and maintaining a 23rd rank in January, suggesting a competitive edge over Fetch in terms of sales recovery. Fetch Soda, another brand under the Fetch umbrella, consistently ranked lower, indicating potential brand dilution or market segmentation issues. These insights underscore the need for Fetch to strategize effectively to enhance its competitive positioning and sales performance in the Ontario beverage market.

Notable Products

In January 2026, Fetch's top-performing product was Classic Cola Zero 10mg THC 355ml in the Beverage category, maintaining its consistent number one rank since October 2025, with sales hitting 2,639 units. Cream Soda 10mg THC 355ml also retained its second-place position from the previous months, with sales figures slightly decreasing to 936 units. Both products have demonstrated remarkable stability in their rankings over the past few months, indicating a strong and consistent consumer preference. Despite a slight decline in sales figures from October 2025, Classic Cola Zero remains the clear leader in its category. These trends suggest that Fetch's Beverage offerings continue to resonate well with consumers, maintaining their top positions in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.